- We are closing a turbulent week on the financial markets.

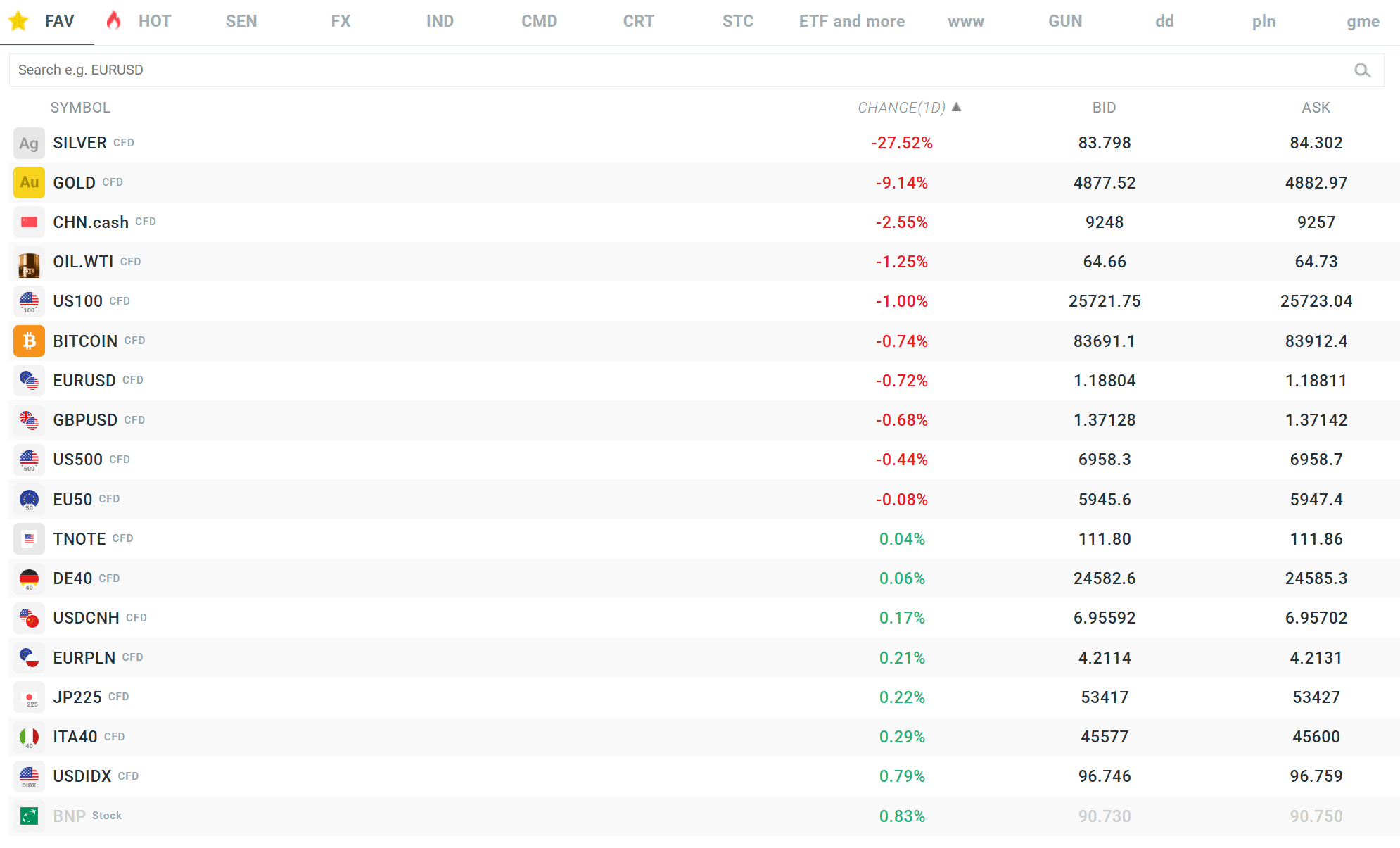

- Gold and silver are experiencing unprecedented declines, closing the most difficult day in their modern trading history. Gold has already lost more than 10.5% of its value. Silver is doing even worse, falling by as much as 30% to £76.5/oz, which is the worst daily percentage result in the history of trading this commodity, surpassing even the famous Hunt brothers' crash of the 1980s.

- Just before 8 p.m., when this entry was being written, metals slowed down their downward momentum somewhat. SILVER reacted to the 50-day exponential moving average.

- President Donald Trump praised the record levels of the S&P 500 index, which reached a new all-time high. Trump announced that he was sending a large "number of ships" towards Iran, describing it as "even bigger than the one sent to Venezuela", and demanded that Iran reach an agreement immediately, warning: "they should make a deal, if not, we'll see what happens". The President gave a positive assessment of the talks with the Venezuelan leadership, stating briefly: "VENEZUELA LEADERSHIP GOING VERY WELL", which suggests progress in negotiations or stabilisation of the situation in that country.

- Donald Trump has announced that Kevin Warsh will be his nominee to succeed Jerome Powell as Fed chair. Warsh was a Fed banker from 2006 to 2011, so he has solid experience in monetary policy. He is also a Wall Street man and was considered one of the most hawkish members of the Fed when he was chairman. He was also a vocal critic of quantitative easing.

- Google's announcement of Project Genie caused panic in the market, with shares of major gaming players falling sharply: Unity Software (U.US) lost 12%, Roblox (RBLX.US) 8%, and Take-Two Interactive (TTWO.US) 7%. Unity is a leader in providing engines and tools for game developers worldwide, Roblox is famous for its user-generated game creation platform, and Take-Two is known for hit franchises such as Grand Theft Auto and Red Dead Redemption. The Genie project threatens the core value offered by these companies – it enables users to create interactive virtual worlds directly from text prompts and images, bypassing the traditional, complex game development processes that required specialised knowledge and tools.

- Apple opens fiscal year 2026 with its strongest quarter ever. The Cupertino giant is not only breaking sales records, but also redefining its growth strategy, focusing on the synergy of powerful hardware with high-margin services and an evolutionary approach to artificial intelligence. Although the company has been repeatedly criticised in recent months for missing out on the entire artificial intelligence rally, it cannot be ruled out that waiting out the first phase may bring the company clear benefits in the form of significantly lower costs incurred by other giant companies such as Alphabet, Meta and Microsoft.

- American Express published its fourth quarter results in line with market expectations. Earnings per share (EPS) amounted to USD 3.53 against the forecasted USD 3.54, while revenues amounted to USD 18.98 billion (a 9% increase year-on-year), slightly above the expected USD 18.92 billion. Revenue growth was driven by higher cardholder spending, an increase in net interest income supported by growth in revolving loan balances, and solid growth in card fees.

- The uncertain geopolitical background supported energy commodities today, primarily oil and gas. However, in the second half of the day, when Trump mentioned that Iran wants to sign an agreement with the US, WTI gains stopped and reversed. NATGAS, however, maintains nearly 10% gains.

- The US dollar is the unprecedented winner on the FX market. The US currency is recording significant gains against most other currencies, but the scale of appreciation is particularly evident against the Australian dollar and the Swiss franc.

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.