Major cryptocurrencies as well as alt coins have been traded lower as of late. Sell-off intensified yesterday's, pushing Bitcoin 7% lower and Ethereum down 8%. Investors have lowered exposure to risky assets ahead of this week's Fed meeting and cryptocurrencies seem to be no exception. Fed is expected to accelerate the pace of QE tapering, which may withdraw part of excess liquidity from the markets and is generally viewed as negative for high-risk asset prices, like equities and cryptos. In more crypto-related news, it was reported yesterday that inflows into digital asset investment funds dropped to below $100 million in the previous week. Second straight week of lower inflows highlights lower interest from investors during the ongoing correction.

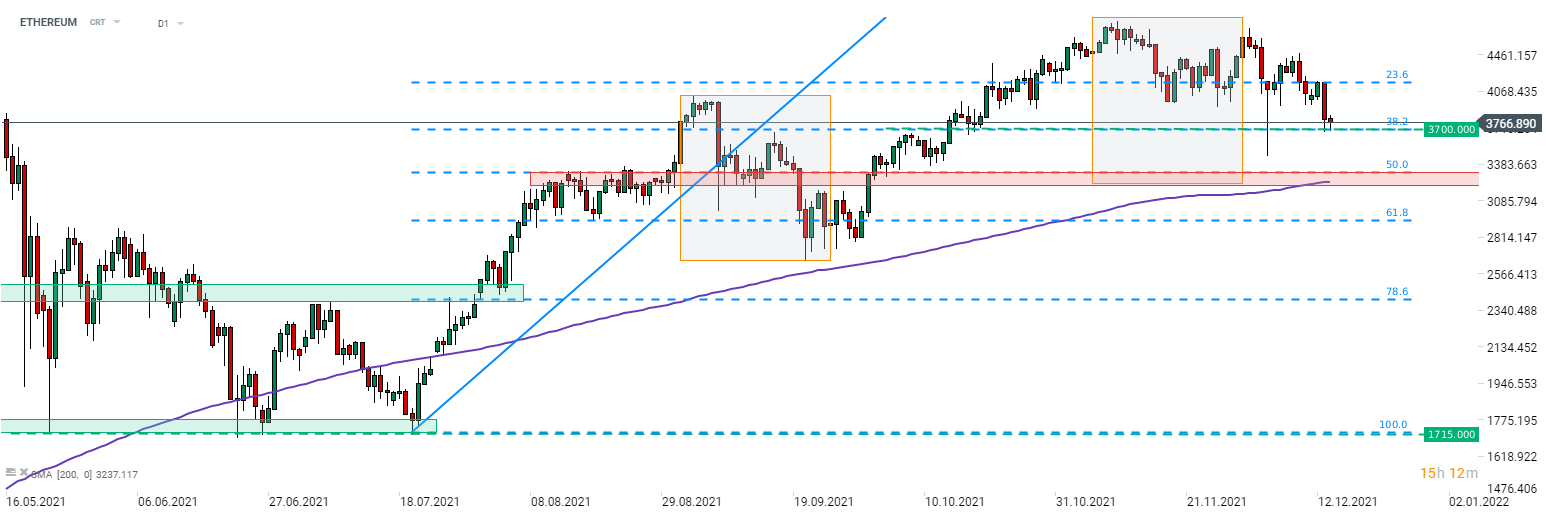

Cryptocurrencies trade off yesterday's lows but remain under pressure. Taking a look at the Ethereum chart, we can see that this coin dropped around 23% off its highs from the beginning of November. Price tested support at $3,700, marked with 38.2% retracement of the upward move started in July, and the area has managed to hold sellers for now. Should declines resume and Ethereum drops below $3,700 area, the next major support to watch can be found in the $3,200-3,300 zone, where 200-session moving average, 50% retracement and lower limit of the Overbalance structure can be found.

Source: xStation5

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.