- European indices open lower

- The Euro and the US Dollar are trading higher

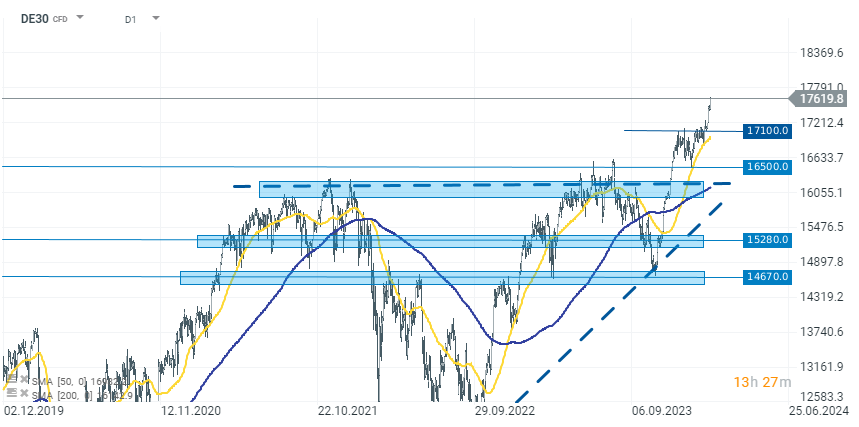

- DAX is unchanged at 17,620 points

European indices are opening lower. Practically all exchanges, except for the Swiss SMI Index, which gains 0.30% at the time of publication, are recording declines. The drops in other markets are not significant and range between 0.00-0.45%. The largest decreases are seen in the UK market - UK100 loses 0.45%, and in Italy - ITA40 drops by 0.35%. The German DAX index is trading without major changes, hovering around yesterday's highs at 17,620 points.

DAX

The German DAX index set a new record level yesterday at 17,620 points, and as of the current publication, the index price is consolidating in this area. However, a strong dollar may increase downward pressure in the second half of the session. In such a case, it is important to watch the opening on Wall Street and upcoming comments from central bankers.

Source: xStation 5

Company News

British telecoms giant Vodafone (VOD.UK) is in advanced negotiations to sell its Italian division to Swisscom, with a preliminary agreement set at eight billion euros ($8.7 billion). This development comes after Vodafone had previously turned down proposals from Xavier Niel's Iliad group, seeking to explore market consolidation in Italy. Vodafone believes the deal with Swisscom offers the most favorable mix of value creation, immediate cash proceeds, and transaction certainty for its shareholders.

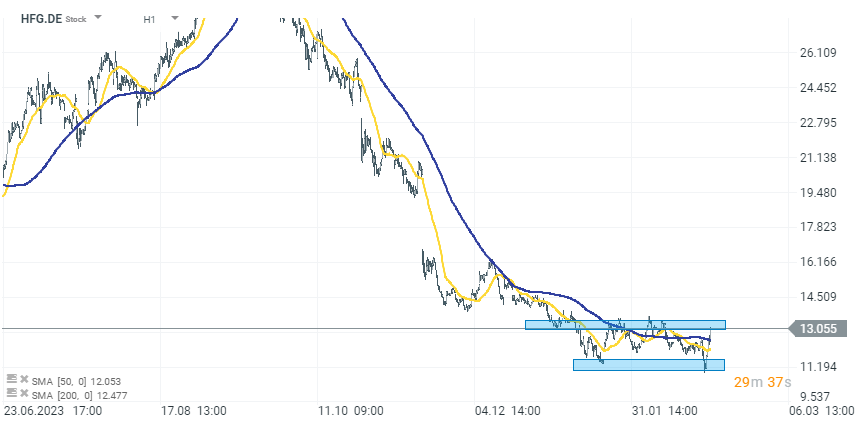

Source: xStation 5

Hellofresh (HFG.DE) gains almost 4.00% following the new recommendation published by JPMorgan. The Berlin-based meal-kit delivery company new price target is set at 18 euros, down from 20 euros, yet JPMorgan continues to hold an "Overweight" rating for the company. Additionally, Hellofresh has been added to JPMorgan's esteemed "Analyst Focus List."

Source: xStation 5

CAPITA (CPI.UK) a UK-based technology outsourcing firm, has secured an uncontested extension to a major contract with Northern Ireland's Education Authority valued at £33 million ($41.8 million). This deal increases the total worth of the IT contract, which commenced in 2012, to an impressive £546 million ($692 million), accounting for approximately a fifth of the Authority's annual budget.

Lerøy Seafood Group (LSG.NO) is gaining over 12% after the company reported better than expected earnings report. In 2023, LSG's revenue surpassed NOK 30 billion for the first time, and recorded an operating profit of NOK 765 million in the fourth quarter. The company encountered specific issues in its Farming sector due to environmental factors, while its Wild Catch earnings remained stable. Lerøy is focused on achieving its 2025 strategic goals, particularly in enhancing fish welfare and biological performance in farming, with a target of 205,000 harvest volumes in Norway. The company is making progress with new technologies like submerged cages and shielding technology for salmon, aiming for one-third of its salmon to be shielded by the end of 2024.

Daily summary: Sentiments on Wall Street stall at the end of the week🗽US Dollar gains

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

AbbVie near 1-month low after earnings report 📉

CHN.cash under pressure despite positive Trump remarks 🚩

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.