- China’s economy grew faster than expected in Q4

- European equities close slightly higher

- Public holiday in the US

European indices finished today’s session mostly higher as the political turmoil continues across the continent. Italy's PM Giuseppe Conte faces two days of parliamentary votes that will decide if his coalition has enough support to remain in power. In Germany, Armin Laschet, who is known as Angela Merkel's loyalist, was elected as the new leader of the CDU party. Meanwhile, rising coronavirus infections and restrictions and a slow vaccination rollout remain in the spotlight. German Finance Minister Olaf Scholz warned that the current lockdown could be extended until mid-February. German government will talk about implementing additional restrictions tomorrow, including the possibility of forcing or incentivizing companies to have more people work from home, compulsory wearing of heavy duty FFP2 masks in certain areas, restrictions on public transport and the introduction of curfews. Elsewhere, better-than-expected data from China lifted market sentiment. Second largest economy expanded 2.3% in 2020, as its GDP jumped by 6.5% in the 4Q from a year ago. DAX 30 rose 0.4% ,CAC 40 gained 0.10% and FTSE 100 finished 0.22% lower.

US financial markets are closed Monday for the Martin Luther King holiday. On Wednesday markets attention will focus on events in Washington, where President-elect Joe Biden’s inauguration will take place amid risks of violence and security concerns. Also investors are trying to assess how much of his proposed $1.9 trillion stimulus plan will get through Congress given Republican opposition. Coronavirus deaths in the US are approaching 400K and the number is expected to reach 500K next month, according to the incoming CDC director.

Meanwhile some market participants wonder if we are already dealing with a bubble on the stock market. In a monthly letter to clients from last week, Mark Haefele, chief investment officer at UBS Global Wealth Management, said all of the preconditions for a bubble are in place. "Financing costs are at record lows, new participants are being drawn into markets, and the combination of high accumulated savings and low prospective returns on traditional assets create both the means and the desire to engage in speculative activity," he said, warning that in the months ahead, investors will need to pay particular attention to "risks of a monetary policy reversal, rising equity valuations, and the rate of the post-pandemic recovery."Haefele said however that while he sees pockets of speculation, the broader equity market is not in a bubble.

US crude futures are trading 0.55% lower at $52.07 per barrel, while Brent contract fell 0.6% below $ 54.80 per barrel as the imposition of fresh lockdowns in Europe and China clouded the outlook on fuel demand recovery. Elsewhere, gold futures rose 0.60% at $ 1,837.00 / oz, while silver is trading nearly 0.90% higher near $ 24.90 / oz. Bitcoin again fell below $36,000 level.

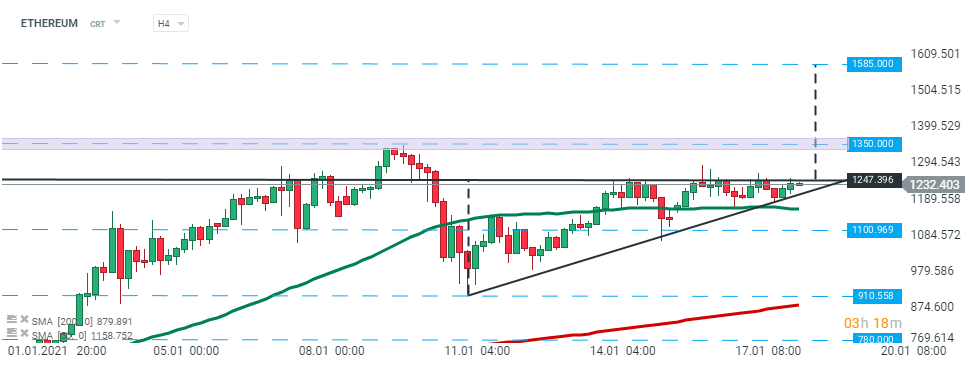

Ethereum price is testing the upper limit of the ascending triangle pattern at $1,247.00 and breakout above can push the price towards all time high at $ 1350.00. However the distance between the triangle's highest points suggests that Ethereum price may reach new ATH around $1585 level. On the other hand, if sellers manage to halt declines here and break below the lower limit of the formation, then larger correction could be on the cards. The nearest support lies at $1100. Source: xStation5

Ethereum price is testing the upper limit of the ascending triangle pattern at $1,247.00 and breakout above can push the price towards all time high at $ 1350.00. However the distance between the triangle's highest points suggests that Ethereum price may reach new ATH around $1585 level. On the other hand, if sellers manage to halt declines here and break below the lower limit of the formation, then larger correction could be on the cards. The nearest support lies at $1100. Source: xStation5

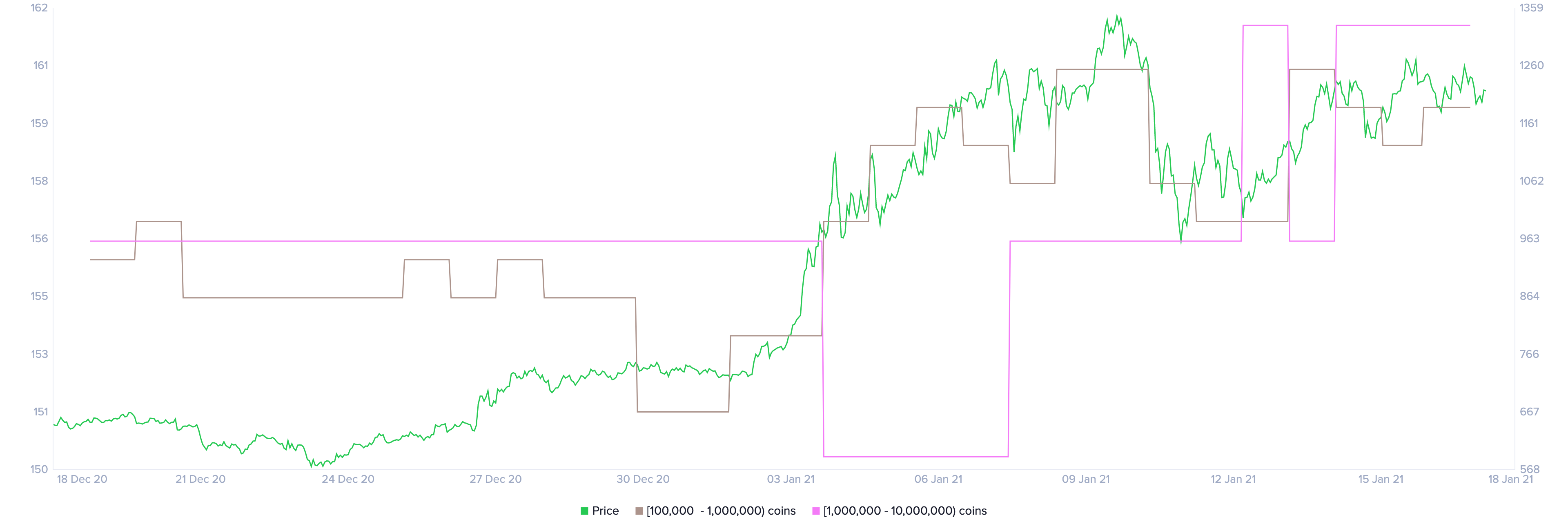

The bullish scenario is additionally supported by an increasing number of whales holding at least 1,000,000 ETH coins and large investors holding between 100,000 and 1,000,000 coins.

Number of big players which are investing in Ethereum continues to increase. Source: Santiment

Number of big players which are investing in Ethereum continues to increase. Source: Santiment

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.