- DAX40 slightly falls ahead to the German CPI data and EBC decision

- Volkswagen loses amid semiconductors supply issues

- Scout24 and Hellofresh slightly gains after the earnings reports

- DAX40 slightly falls ahead to the German CPI data and EBC decision

- Volkswagen loses amid semiconductors supply issues

- Scout24 and Hellofresh slightly gains after the earnings reports

European markets are awaiting today’s key events from the European Central Bank, with the rate decision scheduled for 1:15 GMT and a speech by ECB President Christine Lagarde at 1:45 CET. Market consensus points to interest rates remaining unchanged across the euro area.

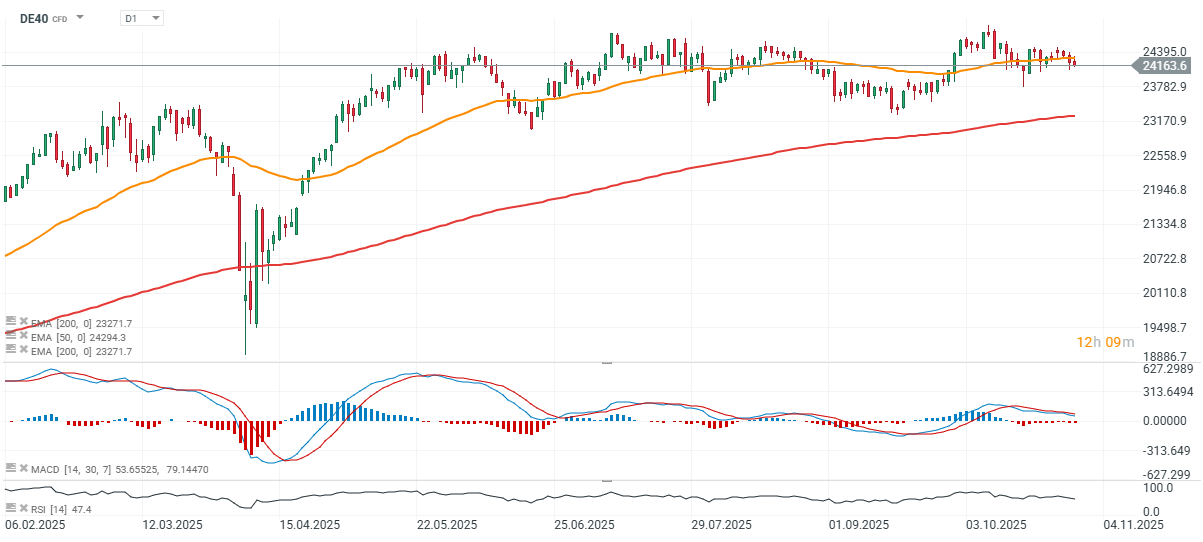

In Germany, investors are also looking ahead to the release of national inflation data at 1 PM GMT, where expectations suggest a decline to 2.2% year-on-year from 2.4% previously. On a monthly basis, inflation is forecast to rise by 0.2%, unchanged from the prior reading. DAX futures are trading lower today, falling below 24,200 points.

