- Sentiment in Europe was mixed today. Germany’s DAX fell more than 2% amid a sharp sell-off in software heavyweight SAP, which disappointed on backlog and raised concerns about demand for the company’s solutions. Britain’s FTSE gained just under 0.2%, while France’s CAC40 finished flat.

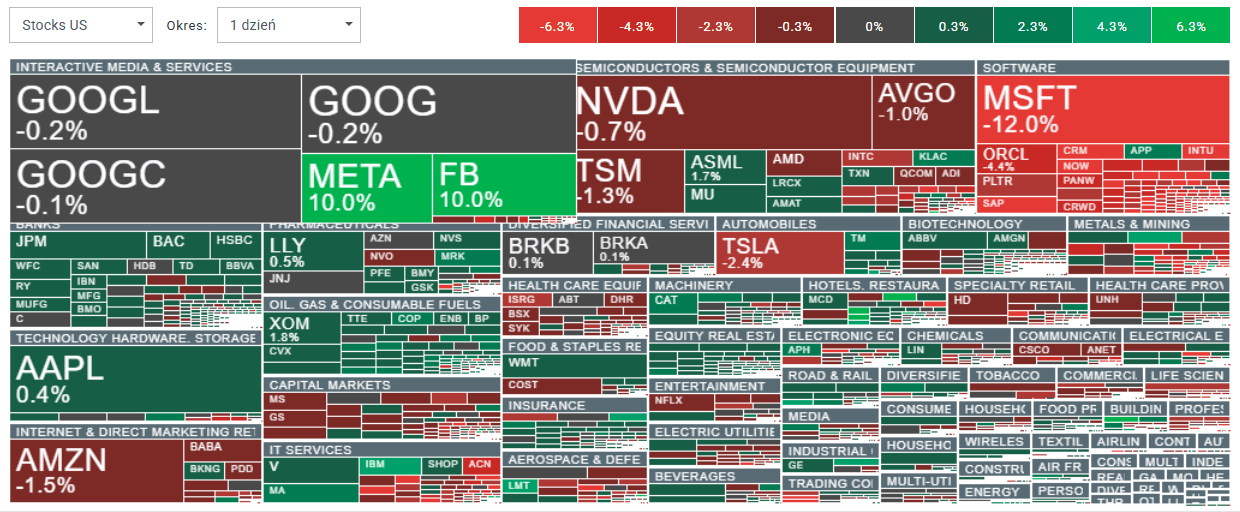

- The sell-off in U.S. equities accelerated after a drop of more than 10% in Microsoft dragged down the entire software sector. Microsoft shares are now down nearly 12% on fears that AI-related investment spending (CAPEX) is becoming excessive. Even a surge of more than 10% in Meta Platforms was not enough to turn sentiment across Big Tech, and investors are now bracing for Apple’s earnings release after the U.S. close.

- US100 initially fell almost 2.2%, but is currently down about 1.6%, making a tentative attempt to stabilize after the sharp sell-off. The DJIA (US30) is holding up best, while the less tech-concentrated US500 is down 0.8%. Among large caps, Meta, IBM, Lockheed Martin and Caterpillar are leading the upside today - all four delivered positive quarterly surprises.

- The equity sell-off also spilled over into other assets that had been rising recently, including precious metals. Gold pulled back from its all-time high near $5,600/oz and is now trading around $5,350/oz, while silver rebounded from $106/oz to nearly $115/oz.

- Oil prices are up almost 3% and approaching $70 amid rising risk of a potential U.S. strike on Iran. The United States has concentrated significant U.S. Navy forces around Iran, and Trump warned that if Tehran does not sign a nuclear agreement, the U.S. would be forced to act.

- According to EIA data, the weekly change in U.S. natural gas inventories came in at -242 bcf, versus -238 bcf expected and -120 bcf previously. U.S. Henry Hub natural gas futures moved lower after the report, as the drawdown was almost perfectly in line with forecasts - but in the evening price rebounded towards $3.85 per MMBtu

- In FX, EURUSD “defended” the 1.19 area and is slowly moving back above 1.195. Cryptocurrencies are sliding alongside a weaker Bitcoin, which is down more than 5% to just under $84,000; Ethereum is about 6% lower, around $2,850.

(summary in progress)

Source: xStation5

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.