- DE30 jumped to 5-Week High

- Wall Street extends rally

- OIL. WTI briefly dropped below $100.00 per barrel

European indexes finished today's session sharply higher, with DAX up more than 2.5%, the highest level since mid- February after a Russian negotiator said that the Ukraine talks have entered a practical phase and that the Zelensky-Putin meeting could take place in the future. Meanwhile Ukraine proposed adopting a neutral status but with international guarantees that it would be protected from attack. Also the Russian Deputy Defense Minister said that Russia is willing to scale military activity near Ukraine’s Kyiv and Chernihiv. However moods worsened this afternoon after US intelligence revealed that this may be a move which aims to regroup Russian forces and launched another better prepared offensive. Across sectors, autos jumped nearly 6% to lead the gains as all sectors traded in positive territory except basic resources and oil and gas, which dropped approximately 2% each.

Major Wall Street indices extended yesterday gains, with Dow up more than 0.40%, the S&P 500 rising 0.70% and the Nasdaq 1.45%, as investors weighed on reports that the first day of talks between Russia and Ukraine had constructive dialogue. Stocks of defense companies like Lockheed Martin and Northrop Grumman are moving lower during today's session, which could be a sign that investors are counting on the suspension of military operations and the continuation of Kyiv-Moscow negotiations. Meanwhile stocks of Tesla, Amazon, Costco and Shopify, which recently announced a share split, rose sharply. The biggest banks, JP Morgan, Bank of America and Wells Fargo cut some of the early gains. Shares of technology companies Intel, Nvidia, Adobe and Palantir are trying to stave off declines for good and resume upward move. In turn, oil companies Exxon Mobil and Chevron took a hit, similar to the raw material giants Rio Tinto and BHP Billiton.On the data front, the number of job openings in the United States came at 11.266 million in February, little changed from January and in line with analysts’ estimates. This week the market will focus on Friday's NFP data to measure the job market's strength further and gauge the outlook for monetary policy.

Inflation concerns eased slightly as oil prices briefly dropped below the $100-per-barrel mark, extending a 7% fall the day before. Precious metals also took a hit early in the session, however bulls regained some ground after the US open. Meanwhile cryptocurrencies swung between gains and losses. Bitcoin is currently trading slightly below the flatline while Ethereum bounced of the major resistance at $3500.

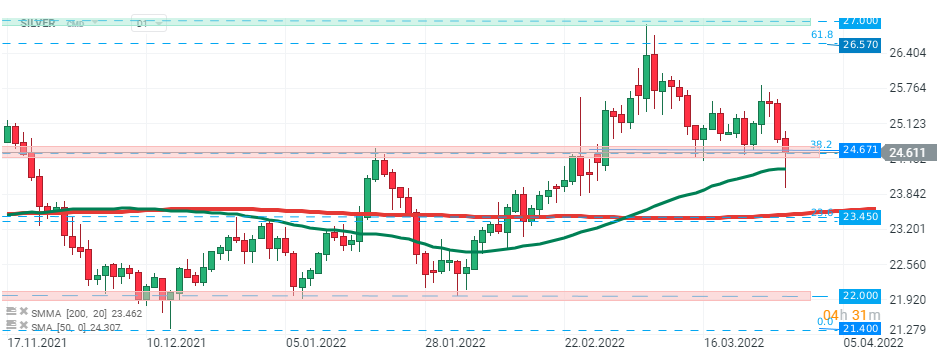

Silver price fell sharply during the European session, however buyers managed to regain control after US traders joined the market. Price erased most of the early losses and returned above major support at $24.67 which coincides with 38.2% Fibonacci retracement of the last major downward correction. Source: xStation5

Silver price fell sharply during the European session, however buyers managed to regain control after US traders joined the market. Price erased most of the early losses and returned above major support at $24.67 which coincides with 38.2% Fibonacci retracement of the last major downward correction. Source: xStation5

Daily Summary: Massive Gains in U.S. Indices Completely Wiped Out

Three Markets to Watch Next Week (02.01.2026)

US Open: A Powerful Start to the New Year for Nasdaq!

Euphoria hits the Hong Kong stock market 📈 CHN.cash surges 3%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.