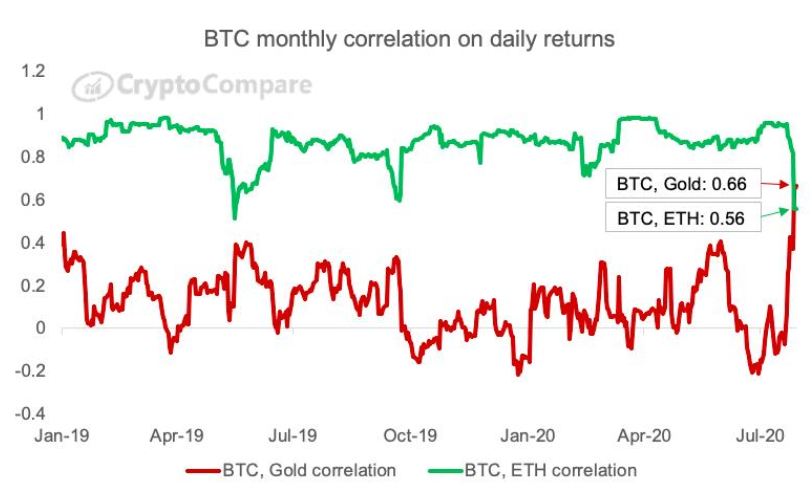

• Growing correlation between Bitcoin and gold

• Ripple become the third most valuable crypto asset

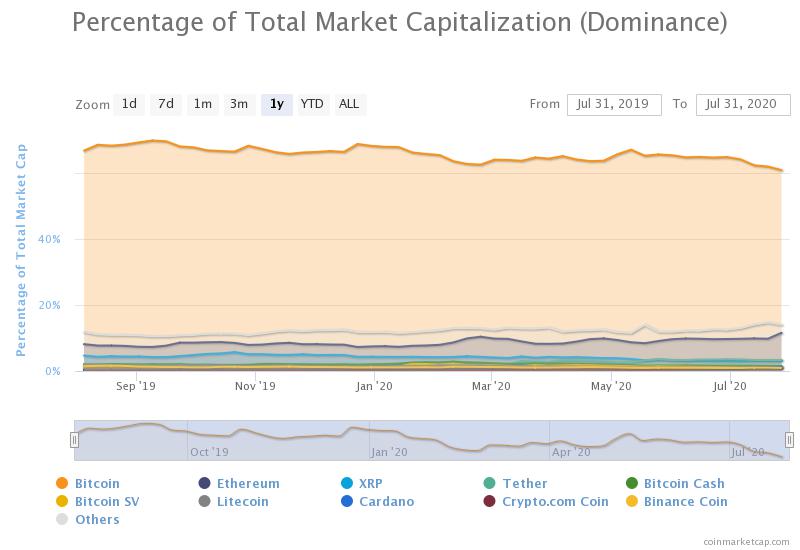

Bitcoin's market dominance decreased to 62.3%. The capitalization of all digital assets in circulation increased to 327.9 billion from reached almost $284 billion last week, while an average daily trading volume is registered at $82 billion. Source: Coinmarketcap

Bitcoin's market dominance decreased to 62.3%. The capitalization of all digital assets in circulation increased to 327.9 billion from reached almost $284 billion last week, while an average daily trading volume is registered at $82 billion. Source: CoinmarketcapAccording to James Li, a research analyst at CryptoCompare:

"Last time Bitcoin had a moderate correlation with gold (around 0.5) was towards the end of 2018. That was when a month earlier in November 2018 bitcoin suffered a 50% drop (at the height of the bitcoin cash war) and made some subsequent rebounds. Gold was recovering from a somewhat cyclical drop a couple of months earlier. The moderate correlation back then was perhaps a bit of a coincidence".

Bitcoin’s monthly correlation with gold on daily returns sits at 0.66.Source: CryptoCompare

Bitcoin’s monthly correlation with gold on daily returns sits at 0.66.Source: CryptoCompare Bitcoin price rallied significantly from a tight range between $9,000 - $9,359 and reached new 2020 highs at $11,354. Currently the most popular coin is testing resistance at $11,100. If positive moods persist, then next target for bulls is located at $12,258.58. However, in case sellers regain control, round $10,000 level should provide strong support. Source: xStation5

Bitcoin price rallied significantly from a tight range between $9,000 - $9,359 and reached new 2020 highs at $11,354. Currently the most popular coin is testing resistance at $11,100. If positive moods persist, then next target for bulls is located at $12,258.58. However, in case sellers regain control, round $10,000 level should provide strong support. Source: xStation5Ripple seems to have joined the crypto market rally and on Wednesday reached its highest levels since the beginning of March.

Ripple has been trading in a tight range for more than 2 months with its volatility at its lowest levels. During this period coin did not attract interest, but now the coin becomes valuable again. Since mid-July, the number of wallets holding 1 million to 10 million Ripple has been steadily increasing. Ripple surpassed Tether and become the third most valuable crypto asset in dollar terms, at around $11 billion. There is no clear reason behind the recent rally, but Nairmetrics, through its data feed, noticed that some whales increased their stakes in the digital coin significantly.

Ripple jumped 21% over the past week and 37% over the past month, making it one of the top performers. Coin managed to break above the major resistance level at $0.2258 and rally. Should upbeat moods prevail resistance at $0.2609 may come into play. However if a break below occur, then local support is located at $0.2060 level. Source: xStation5

Ripple jumped 21% over the past week and 37% over the past month, making it one of the top performers. Coin managed to break above the major resistance level at $0.2258 and rally. Should upbeat moods prevail resistance at $0.2609 may come into play. However if a break below occur, then local support is located at $0.2060 level. Source: xStation5Daily Summary: US Indexes Slip Slightly as Year Comes to a Close

Technical Analysis: Bitcoin (31.12.2025)

Crypto news: Silver crashes, Bitcoin rebounds 📈Is crypto repeating the 2020 cycle?

Daily Summary: Wall Street Rises on Christmas Mood

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.