- The market is in an ultra positive mood. Wall Street indices record moderate gains, with both US500 and US100 trading around 0.30-0.40% higher, however indices keep consolidating around historic highs.

- Stock market gains are supported by the continuing weakening of the dollar, which today continues its downward movement after lower PCE data from the USA. The dollar remains one of the weakest currencies among the G10 countries today.

- Major European stock indices closed the session mixed, with DAX gaining 0.11% today, CAC 40 losing 0.03%, and FTSE 100 adding 0.04%.

- Volatility on the Warsaw Stock Exchange was also limited, with WIG20 losing just under 0.1%.

- EURUSD crossed the 1.10 USD level yesterday and remains above it today, confirming the bullish sentiment that has been ongoing since the beginning of October.

- US macro data package for November:

- PCE Inflation. Currently: 2.6% y/y. Expected: 2.8% y/y. Previous: 3.0% y/y

- Core PCE Inflation. Currently: 3.2% y/y. Expected: 3.4% y/y. Previous: 3.5% y/y

- Durable goods orders: Currently: 5.4% m/m. Expectations: 2.3% m/m. Previous: -5.4% m/m

- US inflation data at 14:30 showed lower-than-expected price pressure in November, strengthening expectations for Federal Reserve rate cuts next year.

- Oil prices are slightly slipping during Friday's session, while NATGAS is down almost 4%.

- Gold started the session with gains, GOLD broke out of a triangle formation and even tested the 2070$ level, followed by a pullback. Gains for the day were limited to 0.5%.

- Cryptocurrencies are consolidating around the highs after yesterday's gains. Bitcoin is holding around 44000 USD. Meanwhile, Ethereum is recording a 4.0% increase, and some Altcoins are gaining even double-digit percentages.

- Solana records nearly 4% gains above 90 dollars and currently jumps into the top 5 cryptocurrencies by market capitalization.

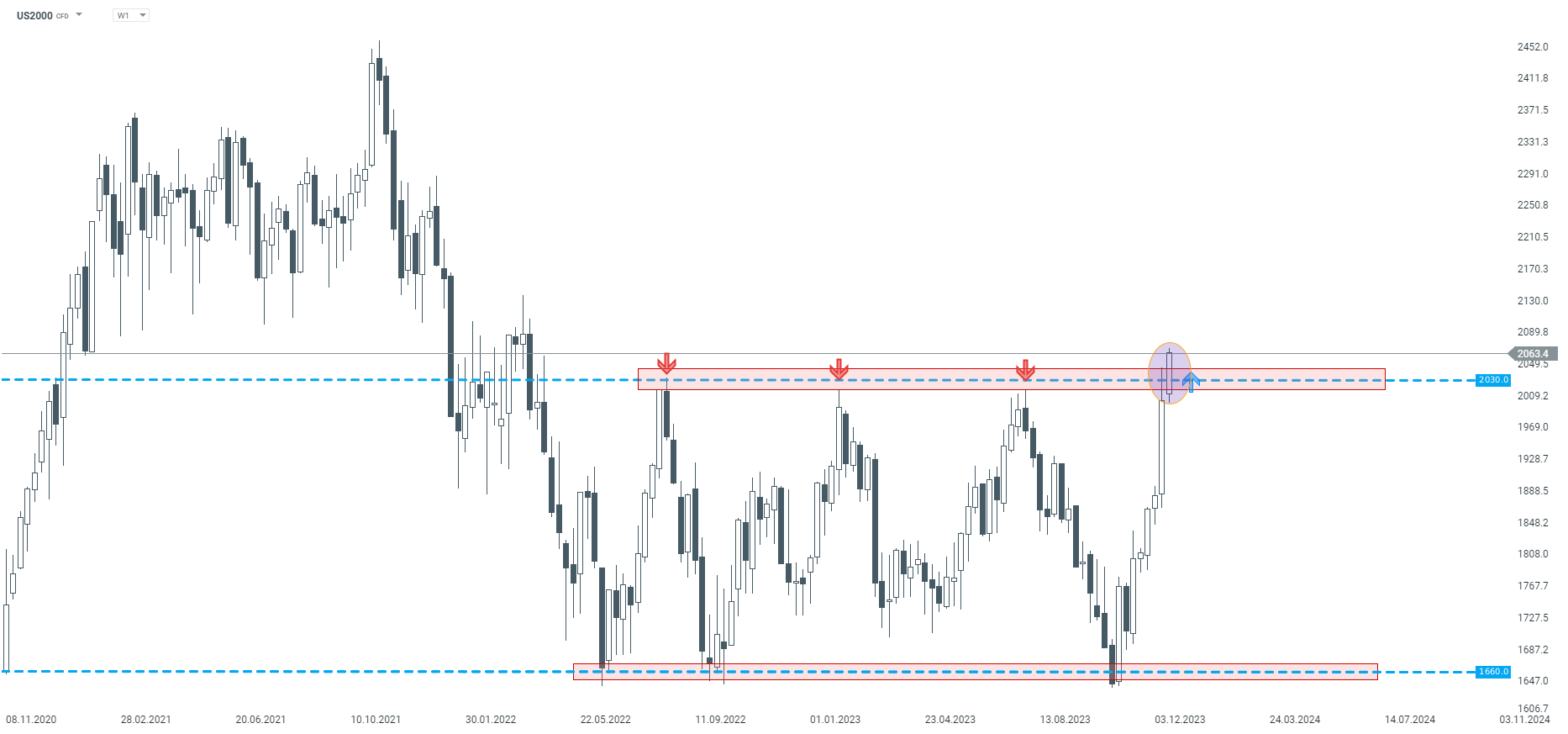

US2000 has a chance to end the week high and break out of the consolidation between 1660 points and 2030 points. Source: xStation5

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

🔵 ECB Press Conference (LIVE)

BREAKING: ECB maintains rates in line with expectations!💶

BREAKING: Bank of England holds rates as expected 📌 GBPUSD ticks down on dovish vote split 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.