Cryptocurrencies are trading slightly weaker amid mixed sentiment on indexes ahead of the Federal Reserve decision and Fed chief Jerome Powell's conference, which will potentially provide assets with a risk of high volatility. Bitcoin is trying to hold near $23,000, while most altcoins are trading down, with Dogecoin, Avalanche and Dydx prevailing among them.

- Traders are beginning to assess the chances of a continuation of the January increases. Matrixport analysts noted that statistically, in 5 of the 6 total years in which BTC recorded a rally in January, it ended the year 245% higher on average with the exception of 2014 when it reached a bull market peak in January;

- Binance announced a partnership with Mastercard on payment services in Brazil allowing users to pay with their own card at all Mastercard terminals. The exchange intends to incentivize with a payment return of 8% in Binancecoin (BNB). The two companies collaborated in the Argentine market that year;

- A Financial Times report indicates that Twitter has applied for regulatory permits regarding payment processing in the US market. Integration with financial services and cryptocurrencies has been heralded in the past by Elon Musk himself, prompting a wave of speculation about possible cryptocurrency backing that Dogecoin could benefit from.

According to Reuters reports, financial institutions are increasingly eager to look to cryptocurrencies, with Bitcoin pointing to it after the second-best January on record for the major cryptocurrency. Institutional inflows into BTC between January 20 and 27 totaled nearly $116 million. Source: Coinshres, Reuters

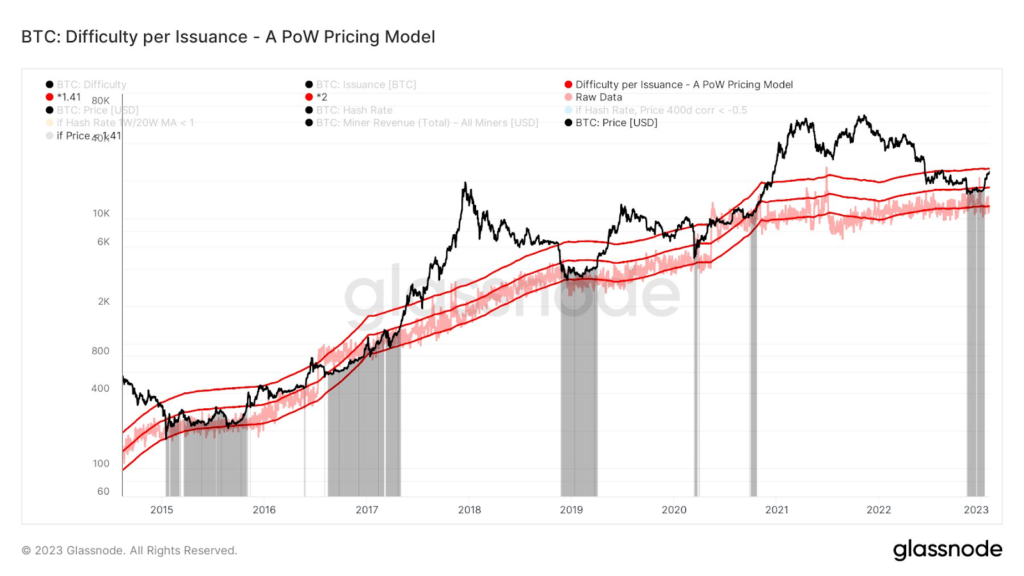

The Proof of Work valuation model indicates that BTC is approaching a significant level at 2.0, meaning that its price is almost double the cost of 'mining' 1 BTC by miners. In previous bull markets, crossing this zone was a good predictor, however, a downward reaction from outlying levels could indicate strong supply and a repeat of the situation from 2015, when the price twice found a bottom at the same level before Bitcoin began its bull market. Source: Glassnode

The Proof of Work valuation model indicates that BTC is approaching a significant level at 2.0, meaning that its price is almost double the cost of 'mining' 1 BTC by miners. In previous bull markets, crossing this zone was a good predictor, however, a downward reaction from outlying levels could indicate strong supply and a repeat of the situation from 2015, when the price twice found a bottom at the same level before Bitcoin began its bull market. Source: Glassnode

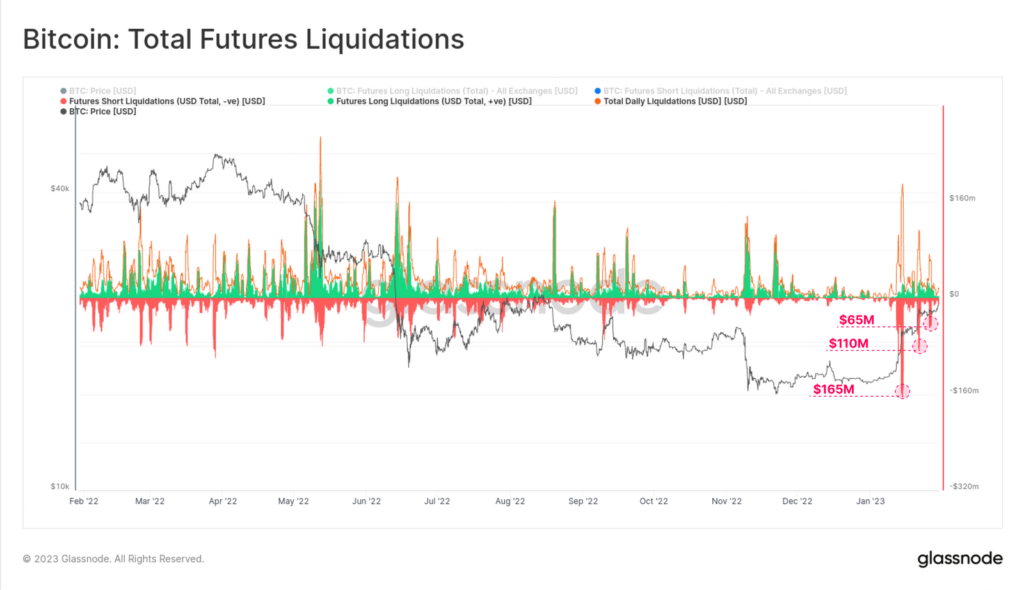

The largest wave of liquidation of short positions in several months took place in January. 85% of futures traders' positions on cryptocurrency exchanges predicted further declines. Faced with a massive 'short squeeze', the positive sentiment may last longer, a sizable portion of traders forecasting declines were removed from the market. Historically, such major deleveraging events have preceded fundamental trend changes. Source: Glassnode

Bitcoin price, H4 interval. Bitcoin's correlation with the NASDAQ (yellow chart) rose to record levels in May 2022, which underscores the importance of today's Fed decision. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.