-

Wall Street ended the day with moderate gains as lower volatility prevails, with investors awaiting the crucial Fed decision and Jerome Powell's conference on Wednesday.

-

The US500 gained 0.30%, trading around 4510 points, while the US100 posted a slightly higher gain of 0.40%, trading near 15450 points.

-

European stock indices closed lower on Monday, with the German DAX down by 1.17%, the French CAC40 depreciating by 1.56%, and London's FTSE100 slipping by 0.76%.

-

The Euro emerged as one of the stronger currencies today following reports that the European Central Bank (ECB) is reportedly preparing to implement a liquidity management strategy in banks. This potential strategy might include raising banks' mandatory reserves from the existing 1% of customer deposits to a range of 3-4%.

-

The Norwegian Krone (NOK) appears weaker today due to speculation that the Norges Bank may conclude its rate hike cycle at Thursday's meeting, despite previous expectations of a 25 basis point increase.

-

Macro update from Canada:

- Housing starts were at 252,000 (expected: 234,300; previous: 255,200)

- PPI inflation stood at -0.5% Y/Y (previously: 2.7%Y/Y)

- The trend in producer prices in Canada resembles that in the USA, although it is unlikely to prompt the Bank of Canada (BoC) to raise rates, especially considering Canada's highly inflated real estate market.

-

In Poland, core CPI inflation aligns with expectations, dropping to 10% from 10.6%. This indicates lower core inflation compared to the general CPI, although September's CPI from the base index should see a significant decline.

-

In the cryptocurrency market, there are some modest gains, likely driven by a rebound from recent declines as there is no clear news from the crypto specific point of view. Bitcoin is up by 1.60%, with peak gains reaching 3.0%.

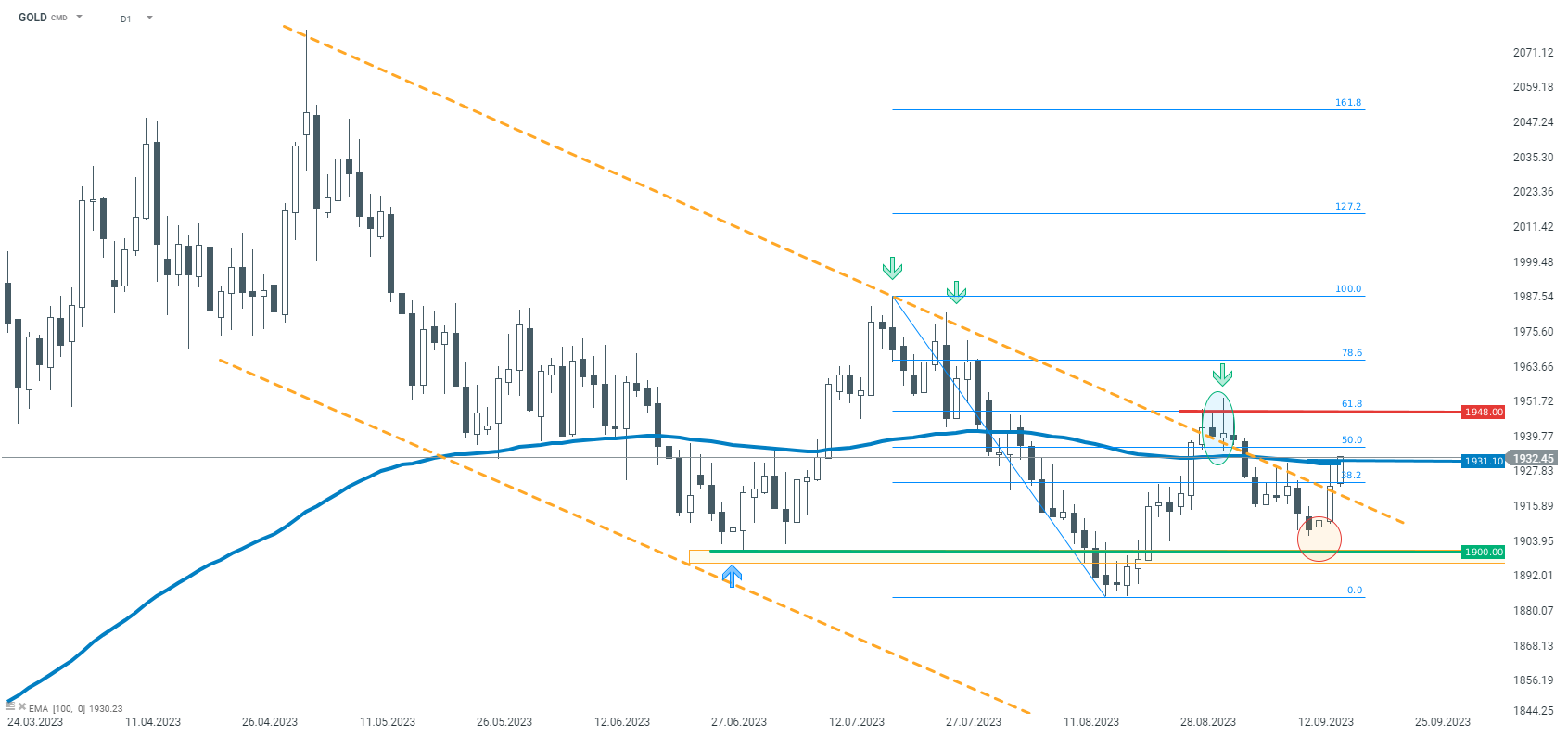

Gold benefits from the weakening dollar, continuing its upward movement after bouncing from support around $1900. A sustained break above $1931 could potentially lead to further gains towards $1948. Source: xStation.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.