- Europe’s major markets finished session higher

- Upbeat US claims report

- Tech stocks rebound

European indices finished today's session higher as optimism in the US helped to spark a rally in afternoon trading. Also news that EU countries agreed to lift some of the COVID-19 travel restrictions on non-EU visitors also lifted market sentiment. On the data front, inflation concerns increased after German producer prices reached the highest level in nearly a decade. DAX30 rose 1.7%, CAC40 gained 1,29% and FTSE100 finished 1% higher.

Upbeat moods can be spotted at Wall Street as technology shares staged a comeback, while weekly jobless claims hit their lowest level since the start of a pandemic which also boosted sentiment. Investors also appear to shrug off worries over a rise in inflation and an early pull back in Fed's monetary stimulus. While cryptocurrencies are trying to erase some of the recent losses, the US Treasury Department announced today that it is taking steps to crack down on cryptocurrency markets and transactions, and said it will require any transfer worth $10,000 or more to be reported to the Internal Revenue Service. At the same time FED is moving forward in its efforts to develop its own digital currency, announcing Thursday that it will release a research paper this summer that explores the move further.

WTI crude fell more than 2.4 % and is trading around $61.80 a barrel, while Brent is trading 2.5% lower around $65.00 a barrel as the US-Iran nuclear talks reportedly will enter the 5th phase early next week. If both sides reach an agreement, this could result in sanctions on Tehran being lifted and more supply coming to the market. Elsewhere gold rose 0.5% to $ 1,880.00 / oz, while silver is trading 0.55% higher, below $ 28.00 / oz amid weaker dollar and lower Treasury yields, with the benchmark 10-year rate dropping to an over one-week low of 1.62%.

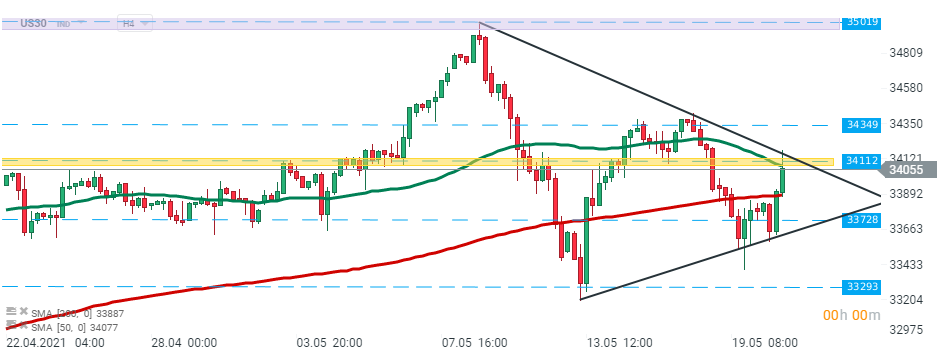

US30 rose sharply today, however buyers struggle to break above the major resistance zone at 34112 pts, which coincides with 50 SMA ( green line) and upper limit of the triangle pattern. Source: xStation5

US30 rose sharply today, however buyers struggle to break above the major resistance zone at 34112 pts, which coincides with 50 SMA ( green line) and upper limit of the triangle pattern. Source: xStation5

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.