- AstraZeneca releases positive Phase 2 COVID-19 vaccine results

- US COVID-19 death toll surpassed 250,000

- US stocks swing between gains and losses

US indices are trading mixed as soaring COVID-19 infections an unexpected rise in weekly jobless claims sparked fears of a slower-than-expected economic recovery. Yesterday US reported more than 173 768 new infections, which is the second-highest number since the pandemic began. Death toll from COVID-19 surpassed 250k on Wednesday. Also hospitalizations reached record number of 79 410. Due to worsening pandemic situation all public schools in New York will be closed. Also new restrictions will be imposed in Kentucky, Minnesota and Wisconsin. On the data front, initial jobless claims rose for the first time since October to a higher-than-expected 742K.

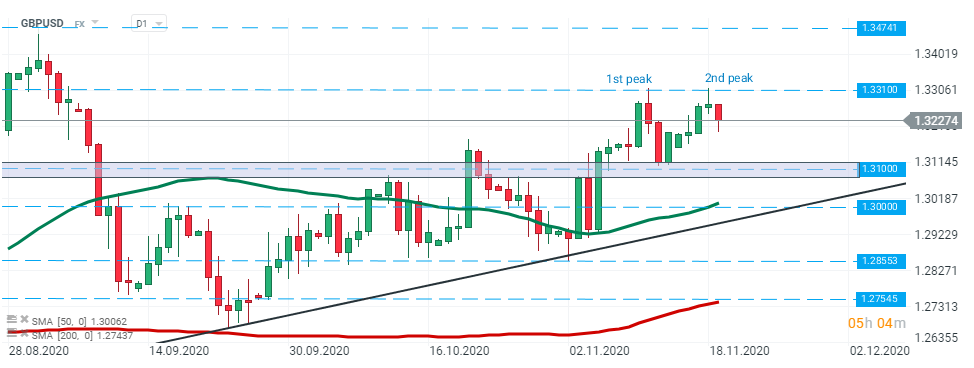

GBPUSD – pair has been trading in an upward trend recently. However, price did not manage to break above the high from 11th November and a double top pattern may be on the cards. The 1.3100 handle is a key support for now. If sellers manage to break below, a bigger downward correction may start. On the other hand, bouncing off the support may trigger another upward impulse. Source: xStation5

GBPUSD – pair has been trading in an upward trend recently. However, price did not manage to break above the high from 11th November and a double top pattern may be on the cards. The 1.3100 handle is a key support for now. If sellers manage to break below, a bigger downward correction may start. On the other hand, bouncing off the support may trigger another upward impulse. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.