The opening of stock markets in Western Europe today is taking place in an atmosphere of heightened caution. Indices such as the UK100 and FRA40 are showing slight increases today, while the German DE40 remains almost unchanged. Such a restrained reaction from investors indicates the market's focus on upcoming decisions and macroeconomic readings.

DE40, the main index of the Frankfurt stock exchange, started today's session in a calm tone, reflecting investors' anticipation of key macroeconomic events. Quotes remain stable, and volatility is limited – the market seems to be in a "pause before decisions" phase. Market participants are primarily focused on communications from the European Central Bank and inflation data publications, which may provide a clearer direction for the German market in the coming hours and days.

Macroeconomic Data:

At the beginning of the session, movements are quite small. Markets in Europe are holding their breath, waiting for a series of extremely important readings and decisions. Today, this includes:

- The European Central Bank's decision regarding interest rates. The market expects no changes in policy.

- In the USA, the publication of both CPI and the number of unemployment claims — crucial in determining the further direction for the economy and markets.

The European Central Bank's decision is crucial for the markets because it sets the direction for the cost of money in the eurozone. Any change, or even the tone of the communication, directly affects asset valuations and growth prospects. The market expects that the European Central Bank will not make any changes today and will maintain its current monetary policy. Investors assume that interest rates will remain unchanged, and any future guidance will only appear in the communication and statements by Christine Lagarde. This approach means that the key will not be the meeting itself, but its interpretation – the market will analyze the tone of the central bank's statements.

Data from the USA, on the other hand, have a significant impact on European markets because they shape global expectations regarding Federal Reserve policy and thus capital flows. Stronger-than-forecast inflation or labor market readings may prompt the Fed to maintain a more restrictive stance, which usually strengthens the dollar and weakens the euro. For European companies, this means simultaneously more difficult financing conditions and pressure on stock valuations.

Conversely, weaker data from the USA may support sentiment on the Old Continent, as they increase the chances of faster interest rate cuts across the ocean. Such a scenario improves the global appetite for risk, encourages capital inflow into stock markets, and may translate into a positive impulse for European indices, including the DAX.

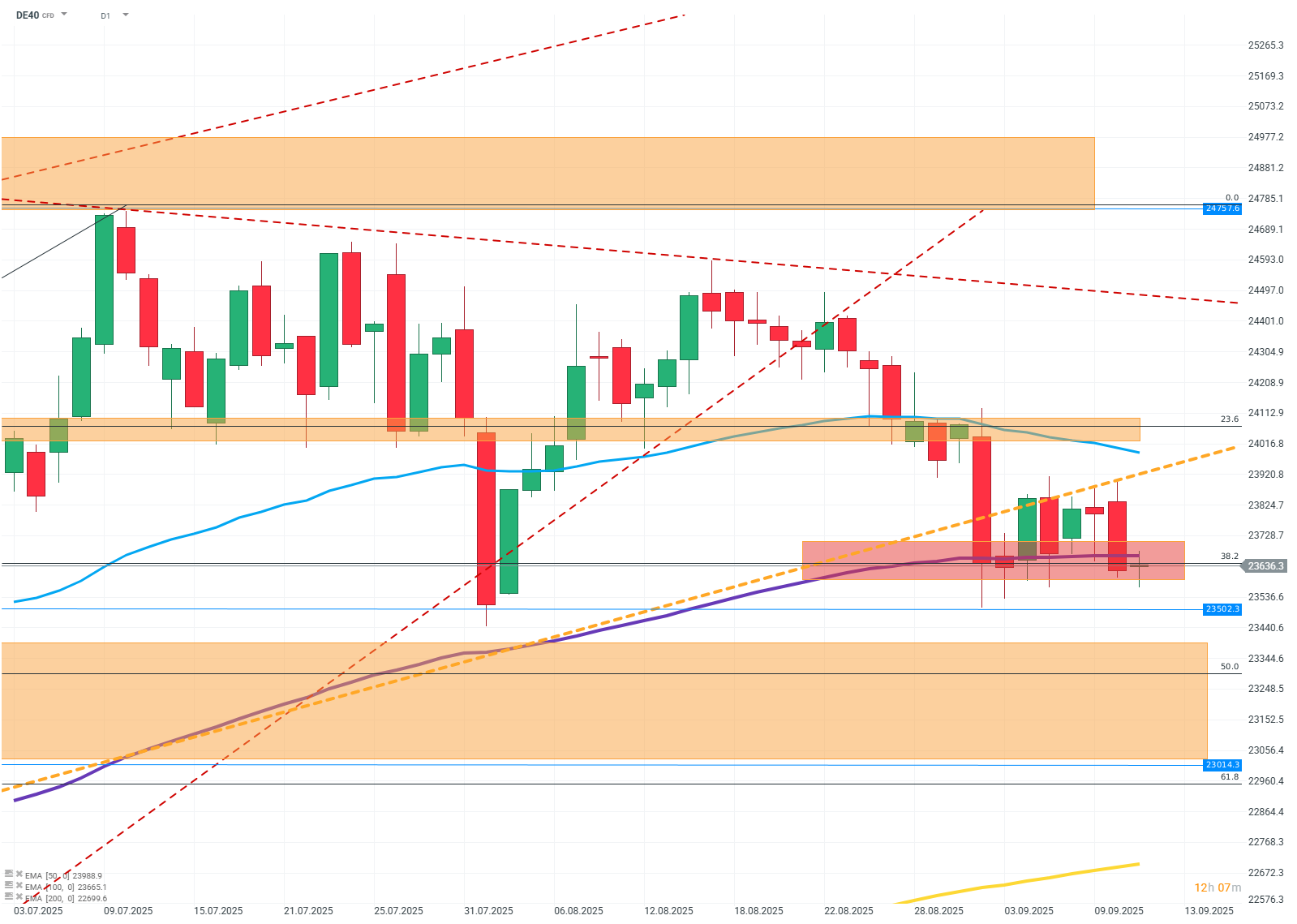

DE40 (D1)

Source: Xstation

DAX remains in a correction phase and consolidates around a key support area, where the demand zone and the 38.2 FIBO level overlap. Defending this area could open the way for a rebound and a retest of moving averages and higher resistance zones, while a breakout below increases the risk of deepening declines towards the 50 and 61.8 FIBO levels – or in extreme scenarios, even a test of EMA200.

Company News:

Avio (AVIO.IT) — Bloomberg reports that the Italian rocket carrier manufacturer is seeking capital donors to finance investments in infrastructure expansion and research. Investors are disappointed with the company's plans, which significantly increase its debt. The stock price drops by over 10% at the opening.

Buzzi (BZU.IT), Heidelberg (HEI.DE) — Cement suppliers received a positive recommendation from JP Morgan, predicting above-average results for the European sector. The companies' stock prices rise by 8% and 3%, respectively.

Adecco (ADEN.CH) — Jefferies agency raised its recommendation for Adecco, increasing the target price from 18.5 CHF to 24 CHF. The company's shares rise by over 1%.

Airbus (AIR.FR) — The CEO of the aviation company announced that despite delays, order deliveries will be completed on time. The company's shares rise by 2%.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.