- According to the FOMC Minutes published at 07:00 pm GMT, bankers were unanimous in their decision to maintain interest rate levels.

- Following the publication of the Minutes, the money market valuation of the further path of interest rates was unchanged. The first full cut is priced for May 2024.

- The US indices limited their daily declines slightly after the publication of the Minutes, but nevertheless recorded sizable declines intraday. The US100 goes below the 16,000 barrier and loses 0.76%.

- European indices ended today's session slightly lower. The Bechmark Euro Stoxx 50 lost 0.24%, the French CAC 40 over 0.24% and the German DAX recorded a marginal decline of -0.01%. The Polish WIG20 recorded relatively large losses, losing 0.42%..

- Today, after the Wall Street session, Nvidia (NVDA.US) will report its third quarter.

- In the broad currency market, the British pound and the Canadian dollar are currently performing best. In contrast, the euro and the Australian dollar are performing much worse.

- Canadian inflation for October is falling, but the m/m readings are coming in relatively high. This does not change the market's attitude - a hike is no longer priced in, but perhaps the market will start to assess a possible cut later.

- US real estate market data on secondary market home sales showed a drop to the lowest level in 13 years, which should be explained by high mortgage rates as well as a low supply of houses.

- During the press conference with the President, Lagarde admonished that the coming months could bring slightly higher core inflation readings and reiterated that if external factors threaten the inflation-fighting process, the ECB could take further action. On the other hand, however, the current level of monetary tightening gives the ECB room to observe the situation and quietly decide on the next steps.

- As the WSJ reported, Binance founder Changpeng Zhao will agree to step down, and the company is also expected to admit wrongdoing and agree to pay a $4.3 billion fine for violating US anti-money laundering requirements, as part of a deal that could preserve the company's ability to continue operating. Bitcoin is losing nearly 1.3% on a daily basis, Ethereum is down 2.25%. Binancecoin is currently losing 5.3%.

- The energy commodities market is sharply divided. Crude oil, of the Brent and WTI varieties, is not experiencing excessive price deviations on an intraday basis. Sentiment is more pronounced in the gas market, where NATGAS is losing more than 1.2% and testing the USD 2.84 zone.

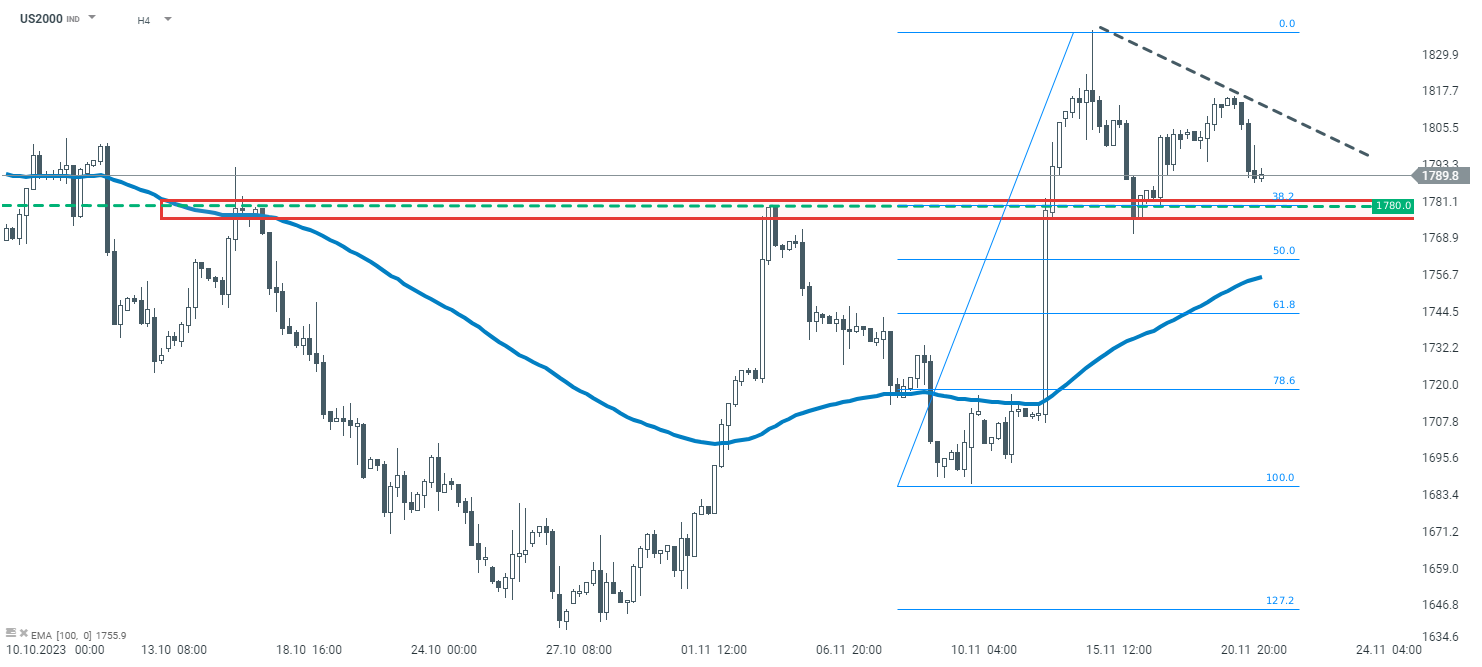

US2000 retreated more than 1% during today's session, nevertheless the key support in the short term for the index remains the zone at 1780 points.

US2000 chart. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.