Cryptocurrencies are posting clear declines on Monday, with Bitcoin retreating from around $96,000 to $92,000, in tandem with weakness in major stock indices and uncertainty linked to escalating trade tensions between the United States and Europe. This is another, so far relatively modest, deleveraging episode that does little to help crypto regain momentum and return to a bull market. If meaningful capital does not flow into the BTC market soon, Bitcoin may struggle to hold above $90,000.

For now, sentiment remains cautious, and it seems investors are unlikely to return to BTC with aggressive buying until the trend on Wall Street becomes more convincing. Digital assets have found themselves in a difficult spot, and if BTC does not move quickly back toward $100,000, the sector may start to be dominated by resignation and a sense that the “fuel” needed to restart the rally is running out.

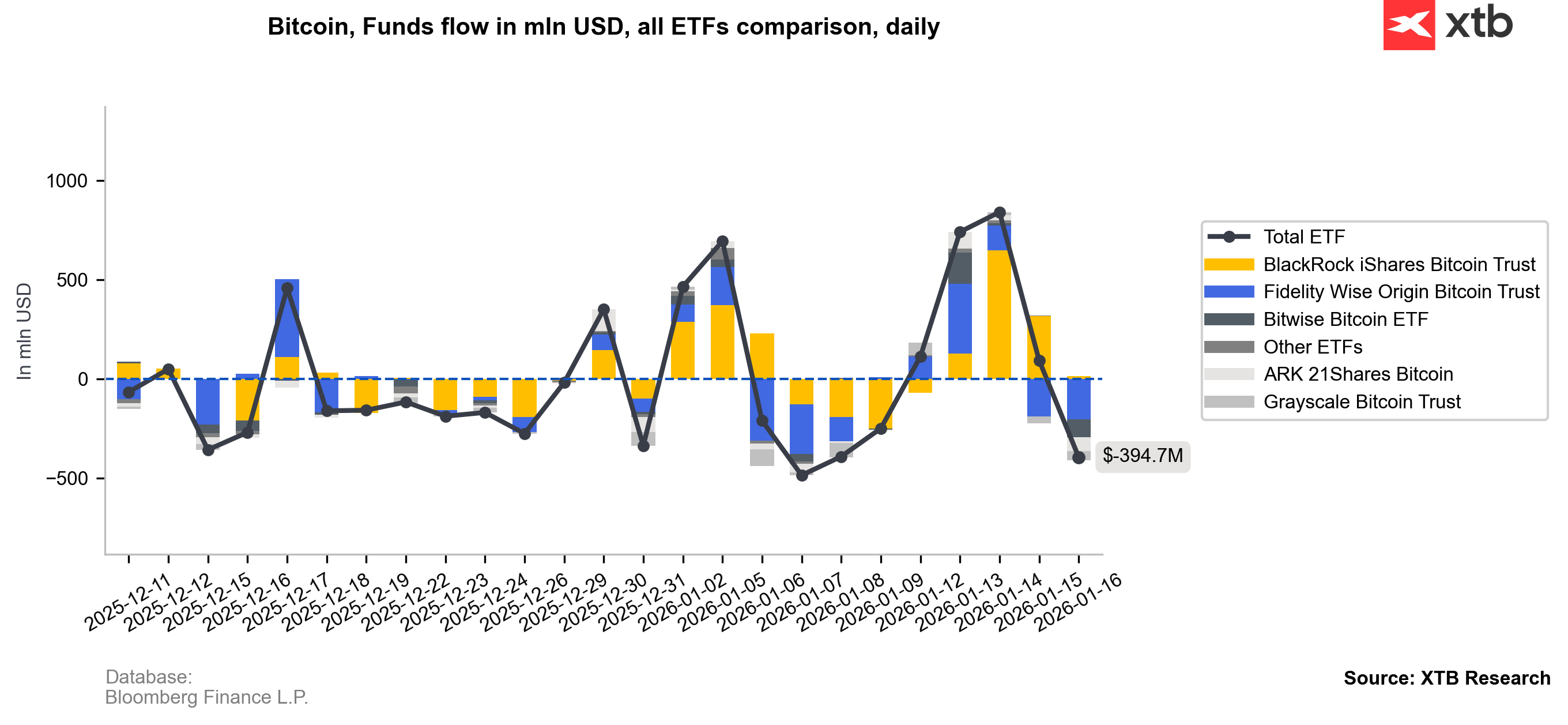

ETF funds without conviction

ETF funds used the latest rebound to sell BTC at higher prices around $95,000 to $96,000. Importantly, we saw two selling sessions in the Fidelity fund. BlackRock has continued to record mostly positive inflows for a long time, but the scale of fresh capital entering the market appears limited and is struggling to sustain the uptrend. According to CoinGlass data, liquidated long positions in the BTC market have already exceeded $525 million.