Source: xStation5

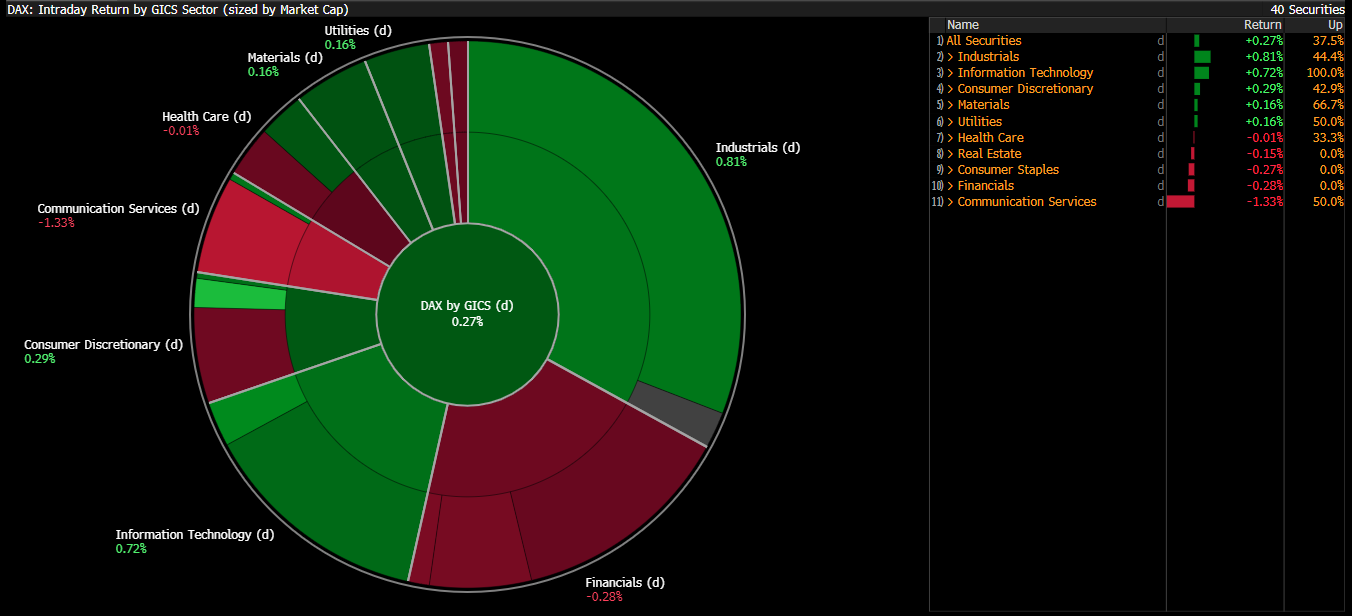

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

Corporate News

Volkswagen AG

Volkswagen warned that meeting its financial targets for the year depends on a stable supply of semiconductors, noting that potential shortages of Nexperia chips could further strain an already struggling automotive sector.

European automakers are currently facing limited access to components from the Dutch manufacturer Nexperia, which has become entangled in a trade dispute between China and Western countries. Industry groups have cautioned that if the situation doesn’t improve soon, production lines could come to a halt within days.

In its quarterly report, Volkswagen maintained its full-year guidance, stressing that it relies on adequate chip availability.

Third-Quarter Results

-

Operating loss: €1.3 billion (≈$1.5 billion)

-

The result reflects €5.1 billion in impairments and write-downs, largely tied to overly optimistic EV expansion plans at Porsche AG, as well as U.S. import tariffs that hit the group’s most profitable brands.

-

Operating margin (excl. one-offs): 5.4% vs. -1.6% a year earlier

Outlook and Challenges

Volkswagen is struggling with a slower-than-expected shift toward electric vehicles in Europe. Weak demand and a sluggish post-pandemic recovery have left the company with costly excess production capacity, while declining sales in China and the U.S. continue to weigh on results.

To address these challenges, CFO Arno Antlitz said the company will tighten cost discipline and implement new structural measures, focusing on leveraging scale and enhancing group synergies.

CEO Oliver Blume has also taken steps to reduce investment burdens, scaling back battery and in-house software production plans and forming partnerships with China’s Xpeng Inc. and U.S.-based Rivian Automotive Inc. to strengthen VW’s position abroad.

In Germany, Volkswagen, Audi, and Porsche are restructuring operations in agreement with labor unions to achieve significant cost savings and higher efficiency.

HelloFresh SE

HelloFresh reported adjusted EBITDA above analysts’ expectations for the third quarter, sending its shares up nearly 3% today.

Third-Quarter Results

-

Adjusted EBITDA: €40.3 million (-44% y/y), est. €37.4 million (Bloomberg consensus)

-

International adjusted EBITDA: €33.2 million (-4.3% y/y), est. €33.4 million

-

North America adjusted EBITDA: €47.5 million (-36% y/y), est. €53.7 million

-

Revenue: €1.58 billion (-14% y/y), est. €1.61 billion

-

Sales at constant FX: -9.3%, est. -8.83%

-

Adjusted EBITDA margin: 2.5% (vs. 3.9% y/y), est. 2.45%

-

Average order value: €65.60, est. €66.11

-

Orders: 23.93 million, est. 24.53 million

-

International orders: 10.94 million

-

North America orders: 12.98 million, est. 13.23 million

Full-Year Outlook

-

Company maintains guidance for a 6–8% decline in sales at constant FX (est. -8.05%)

-

Adjusted EBITDA still expected between €415–465 million (est. €436.9 million)

-

FY2025 guidance reaffirmed, with no changes to sales or profitability assumptions.

Source: xStation5

Scout24 SE

Scout24 expects full-year revenue growth to reach the upper end of its previously guided range (+14% to +15%), maintaining a strong outlook for 2025.

Full-Year Forecast

-

Revenue growth seen at the high end of +14%–15% (previously: +14%–15%)

Third-Quarter Results

-

Operating EBITDA: €104.2 million (+15% y/y), est. €102.4 million (Bloomberg consensus)

-

Operating EBITDA margin: 62.9% (unchanged y/y)

-

Revenue: €165.6 million (+15% y/y), est. €163 million

Commentary

The company narrowed its guidance for an increase in the adjusted operating EBITDA margin to the upper end of the previous range (up to +70bps). Management reiterated that boosting EBITDA and profitability remains the company’s main strategic focus. Scout24 shares are trading modestly higher today.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.