• Correction on the altcoin market

• Diminishing correlation between Bitcoin and traditional stock markets

This week cryptocurrencies across the board are trading under intensifying selling pressure, except for Bitcoin, the price of which remains relatively stable compared to the large declines that we can see on the altcoin and DeFi market. Bitcoin's market dominance increased to 63.3%. The capitalization of all digital assets in circulation decreased to 388 billion, while an average daily trading volume is registered at $102 billion.

JP Morgan changes the approach to Bitcoin

JP Morgan, America’s biggest bank, recently has changed its rhetoric towards Bitcoin. After calling it a fraud in 2017 now JP Morgan believes that bitcoin has a considerable upside in the long run and competes with gold as an "alternative currency." The bank notes that the value of cryptocurrencies comes not just for being a store of wealth but mainly due to their utility as a means of payment. However bank's analysts have also noted that coin is currently “overbought for the near term." As such, Bitcoin’s latest price surge that has seen it add over 20% through October might have made it vulnerable for a near-term correction. Bank also believes that “modest crowding out of gold” as an alternative currency automatically implies a 2X or 3X growth of bitcoin's price.

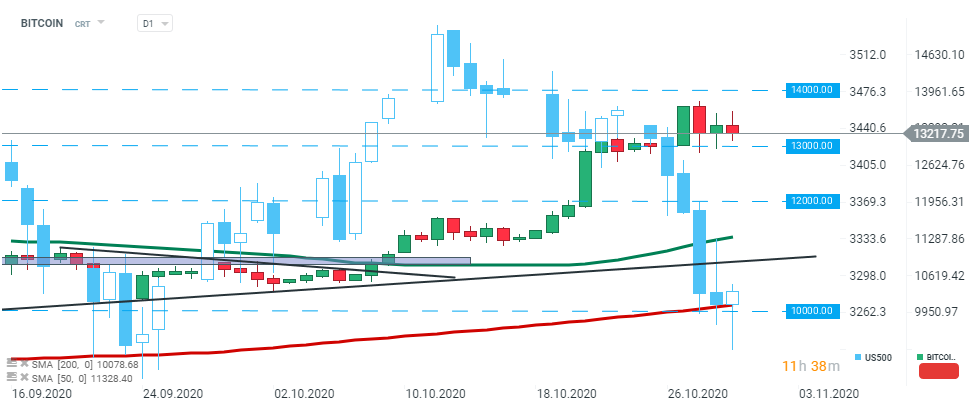

It seems that Bitcoin managed to decouple from the traditional stock market at least in the short term, as its price has been able to maintain its strength while the stock market has been tumbling within the last few days. As long as the price sits above $13 000 support, the upward move looks to be more probable. Source: xStation5

It seems that Bitcoin managed to decouple from the traditional stock market at least in the short term, as its price has been able to maintain its strength while the stock market has been tumbling within the last few days. As long as the price sits above $13 000 support, the upward move looks to be more probable. Source: xStation5After reaching yearly high of $169 billion at the beginning of September, total market capitalization of altcoins lost around $23 billion during the past two months. As Bitcoin's dominance increases, altcoin market is currently in a period of correction, trying to find the bottom. There seems to be an inverse correlation between Bitcoin’s dominance and the market capitalization of altcoins.

Total market capitalization of altcoins has declined significantly in recent months. Source: Coinmarketcap.com

Total market capitalization of altcoins has declined significantly in recent months. Source: Coinmarketcap.com Ethereum has retreated by almost 10% from October highs at $417 due to the consistently growing bearish pressure. This week Ethereum price slide below the key $390.00 level recently and is approaching local bottom at $365.00 which is additionally strengthened by 50 SMA (green line). If sellers will manage to break below it, then downward move could be extended towards $310.00. Source: xStation5

Ethereum has retreated by almost 10% from October highs at $417 due to the consistently growing bearish pressure. This week Ethereum price slide below the key $390.00 level recently and is approaching local bottom at $365.00 which is additionally strengthened by 50 SMA (green line). If sellers will manage to break below it, then downward move could be extended towards $310.00. Source: xStation5 Ripple is extending recent losses during today's session. Yesterday sellers managed to push the price below upward trendline which is additionally strengthened by 50 SMA (green line). Currently Ripple is testing major support at $0.23. Should current sentiment persists, then next support at $0.2146 could be at risk. Source: xStation5

Ripple is extending recent losses during today's session. Yesterday sellers managed to push the price below upward trendline which is additionally strengthened by 50 SMA (green line). Currently Ripple is testing major support at $0.23. Should current sentiment persists, then next support at $0.2146 could be at risk. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.