- Major European indices finished today's session higher, with DAX rose 0.48%, the highest since January 2022, whileCAC40 reached new all-time high at 7400 pts.

-

ECB's chief economist Lane said it would be appropriate to raise interest rates further beyond the March meeting as inflation in the bloc remained high.

-

ECB's Holzmann hopes that peak interest rates will be reached in the next year and calls for 50 bp hikes at the next 4 meetings.

-

US indices also trade higher, with Dow Jones gaining 0.26%, while S&P 500 Nasdaq rose 0.40% and 0.45% respectively

-

JPMorgan CEO Dimon: Consumer is currently in great shape, but this will come to an end at some point.

-

Apple stock rose over 2.5% after Goldman Sachs initiated coverage on the iPhone maker with a "buy" rating. .

-

The markets are waiting for Powell's testimony on Tuesday and job data on Friday.

-

Precious metals pulled back amid a slightly stronger dollar. Gold fell below the $1850 mark, while silver retreated towards support at $21.00.

-

Cryptocurrencies are trading higher however the scale of moves is rather negligible as uncertainties surrounding Silvergate and Binance capped upward move. Bitcoin is trading below resistance at $22,500, while Ethereum defended support at $1550.

-

Mixed moods prevail on the energy commodities market. WTI gains slightly, while Brent oscillates around flatline as the Chinese government set a modest 5% target for economic growth this year, which sparked speculation that the reopening of the world's second-largest oil consumer would not spur demand as initially thought. Meanwhile, WSJ reported a growing rift between two of OPEC's biggest producers, Saudi Arabia and the UAE, sparking fears of a crack in the cartel's policy which could lead to more supplies.

-

NATGAS fell over 10.0% and tested support at $2.55, the biggest daily decline since December 14, on expectations of lower demand in the next two weeks after forecasts pointed to milder weather.

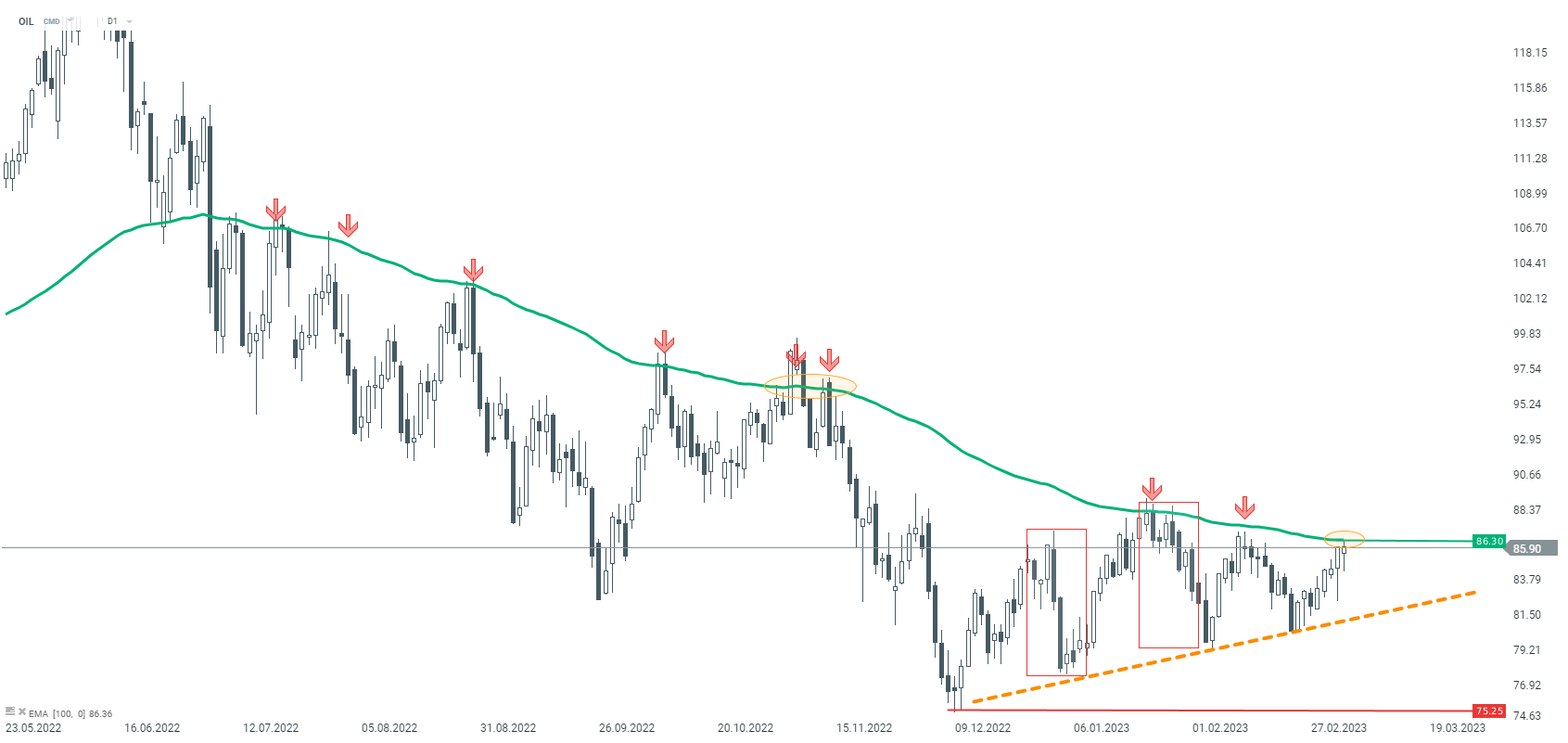

Crude oil (OIL) once again tests the key EMA100 average, which several times managed to fend off the buyers. Therefore the $86.30 level should be treated as nearest medium-term resistance. An upward breakout may herald a change of the main sentiment to bullish. Otherwise, if sellers manage to regain control, another downward impulse towards local upward trendline may be launched . Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.