-

Stocks from Western Europe mostly higher

-

US markets little changed

-

Rising inflation expectations in the US

Investors witnessed a mixed session during the last trading day of the week. Following rather pessimistic moods during Asian hours, most major indices from Western Europe finished the day higher. The German DAX gained 0.06% and closed above 14,000 pts. FTSE 100 and CAC 40 advanced 0.94% and 0.60% respectively. US markets opened lower, yet market bulls try to push stocks higher - at press time S&P 500 and Nasdaq are trading slightly above the flatline.

Oil markets extend rally as Brent and WTI prices advance more than 2% today. An upward move accelerated in the afternoon GMT time and WTI has approached the $60 a barrel mark. As far as precious metals are concerned, silver outperforms gold and gains more than 1%. US yields continue their rally amid soaring inflation expectations in the US. University of Michigan 1-year inflation outlook climbed to 3.3% (above expected 3.0%). The British pound climbed above 1.3850 against the US dollar.

Today’s data from the United Kingdom showed that UK economy expanded faster than forecasted in 4Q as it grew by 1.0% QoQ against expected 0.5%. On the other hand, industrial production from the UK for December came in slightly below estimates (0.2% MoM vs exp. 0.5%). The release of UoM’s survey data was another key macro event of the day - the data left investors disappointed as headline consumer sentiment index came in below expectations (76.2 vs exp. 80.8).

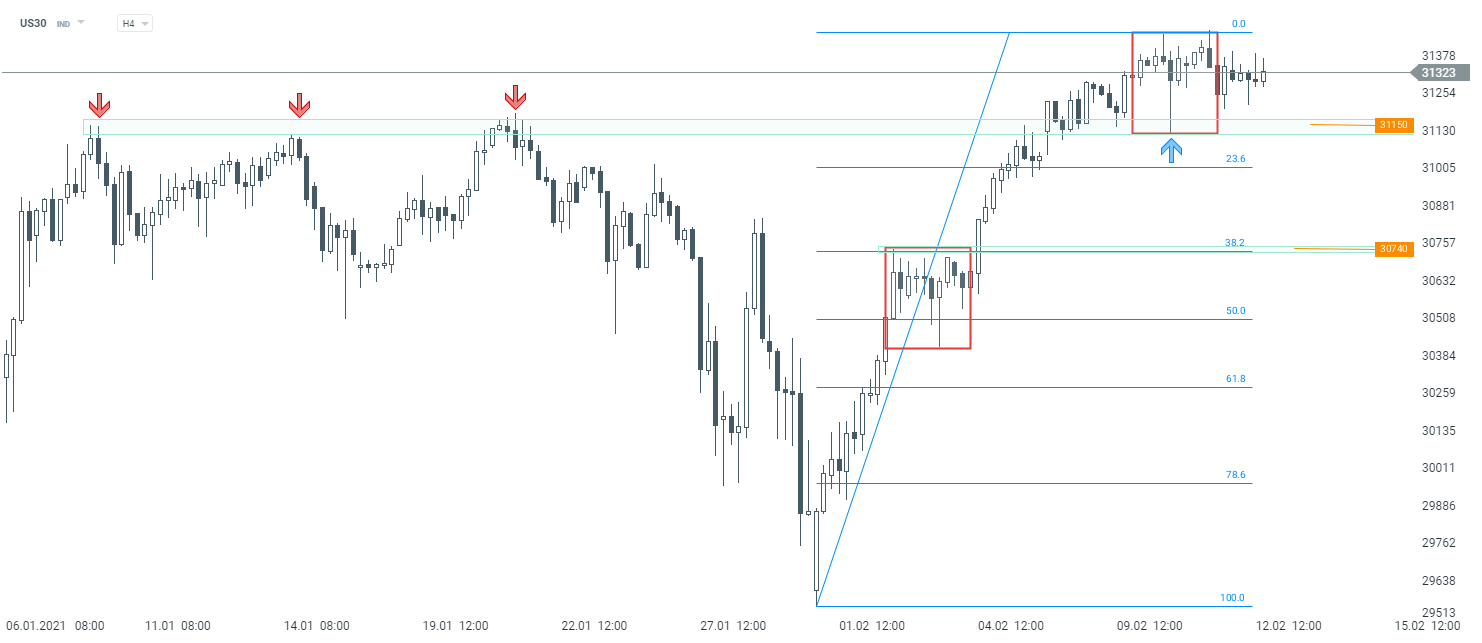

US30 broke above resistance area at 31,150 pts at the beginning of the week. The threshold turned out to become a support level later. According to classical technical analysis, as long as the index stays above, one should expect a bullish scenario to continue. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.