-

Cryptocurrencies enjoyed major gains recently

-

DASH more than doubled in value

-

Bitcoin halving could start another bull market

Cryptocurrency market is nearing the end of a stellar week. During the past couple of days capitalization of the digital asset market increased over $30 billion, or around 14%. Bitcoin rallied 11% following a break above the upper limit of the downward and has set the tone for altcoins, some of which doubled in value. However, there are not any reports that could justify this jump on a fundamental level.

DASH

Source: xStation5

Source: xStation5

DASH is a true leader of an ongoing upward impulse. The altcoin gained around 130% in just two days. Rally was halted near the resistance at 135. However, a pullback has occurred following this steep rise and the coin moved back to the 115 handle. A point to note is that this coin has been trading in a downward trend for almost two years. A break above the upper limit of the Overbalance structure (green box) could herald a bigger upward move. In such a scenario, one should focus on the previous peak at 186 USD.

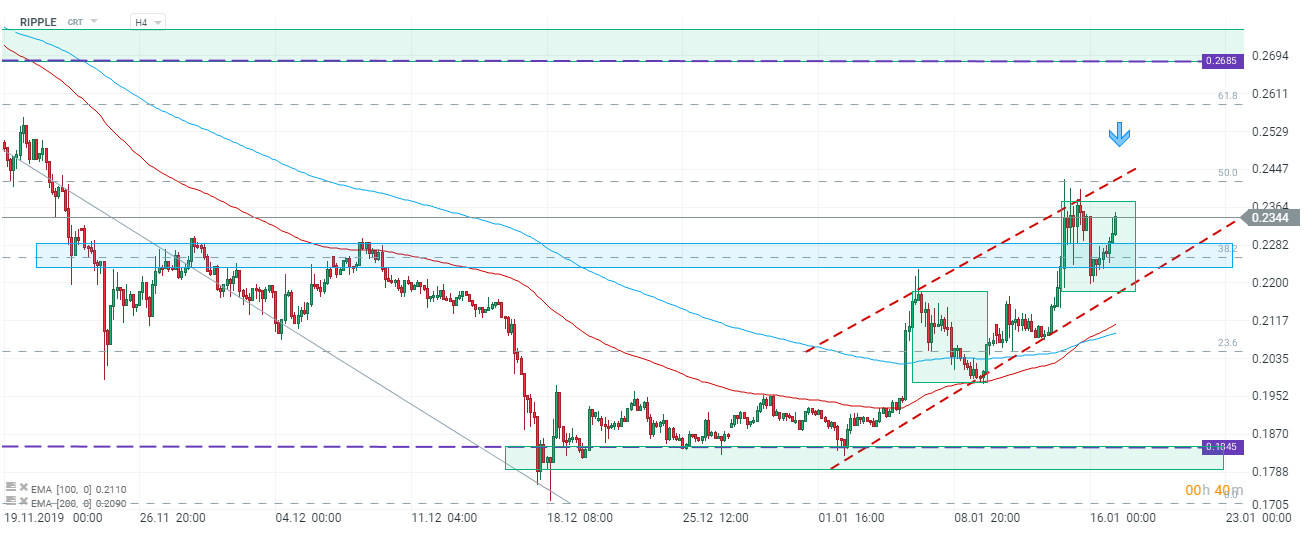

RIPPLE

Source: xStation5

Source: xStation5

Ripple is also making moves this week. The altcoin trades in an upward channel and has ended correction at 0.22 handle recently. The ongoing upward impulse has pushed the price 6% higher and a test of recent highs at 0.24 could be on the cards now. A point to note is that this level coincides with the upper limit of the channel therefore resistance there could be strong. Should the coin start to decline, one should focus on the aforementioned 0.22 level in the first place. In case it fails to stop the bears, attention will shift to the lower limit of the Overbalance structure at 0.2170.

Will cryptocurrencies rise after Bitcoin halving this time?

Another halving milestone for Bitcoin is approaching. Block no. 630000 is expected to be solved near mid-May and rewards to miners will be halved afterwards. The move is aimed at limiting inflation on the digital currency. A point to note is that the previous two halvings were succeeded by Bitcoin bull market. The first such bull market pushed Bitcoin 1700% higher while the second saw digital coin price increasing by 3600%. Having said that, cryptocurrencies may be ahead of another major rally should the history repeat itself. However, traders should keep in mind that those gains were realized over the long time frame as both aforementioned bull markets lasted around 1000 days.

Crypto news: Silver crashes, Bitcoin rebounds 📈Is crypto repeating the 2020 cycle?

Daily Summary: Wall Street Rises on Christmas Mood

Chart of the day: Bitcoin (16.12.2025)

Crypto news: Bitcoin slides below $90k again🚩Cryptocurrencies under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.