- European equities approach all-time highs

- US indices trade near record levels

- Investors poured a record $1.5 billion into crypto funds last week

- Several Big Tech companies will publish quarterly results after market close

European indices finished today's session higher, with Frankfurt’s DAX up 1.0% to a 7-week high of 15,774 pts and the pan-European Stoxx ended at a new all-time high as investors welcomed strong corporate results across Europe and North America. Swiss bank UBS recorded a 9% increase of net profit in the third quarter, as continued trading helped the world's largest wealth manager to its best quarterly profit since 2015. Reckitt Benckiser Group Plc, producer of the well-known Strepsils throat pills, lifted its full-year outlook amid strong sales of cold and flu remedies and higher prices. Europe’s largest retailer Carrefour will launch a new rapid grocery delivery service in Paris in cooperation with Uber.

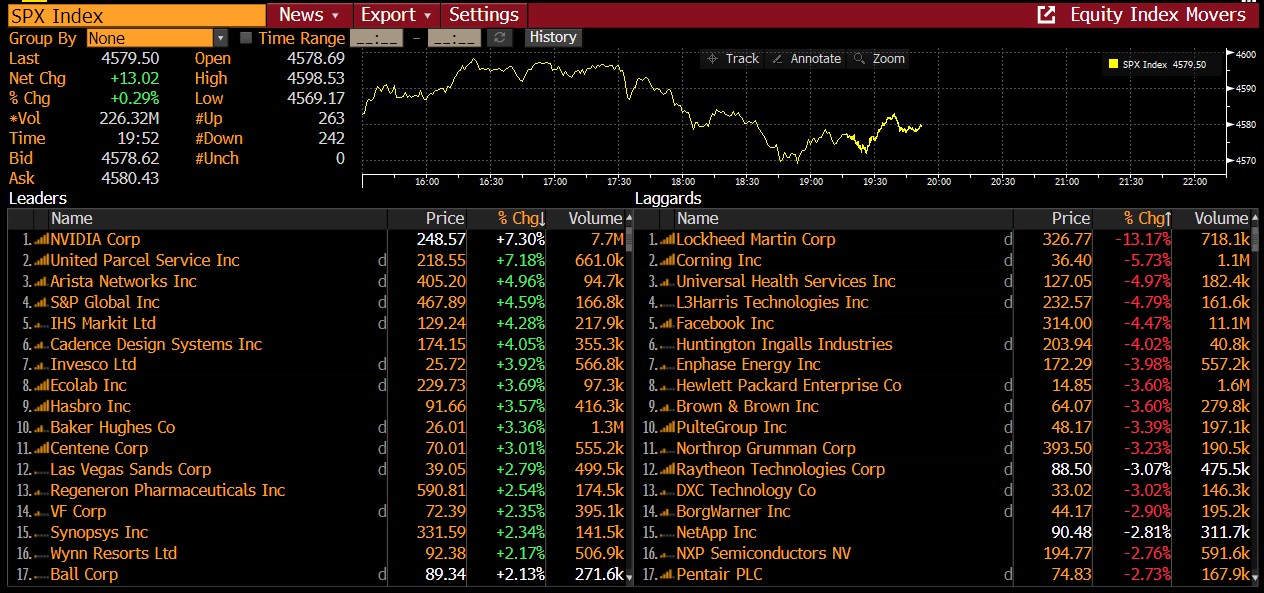

US indices launched today’s session sharply higher, with both the Dow Jones and the S&P 500 hit a fresh record high, as major corporations continued to turn in solid quarterly results. However moods deteriorated later in the session, as intraday reversal in shares of Facebook and Tesla weighed on major averages. Earnings from 3M, UPS and General Electric beat market expectations and Eli Lilly raised its full-year guidance. On the other hand, the results of Lockheed Martin Corp. turned out to be much worse than the analysts' predictions. The company also said it expects a further decline in revenues, which will prevent it from reaching the 2021 target, and that the current trend will continue into 2022. The company's shares fell more than 13% today. Meanwhile, Microsoft, Twitter and Alphabet will release their quarterly earnings after the closing bell.

The current "winners" and "losers" from the US500 index. Source: Bloomberg

The current "winners" and "losers" from the US500 index. Source: Bloomberg

WTI crude rose 1.20% and is trading above $84.50 a barrel, while Brent added 0.35% and is trading around $85.50. Concerns about demand from China weighed down on an otherwise bullish market sentiment, after government intervention cooled a surge in energy and coal prices. Still, prospects for a colder-than-usual November month, coupled with OPEC+ countries’ strategy to keep supplies tight, have been pushing the market closer to a squeeze. Later in the day, investors will gauge on API crude oil stocks change to assess the strength of US demand.

Elsewhere, gold fell over 1.2% and price broke below $1800 level while silver lost 2.7% and is trading around $24.00 as the dollar index rebounded from recent lows and bond yields remain elevated at 1.62%

Bitcoin price pulled back slightly after a failed attempt to break above resistance at $63,000 and is currently trading around $ 62,200 level. Ethereum price rose slightly and is trading around $ 4,200. Cryptocurrency products and funds recorded inflows totaling $ 1.5 billion last week, which is a new record high amid a rally in cryptocurrencies and the launch of the first Bitcoin ETF in the US according to a recent CoinShares report.

Silver price fell more than 2.5% on Tuesday, however sellers failed to break below major support at $23.85 which coincides with the upward trendline, lower limit of the 1:1 structure, 50 SMA (green line) and 200 SMA (red line). If buyers will manage to regain control, then another upward impulse towards local resistance at $24.90 may be launched. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.