- European equities higher despite rising yields

- The 10-year Treasury yield hit a 14-month high

- US jobless claims unexpectedly increase to a one-month high

European indices finished today's session higher despite rising Treasury yields. The German DAX reached new historic highs and is approaching 14,800 pts level, partially thanks to the superb performance of Volkswagen stock, which is planning to surpass the current leader in the electric car market, Tesla. It's also worth mentioning that the Dax index is largely composed of cyclical stocks that have been doing well recently. Meanwhile, ECB President Lagarde said that short-term inflation movement related to temporary factors of a transitory nature should not precipitate any particular move. Elsewhere, the BoE left interest rate on hold at a record low of 0.1 % and its bond-buying programme unchanged during its March meeting.

US indices are trading under pressure today. Nasdaq fell more than 2.5% and the S&P 500 lost nearly 0.7% as yields continue to soar which weighs on tech stocks. The 10-year Treasury yield rose to 1.75% , the highest level in 14 months, while the 30-year bond reached 2.50% level. Meanwhile, the Dow Jones pulled back after the index hit a fresh record high, early in the session led by the banking sector and cyclical stocks. It seems that FED Chair Powell failed to calm investors' nerves over runaway inflation and market measures of inflation expectations rose to multi year highs. On the data front, initial claims unexpectedly increased 45,000 to a seasonally adjusted 770k from 725k in the prior week, above analysts’ expectations of 700k. Philadelphia Federal Reserve’s manufacturing index jumped to 51.8, the highest reading since 1973 well above market consensus of 22.0.

WTI crude fell more than 7.0% and is trading slightly above $60.00 a barrel, while Brent is trading 6.90% lower around $63.30 a barrel. The International Energy Agency said in its monthly report that demand is not expected to return to pre-pandemic levels until 2023. Elsewhere gold fell 0.6 % to $ 1,733.00 / oz, while silver is trading 1.3 % lower near $ 26.00 / oz as both the dollar and Treasury yields soared on concerns over price pressures despite the Fed maintained its dovish stance.

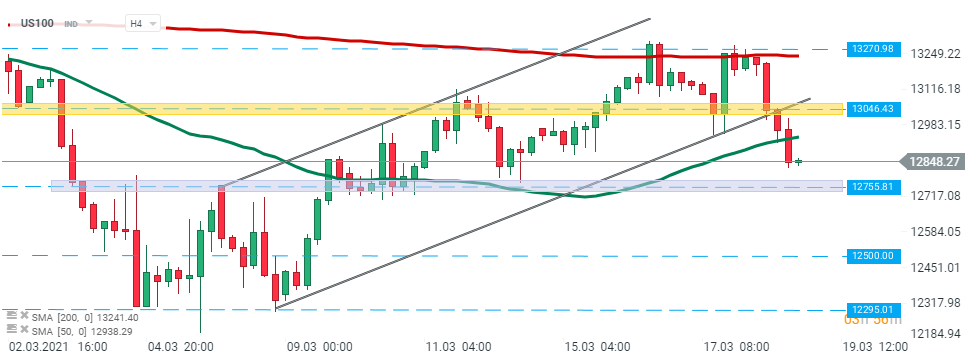

US100 fell more than 2.5% as a spike in US bond yields put pressure on tech stocks. Early in the session index broke below an important support zone which consists of the lower limit of the ascending channel and 13,046 pts level. Later sellers managed to break below 50 SMA (green line) which opened the way towards next support at 12,755 pts. Only, breaking above the aforementioned 13,046 pts level will invalidate the bearish scenario. Source: xStation5

US100 fell more than 2.5% as a spike in US bond yields put pressure on tech stocks. Early in the session index broke below an important support zone which consists of the lower limit of the ascending channel and 13,046 pts level. Later sellers managed to break below 50 SMA (green line) which opened the way towards next support at 12,755 pts. Only, breaking above the aforementioned 13,046 pts level will invalidate the bearish scenario. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.