Source: Bloomberg Finance L.P., XTB Research

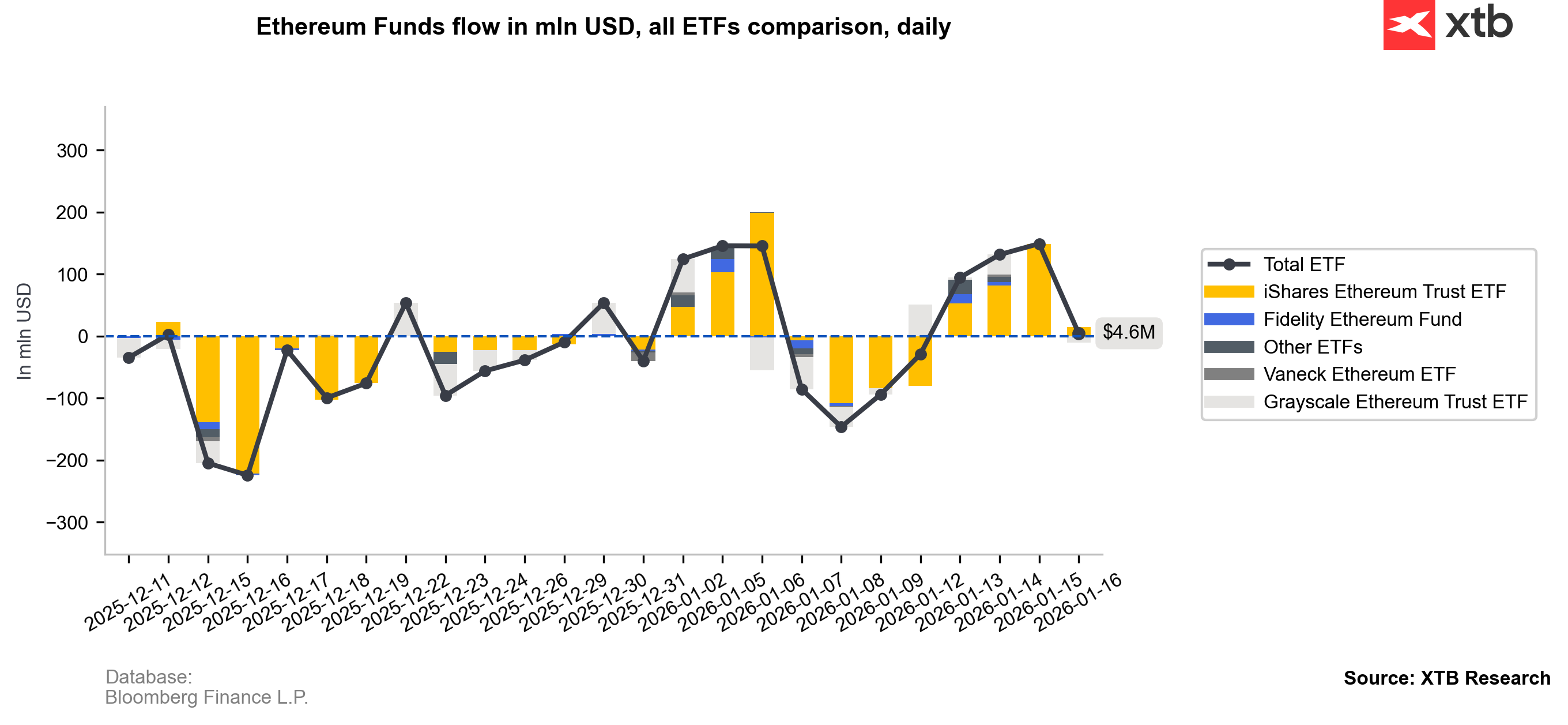

Over the last 30 days, net flows into Ethereum have been clearly negative, and Friday brought just under $4 million in positive net inflows. Overall ETF trading volumes for ETH have fallen noticeably compared with the autumn, reinforcing the uncertainty around the next leg of the trend.

Source: Bloomberg Finance L.P., XTB Research

Bitcoin and Ethereum charts (H1, D1 timeframes)

Looking at the two largest cryptocurrencies, on the hourly timeframe Bitcoin is currently holding a potential 1:1 corrective structure, which gives bulls some hope that $92,000 can hold as a key support level. On the other hand, Ethereum has pulled back to the lower boundary of its rising price channel, and the uptrend remains intact as long as the price does not fall below $3,200.

Source: xStation5

Source: xStation5

itcoin has fallen below the EMA50 again (orange line) and was unable to stay above the average for an extended period. If the price were to move back above $93,600 later today, it could point to a likely, fast reversal of the short-term downtrend. Assuming that a “cooling” of trade tensions between the U.S. and Europe is plausible, Bitcoin could relatively quickly erase the panic reaction.

Source: xStation5

Ethereum has recently struggled to break through a key resistance level represented by the 200-session moving average on the daily timeframe (EMA200). At the moment, it appears that the area around $3,400 is what separates ETH from a broader bull market. The main support level is the psychological $3,000 zone, while buyers should keep the price above the EMA50 ($3,200) if momentum is to hold.

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.