-

Nasdaq, Dow Jones and Russell 2000 up 1%

-

European indices erased early losses and closed higher

-

Russian RTS rallies after Putin-Macron meeting

-

Oil drops on positive comments on Iran talks

-

Turkish authorities encourage converting gold to TRY

European stock markets gained during today's cash session on the Old Continent. While European markets traded mixed at the beginning of today's session, moods started to improve in the early afternoon and majority of European blue chips indices managed to finish the day higher. Russian indices outperformed after Russian President Putin assured French President Macron that the Russia-Ukraine situation will not escalate. Russian RTS jumped 3%, even in spite of a drop in oil prices.

First half of the Wall Street session was also marked with upbeat moods. Following a mixed opening, major US indices moved higher. Nasdaq, Dow Jones and Russell 2000 trade around 1% higher while S&P 500 gains 0.7% at press time. Harley-Davidson rallies 15% following unexpected Q4 profit while Peloton has another day of 20+% gain on the back of CEO departure. Novavax dropped over 10% after Reuters reported that the vaccine maker sees slow progress with vaccine deliveries.

Oil takes a hit following upbeat comments on Iranian nuclear talks from Russian, Chinese, US and French officials. Brent and WTI trade over 2% lower. API report on oil inventories will be released later today at 9:40 pm GMT. Elsewhere, precious metals gain with silver breaking above $23 per ounce and gold reaching $1,827 per ounce. Aluminium rallied to 14-year highs amid tight supply and uncertain outlook.

GBP, AUD and NZD are the best performing major currencies while JPY, CAD and CHF lag the most. The US dollar is trading mixed against major currencies even as yields continue to rise, which should provide support for USD. Lira trades flat against USD after Turkish authorities announced today that they will unveil a plan encouraging citizens to convert gold to TRY. Polish National Bank delivered a 50 basis points rate hike - in-line with expectations. However, it failed to provide support for PLN which is dropping against EUR, USD, CHF and GBP today.

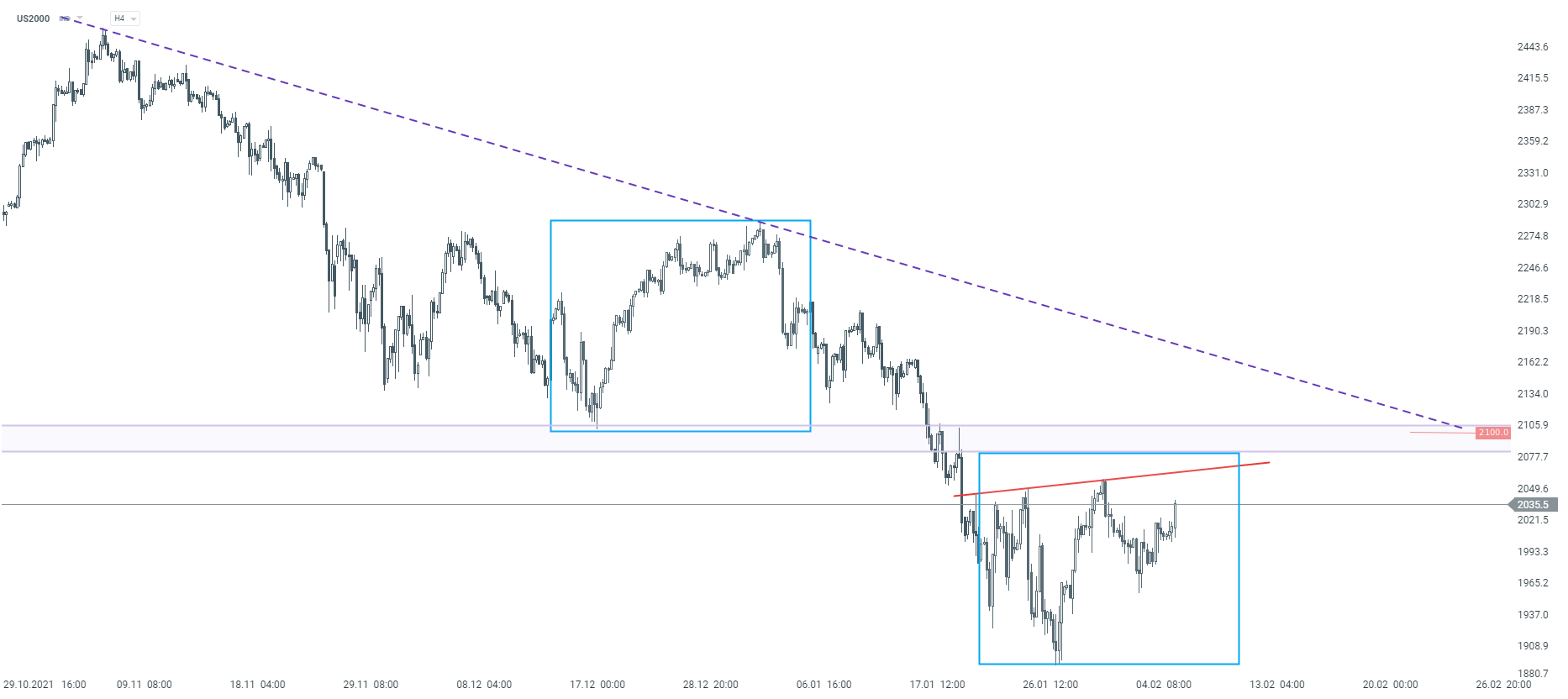

Taking a look at US2000 chart at H4 interval, we can see that a potential inverse head and shoulders pattern is building up. Such technical pattern often heralds trend reversal. However, it should be noted that an important resistance zone, marked with market geometry and lower limit of a year-long trading range, can be found above neckline of the pattern. A break above 2,100 pts handle could therefore be seen as a bullish signal. Source: xStation5

Taking a look at US2000 chart at H4 interval, we can see that a potential inverse head and shoulders pattern is building up. Such technical pattern often heralds trend reversal. However, it should be noted that an important resistance zone, marked with market geometry and lower limit of a year-long trading range, can be found above neckline of the pattern. A break above 2,100 pts handle could therefore be seen as a bullish signal. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.