- US stocks take a breath ahead of Fed meeting

- Several EU countries suspended the use of AstraZeneca’s Covid-19 vaccine

- President Biden plans first major tax hike in almost 30 years

European indices erased early gains and finished today's session mostly lower amid increasing concerns about a further slowdown in the Covid-19 inoculation campaign. Germany, Ireland and the Netherlands have joined the rising number of countries that have temporarily suspended the use of the COVID-19 vaccine developed by AstraZeneca and the University of Oxford due to an investigation into cases of blood clots. At the same time, number of new COVID-19 infections have been rising in Europe, especially in Germany and Italy. Meanwhile, stronger-than-expected industrial production and retail sales numbers from China provided some support. DAX 30 fell 0.3%, CAC 40 lost 0.4% and FTSE 100 finished 0.2% lower.

US indices are trading slightly above the flat line while the 10-year Treasury yield eased slightly to 1.616%, after reaching its highest level in more than a year on Friday. President Biden is planning the first major federal tax hike since 1993, Bloomberg reported. Meanwhile, some Americans already received their stimulus payments during the weekend and next 100 million stimulus checks will be delivered within the next 10 days. On the coronavirus front, the US government administered 100 million Covid-19 vaccine doses with about 35 million citizens fully vaccinated. Investors are waiting for Wednesday and the Fed decision on interest rates. The central bank is expected to acknowledge much better growth in the economy. However traders will focus on Fed’s interest rate outlook, which now does not include any rate hikes through 2023.

WTI crude fell more than 0.5% and is trading around $65.30 a barrel, while Brent is trading nearly 0.60% lower around $68.80 a barrel. Early in the session oil rose thanks to upbeat Chinese industrial production figures. Elsewhere gold rose nearly 0.3% to $ 1,731.00 / oz, while silver is trading 1.20 % higher near $ 26.20 / oz amid a slightly weaker dollar. Bitcoin fell from a new all-time high at $61,800 and is trading below $56.000.

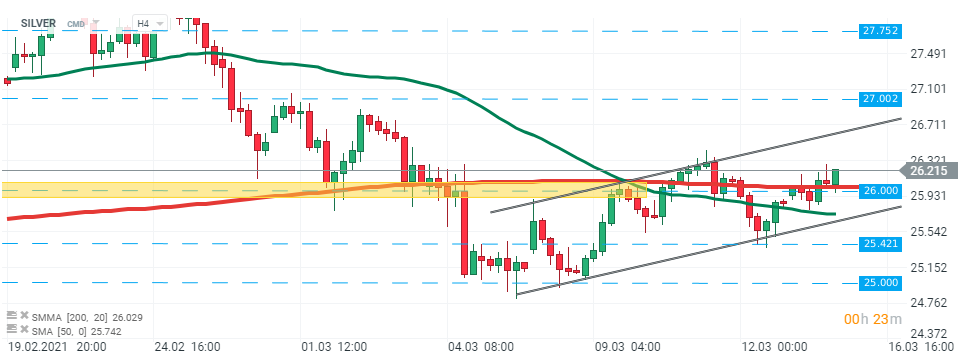

Silver price managed to break above the major resistance at $26.00/oz which coincides with 200 SMA ( red line). If the current sentiment prevails, upward move could be extended to the upper limit of the ascending channel or even $27.00 handle. However, if buyers will manage to regain control and push the price below the aforementioned $26.00 level, then next support to watch lies at $25.42 level. Source: xStation5

Silver price managed to break above the major resistance at $26.00/oz which coincides with 200 SMA ( red line). If the current sentiment prevails, upward move could be extended to the upper limit of the ascending channel or even $27.00 handle. However, if buyers will manage to regain control and push the price below the aforementioned $26.00 level, then next support to watch lies at $25.42 level. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.