-

Wall Street benefits from the wave of high investor expectations regarding quarterly earnings season for companies.

-

S&P 500 is up 0.25% to 4565 points, the Nasdaq 100 is trading flat at 15845 points, and the Russell 2000 is up 1.30%. Wall Street indices are heading towards record levels, maintaining their year-highs.

-

Apple stocks are gaining and reaching historic highs after the company announced its new generative artificial intelligence model. The company stated that it is currently building its strategy in this segment, and the model is being used for internal purposes. Apple's market capitalization today reaches $3.06 trillion.

-

Data from the real estate sector, including housing starts and building permits, shows a slightly weaker state in the American real estate market, which is associated with higher rates.

-

The report from the Energy Information Administration (EIA) reveals that the change in oil inventories was -0.71 million barrels, which is less than the expected -2.2 million barrels and significantly lower than the previous result of 5.95 million barrels.

-

Inflation in the UK dropped to 7.9% YoY for June, with an expectation of 8.2% YoY and a previous level of 8.7% YoY.

-

Goldman Sachs announced its results for the second quarter of 2023, which did not meet expectations. Its profits dropped to $1.07 billion or $3.08 per share, compared to $2.79 billion or $7.73 per share in the same period last year.

-

Goldman Sachs' results were anticipated after other banks published good results, with the investment segment being the weakest (Goldman Sachs' main area).

-

Car sales in Europe continue their upward trend. According to the European Automobile Manufacturers' Association, new vehicle registrations increased by 19% to 1.27 million vehicles in June, with electric cars accounting for 55% of the growth. Diesel cars, on the other hand, experienced a decline of nearly 10%.

-

Shares of Kering (KER.FR), the owner of Gucci, Yves Saint Laurent, and Balenciaga, are gaining over 6.5% at the beginning of the session following the resignation of the company's CEO. This change is intended to revitalize the Group's businesses.

-

Today, the Canadian dollar (CAD) is one of the stronger currencies, but the US dollar is also gaining. The EURUSD pair is falling below the 1.12 level.

-

Energy commodities are gaining today, with LSGASOIL leading the increases with a 1.8% gain. Brent oil contracts are trading slightly above $80 per barrel.

-

Cryptocurrencies are trading flat, with BTC holding just below the $30,000 level and ETH at $1,900. However, XRP is gaining momentum again, with its price rising to around $0.80 cents.

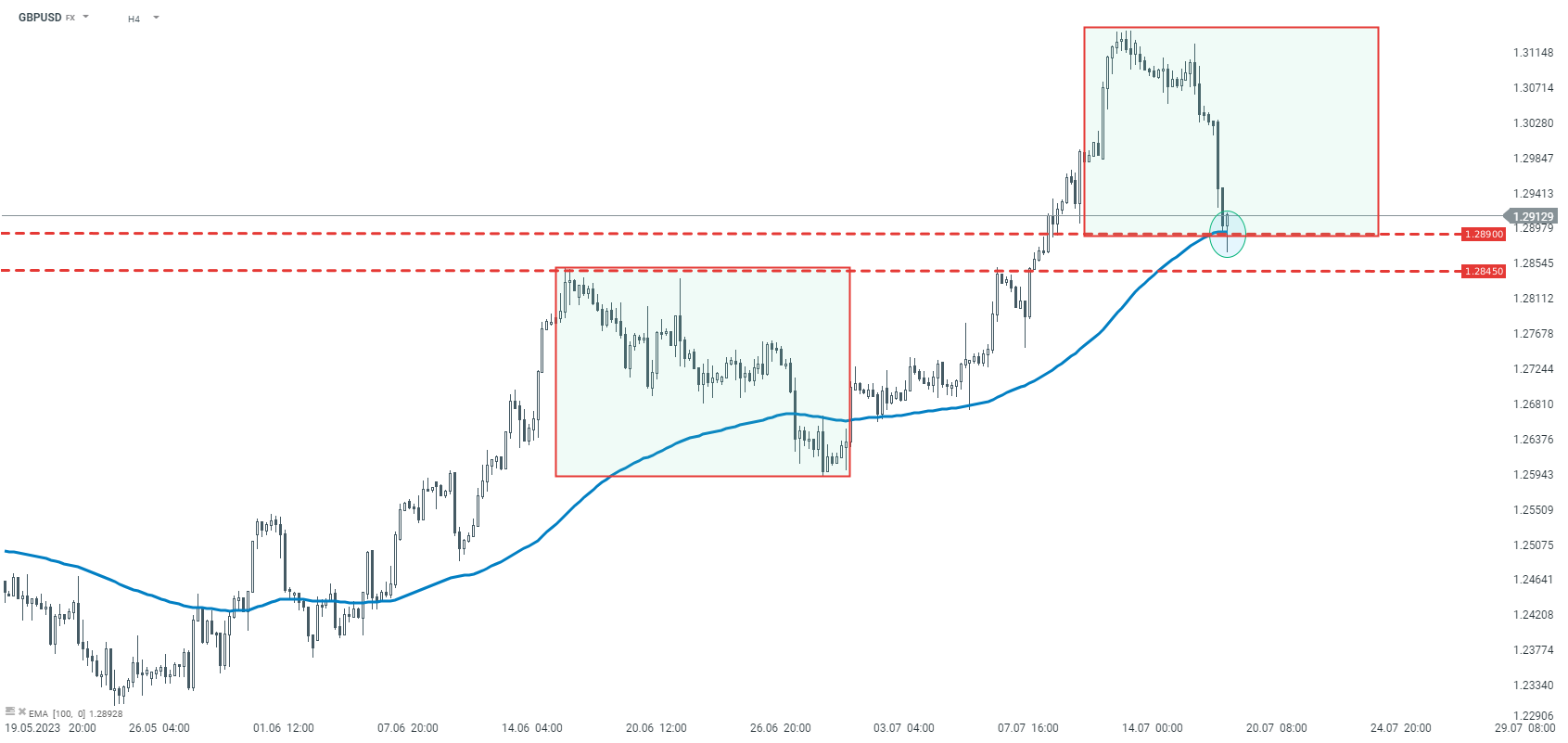

GBPUSD price experienced a significant decline following the inflation data from the UK. However, the currency pair found support at 1.2890, which is derived from the 1:1 geometry and the EMA100 moving average. Source: xStation5.

GBPUSD price experienced a significant decline following the inflation data from the UK. However, the currency pair found support at 1.2890, which is derived from the 1:1 geometry and the EMA100 moving average. Source: xStation5.

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.