DAX posts solid gains on Thursday ahead of eurozone retail sales data and U.S. jobless claims. Today’s rise on the German market is led by car manufacturers — from Volkswagen and BMW to Mercedes and Porsche AG. The sector was supported by a ‘buy’ recommendation from Bank of America for Porsche SE, along with a broad, optimistic outlook for European automotive companies, which the bank considers attractively valued as markets had expected “total disruption” to growth due to new emissions standards.

- Bank of America removed Infineon from the ‘Europe 1’ list; Dutch semiconductor giant ASML returned to the list.

- Deutsche Bank downgraded Siemens Healthineers to ‘hold’ with a target price of EUR 46 per share.

- Goldman Sachs upgraded Commerzbank to ‘neutral’ with a target price of EUR 35.5 per share and downgraded Grand City Properties to ‘neutral’ with a target of EUR 11.5 per share.

The DAX (DE40) futures contract is trading between the 200-day (red line) and 50-day moving averages (orange line). Recent sessions have brought gains supported by the rebound on Wall Street, where Salesforce (CRM.US) shares are rising pre-market after earnings.

Source: xStation5

Bank of America backs European automotive companies

Bank of America analysts expressed a positive view on the growth outlook for European carmakers and issued a ‘buy’ rating for Porsche SE. They highlighted regulatory support, a more relaxed future approach to emissions standards, and the postponement of the combustion-engine ban — originally expected in 2040 — to a more distant future.

According to analysts, beneficiaries include Ferrari, Aumovio, and Continental. They noted that Porsche SE deserves attention because it offers exposure to both Volkswagen and Porsche AG shares at a significant discount. Analysts also upgraded Mercedes to ‘neutral’, saying the worst is likely behind the company, and raised Renault to ‘buy’ from ‘neutral’, suggesting the firm still represents deep value at its currently low valuation.

Source: xStation5

Rheinmetall attempts a rebound

One of the major topics on the German stock market remains the sharp decline in Rheinmetall shares, which—despite recovering slightly in recent days—are still trading 25% below their highs. The U.S. delegation returned from the Kremlin with no concrete progress, but on Thursday Trump is expected to meet with Ukraine’s chief negotiator, Rustem Umerov. Moscow has stated that it is incorrect to say that the U.S.-Ukraine proposal was rejected by Putin.

Financial results for the first three quarters of 2025:

-

Sales: EUR 7.5 billion, up 20% year-over-year

-

Defense segment sales: +28%, driven by vehicle systems and ammunition

-

Operating profit: EUR 835 million, up 18% from EUR 705 million a year earlier

-

Operating margin: 11.1% at Group level; 13.6% in the defense segment

-

Order backlog: EUR 64 billion, up from EUR 52 billion a year earlier

-

Order intake: EUR 18 billion, below last year’s level due to delays in the German budget and postponed orders

-

Operating free cash flow: approx. EUR 813 million, weighed down by high capex, inventory growth, and delayed German orders

The management board reaffirmed its 2025 guidance, expecting full-year sales growth of 25–30% (vs. EUR 9.75 billion in 2024) and an operating margin of around 15.5% (vs. 15.2% in 2024).

Rheinmetall (D1 interval)

The company’s shares are trading below two key medium-term moving averages: EMA50 and EMA200.

Source: xStation5

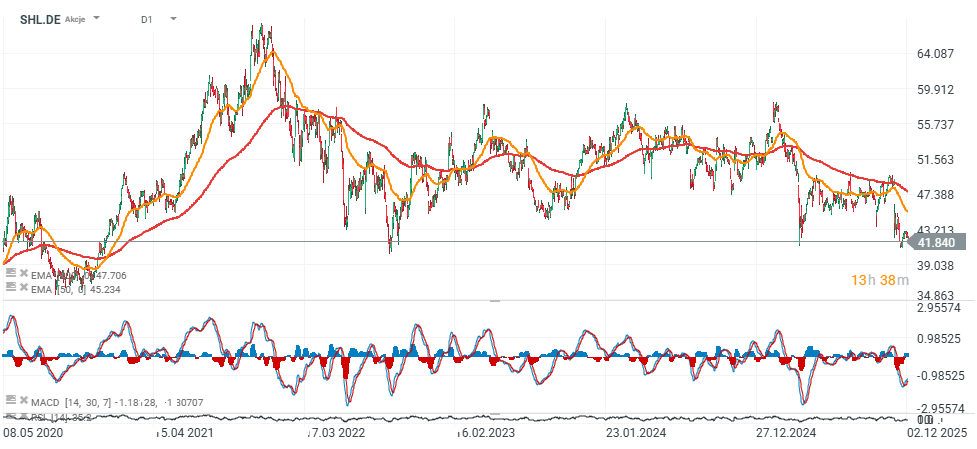

Siemens Healthineers shares (SHL.DE)

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.