-

In the broad market today, we a gradually camling sentiment. Both the US500 and US100 are trading on a slight upside. The gains were somewhat limited later in the day.

-

The dollar is strengthening and remains one of the stronger currencies today alongside the Australian dollar. The euro is losing ground, with the EURUSD currency pair trading 0.75% lower.

-

Bitcoin momentarily crossed the $35,000 level today, which was linked to the narrative regarding the imminent approval of an ETF for spot Bitcoin. Increases on some cryptocurrencies have exceeded as much as 15% since the beginning of this week

-

As history shows, the emergence of an ETF for a given market is a net positive for prices, against which it was Bitcoin that gained very strongly

-

In the late afternoon, mixed news was released, which limited the rise in cryptocurrency prices. The ticker of a potential ETF from Blackrock disappeared from the DTCC website, which led to the beginning of strong gains yesterday

-

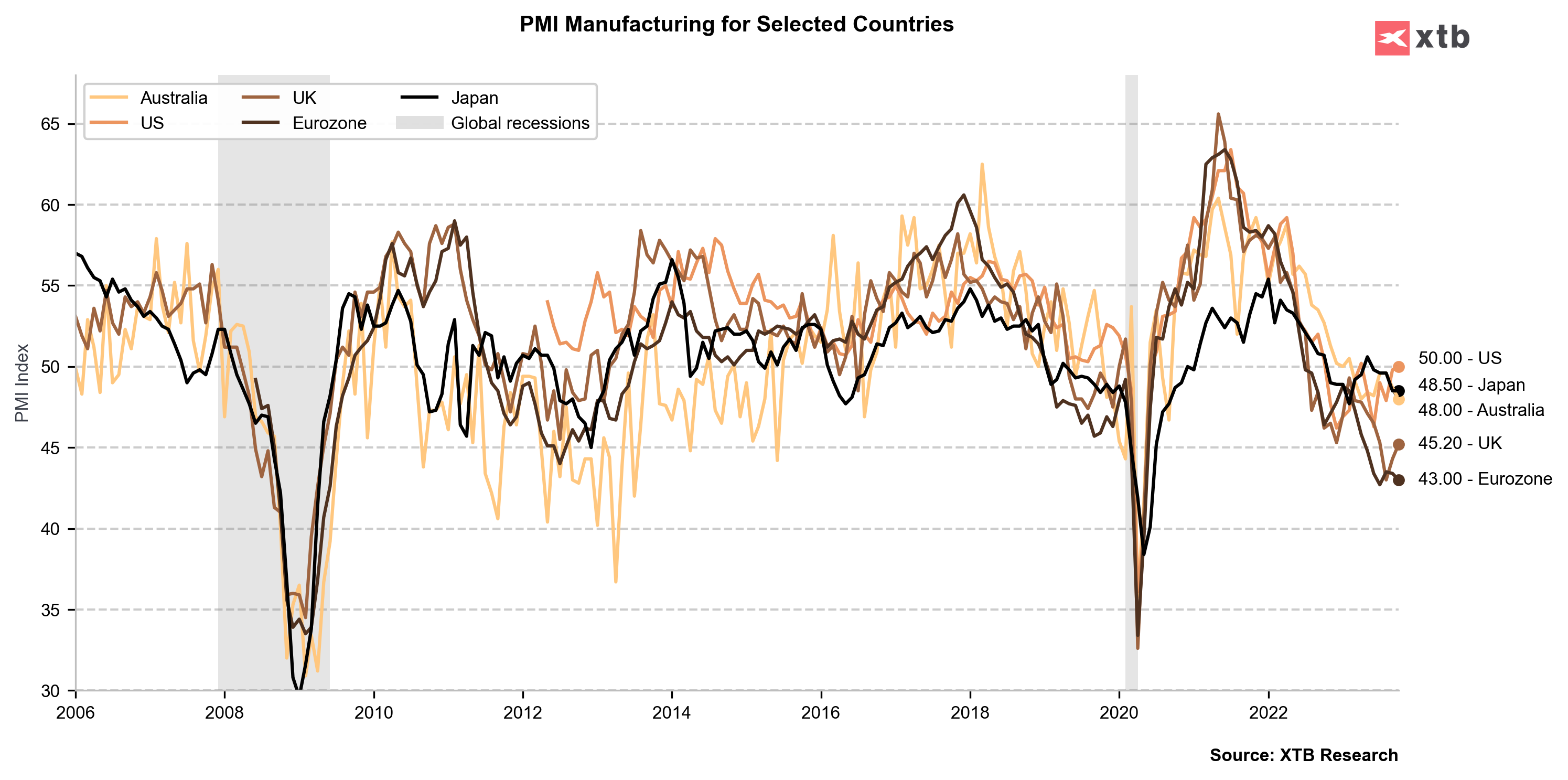

Preliminary PMI indexes fared mixed today - on the one hand, a slight improvement in Germany, where the industrial PMI rose to 40.7 points from 39.6 points. On the other hand, the services PMI fared worse, coming in at 48 points from 50.3 earlier.

-

In the U.S., on the other hand, the PMI indexes surprised positively, with the industrial index coming in at exactly 50 points, while the services index came in at 50.9 on expectations of a drop below 50 points

-

Verizon (VZ.US) shares are gaining after the release of quarterly results. The company reported very solid cash flow and better performance in the broadband sector.

-

After the Wall Street session, Microsoft and Alphabet results will be published. For Microsoft, the key questions will be the impact of AI on the company's results, while for Alphabet, further growth in the advertising and cloud computing segments. Alphabet is gaining about 1% ahead of the earnings releases, while Microsoft is losing marginally.

-

WTI crude oil fell below $85 per barrel today amid speculation that OPEC+ would raise production in the face of supply tensions. On the other hand, the lack of escalation of the conflict in the Middle East is also working to limit recent gains.

-

On the other hand, gold prices recovered from around $1,950 to $1,975 per ounce at the end of the U.S. session

Preliminary PMI data shows a slight rebound in the industry, but the data still indicates an economic contraction zone.

MIDDAY WRAP: Mixed sentiment in Europe, declines on U.S. indices

BREAKING: US consumer spending stays strong into late 2025 📈📌

Economic calendar: US retail sales and PPI data in focus on Wall Street 🗽

Morning wrap (14.01.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.