- Mixed moods in Europe

- Wall Street slides ahead of FED meeting

- Precious metals took a hit after US PPI inflation reading

- Dogecoin gains after Musk's comments, Bitcoin below $47,000

European indices finished today's session in mixed moods - DAX fell 0.9%, while Italy’s FTSE MIB and the UK’s FTSE finished around the flat line, and Spain’s IBEX rose 0.4%. Stocks from basic resources and banking sectors moved higher while tech and travel companies took a hit due to persistent uncertainties regarding the potential impact of the omicron variant on the economy. WHO warned the new strain is spreading faster than any other and expressed uneasiness at the way it is being dismissed as a mild variant before any scientific conclusions. Also investors restrain themselves from making any big moves ahead of the key monetary policy decisions from major central banks including the US Fed, Bank of England, the ECB.

Major Wall Street indices extended yesterday losses, with Dow Jones losing over 0.40%, the S&P is trading 1.2% lower and the Nasdaq Composite fell nearly 2.0% as tech stocks plunged after data showed producer prices increased more than expected in November. The year-on-year increase hit a new record high ahead of the highly anticipated Fed policy statement due Wednesday. As it will be a quarterly meeting, a new set of economic forecasts and rate forecasts will be issued. Apart from that, the Fed is also expected to announce an acceleration in the pace of QE tapering. Recent data from the US has been solid and now the Fed may be more focused on bringing inflation back under control.

Major cryptocurrencies have not been able to take one clear direction today. Bitcoin is trading slightly lower, below $47,000 level. On the other hand, Dogecoin price soared after Elon Musk informed on Twitter that Tesla will accept memecoin as payment for some of its products. Precious metals launched today’s session under pressure and the sell-off accelerated after the publication of the US PPI inflation data. Currently gold is losing about 0.8% and silver is trading nearly 2% lower.

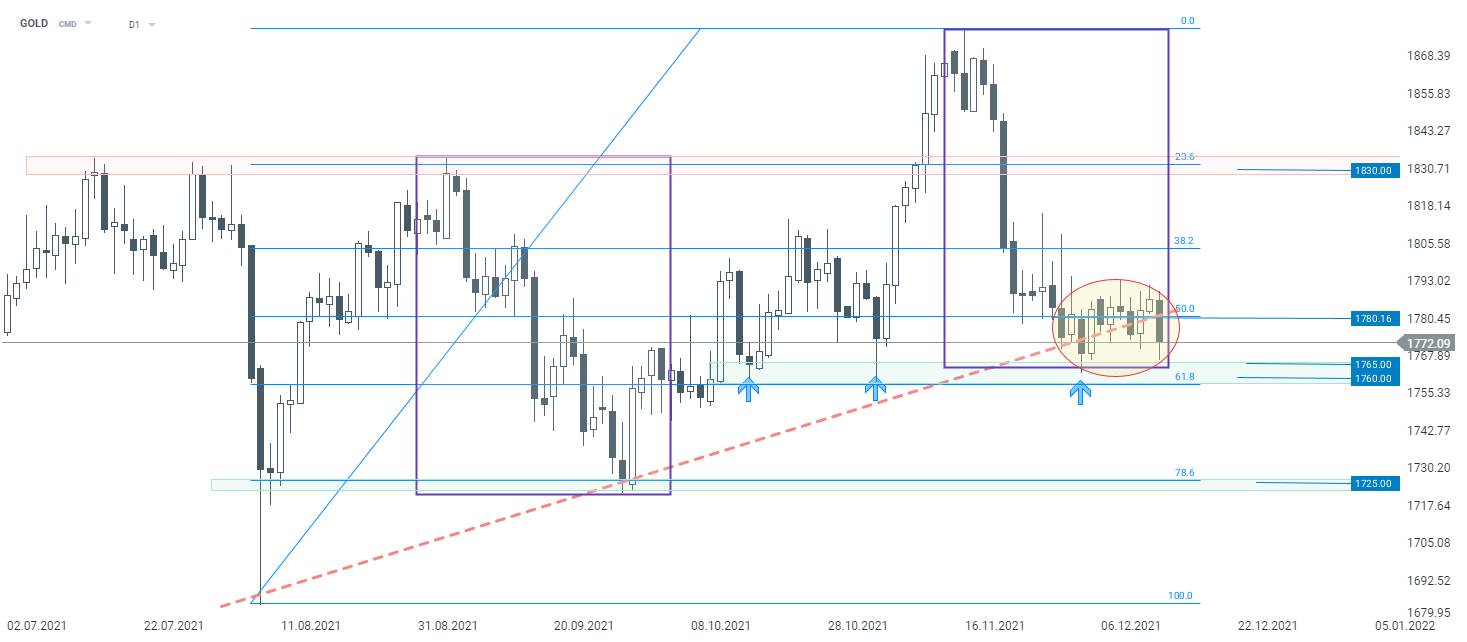

Looking technically at the gold chart on the D1 interval, the situation has not changed much- since the beginning of December, the price has remained in the local consolidation zone, however it is very possible that the situation will clear up after tomorrow's FED meeting. The key support is located around $ 1760 - $ 1765 zone, and break below may deepen the downward move.

Gold interval D1. Source: xStation5

Gold interval D1. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.