- European indexes close mixed

- US inflation expectations hit new high

- Bitcoin approaches record level

European indices finished today's session almost flat, near record levels tracking lackluster sentiment elsewhere. On the earnings front, Henkel stock plunged over 6.0% after the chemicals company lowered its full-year guidance. Meanwhile, wind turbine maker Siemens Gamesa shares rose nearly 9% after the company became preferred supplier for UK’s Norfolk offshore wind projects. This news overshadowed its weak FY21 results, which saw a net loss of €672 million. Also mixed foreign trade data from China weighed on market moods. Exports increased to 27.1% from a year ago in October, above analysts' estimates of 24.5% gain, while imports increased by 20.6%, well below market projections of 25% advance, raising concerns over a slowdown in domestic demand. Meanwhile, ECB Lane said in an interview with a Spanish newspaper published on Monday that Eurozone inflation will ease next year.

Mixed moods prevail on Wall Street due to an almost empty macroeconomic calendar and the lack of any significant comments from central bankers. The New York FED today released a new report on inflation and economic growth, which shows that the median of inflation expectations remained unchanged in the medium term, while expectations rose in the short term. Uncertainty and disagreement about future inflation rose both in the short and medium term, reaching new highs. Today's data show that fewer US citizens believe Fed Chairman Powell's assurances that inflation is a temporary phenomenon. Also Fed Governor Michelle Bowman spoked in a similar tone and noted that inflation has remained high and some of the forces driving up prices are expected to last well into next year. A challenge with higher inflation is its greater effect on the low, moderate income people. She also noted that there is a risk that food, energy price spikes can have a bigger than thought impact on inflation expectations. Other FED members, including Chair Jerome Powell did not say anything that would deviate significantly from the earlier opinions expressed by the central bank. Wall Street indices are currently trading slightly higher, shaking off some of the bullish momentum that we could see in recent days. Investors' attention during today's session focused on AMD (AMD.US), whose shares rose sharply after the chip producer entered into cooperation with Meta (formerly Facebook). At the same time, the market capitalization of Alphabet broke the psychological barrier of USD 2 trillion, thus becoming one of the three American companies that exceeded this level.

Early in the session WTI crude futures rose more than 1% to above $82.50 a barrel on Monday, while Brent added 1.8% and was trading around $84.00 as expectations of higher demand and supply constraints outweighed the possibility of US government intervention in the oil market. Approval of a $1 trillion infrastructure bill coupled with last week’s decision by OPEC+ to retain its production level and news that Saudi Aramco boosted prices for Asian customers drove momentum. However some of the gains were erased later in the session. President Biden will deliver a speech addressing high oil and gas prices later this week. Elsewhere, gold rose 0.43%, while silver is trading 1.4% higher as a weaker dollar and declining treasury yields fueled appetite for non-yielding assets such as precious metals. The US benchmark 10Y yield has dipped below 1.5%, a level not seen in over a month following last week’s comments from major central banks regarding the tapering process.

For the same reason upbeat moods prevail on the cryptocurrency market, where Bitcoin broke above $66,000 level and is approaching its all-time high, while Ethereum hit a new record and is heading towards $4800 level. Other altcoins widely followed the uptrend, and added fuel to the rally.

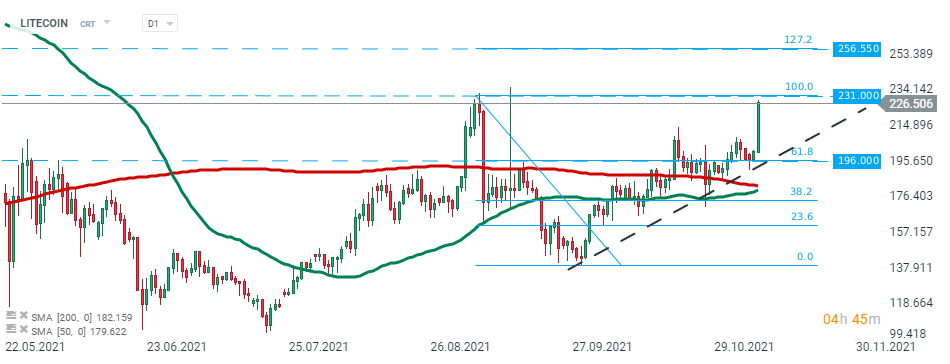

LITECOIN price jumped more than 14% during today's session amid upbeat market sentiment and is currently approaching major resistance at $231.00 where September high is located. Should break higher occur, upward move may accelerate towards $256.55. On the other hand, if sellers manage to regain control, then nearest support to watch lies at $196.00. Source: xStation5

LITECOIN price jumped more than 14% during today's session amid upbeat market sentiment and is currently approaching major resistance at $231.00 where September high is located. Should break higher occur, upward move may accelerate towards $256.55. On the other hand, if sellers manage to regain control, then nearest support to watch lies at $196.00. Source: xStation5

Cryptocurrencies sell-off 📉Ripple loses despite Amazon partnership

Will the defense sector keep European stock markets afloat❓

Chart of the day: JP225 (08.01.2026) 💡

Bitcoin slips below $90,000 📉 Is a broader sell-off ahead?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.