- Europe shares fall for 3rd day in a row

- Disappointing US weekly jobless claims report

- US crude stockpiles fall sharply to the lowest level since March

Europe indices extended recent losses, with Dax down 0.2% and other major indexes falling between 0.7% and 1.4%, due to mixed corporate results and concerns regarding lagging coronavirus vaccination across the EU. Airbus operating profit plunged 75% last year while Orange revenues fell below expectations and Credit annual profit dropped 22%. Meantime, ECB minutes showed that policymakers remain concerned over the euro's strength.

US indices are trading in red as investors were discouraged by a weak jobless claims reading. Meanwhile, housing starts fell also disappointed however building permits came in above expectations. The recent jump in bond yields together with inflation expectations raised some concerns regarding potential pullback for stocks in the near future. The fast-growing tech companies that fueled last year's rally are particularly vulnerable to higher interest rates and inflationary pressures. On the corporate front, Apple stock fell another 2.4% and iPhone maker is down 4.6% amid profit-taking. Tesla dropped 2.5%, bringing its week-to-date losses to 4.6%. Walmart shares fell nearly 6% after the company posted disappointing quarterly figures and warned it expects sales to moderate this year.

Oil is trading slightly lower, with WTI below $61 a barrel and Brent about $63.65 a barrel. US crude oil inventories fell by 7.258 million barrels last week, compared to analysts’ expectations of a 2.429 million drop. It is a fourth consecutive week of decline due to production disruptions in Texas which are caused by historic winter storm. Oil producers and refiners remaining shut and the governor ordered a ban on natural gas exports from the state. Elsewhere gold futures fell 0.10% below $ 1,775.00 /oz, while silver is trading 1.0% lower near $ 27.00 /oz as the dollar strengthened and US Treasury yields remained elevated.

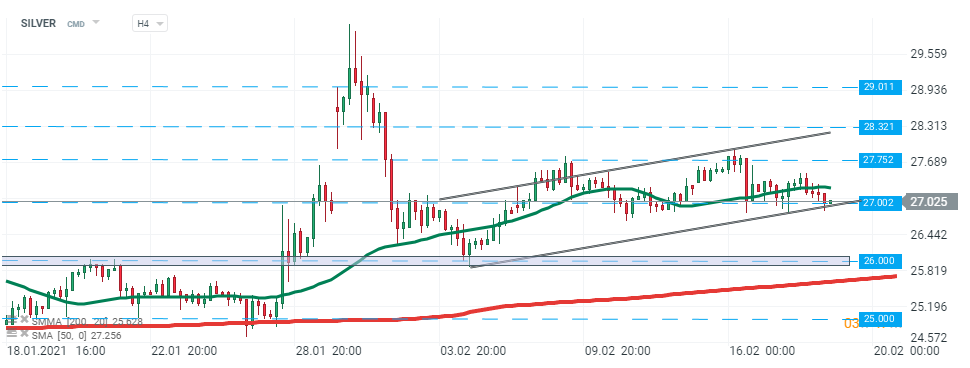

Silver is trading under pressure, however sellers failed to uphold momentum and price bounced off the lower limit of the ascending channel which coincides with major support at $27.00/ oz. However only breaking above the 50 SMA (green line) will invalidate bearish scenario. On the other hand, if daily candlestick closes below the aforementioned $27.00 support, downward move towards the next support area at $26.00 could be triggered. Source: xStation5

Silver is trading under pressure, however sellers failed to uphold momentum and price bounced off the lower limit of the ascending channel which coincides with major support at $27.00/ oz. However only breaking above the 50 SMA (green line) will invalidate bearish scenario. On the other hand, if daily candlestick closes below the aforementioned $27.00 support, downward move towards the next support area at $26.00 could be triggered. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.