The German equity benchmark opened Tuesday’s session with cautious gains, although the upside remains limited due to investor caution in the United States, where equity futures are posting slight declines. Today’s macro calendar is nearly empty, with the main reading from Europe being the preliminary Eurozone CPI inflation for November.

In Germany, headlines are dominated by Bayer, which may benefit from support from the U.S. administration after it proposed exempting the company from multi-billion-dollar penalties related to glyphosate litigation. Shares of Hypoport were upgraded to “Overweight”, with a price target of 210 EUR at BNPP Exane.

Eurozone inflation data (November):

-

Headline CPI (y/y): 2.2 percent (forecast 2.1 percent; previous 2.1 percent)

-

Core CPI (y/y): 2.4 percent (forecast 2.4 percent; previous 2.4 percent)

-

CPI (m/m): minus 0.3 percent (forecast minus 0.3 percent; previous 0.2 percent)

-

Eurozone unemployment rate (October): 6.4 percent (forecast 6.3 percent; previous 6.3 percent; revised to 6.4 percent)

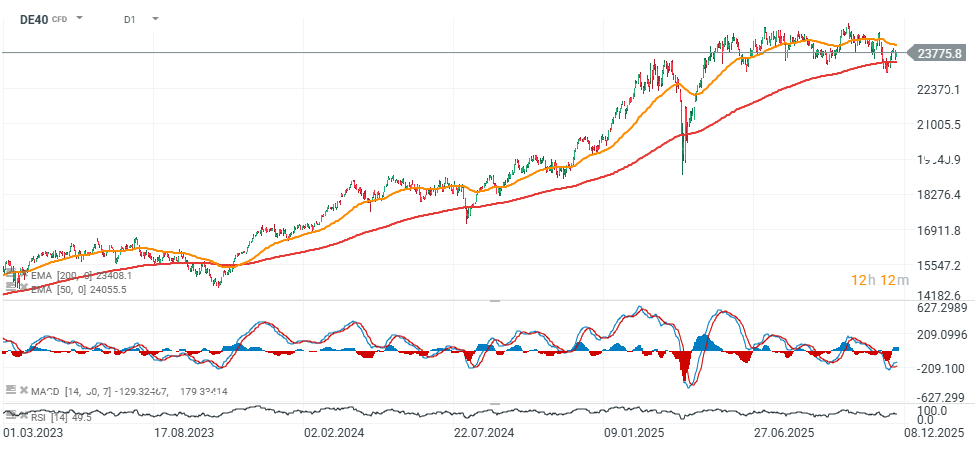

DE40 (D1 interval)

Source: xStation5

Bayer is leading gains on the German market, while Siemens and the financial sector are also performing strongly, including Deutsche Boerse, Deutsche Bank and Commerzbank. Rheinmetall is attempting to rebound after its recent decline. Source: Bloomberg Finance L.P.

Will Bayer benefit from Trump support?

Support from the Trump administration significantly improves Bayer’s legal position in the U.S., increasing the likelihood of limiting litigation risk related to glyphosate (Roundup). The Solicitor General’s recommendation signals that Washington is leaning toward an interpretation favoring federal EPA oversight over state-level regulations. This could represent a turning point in the years-long legal battle. The market is reacting immediately, with the rally in Bayer shares suggesting a sharp reduction in the litigation risk premium.

- A potential Supreme Court ruling could lead to a reduction in litigation reserves, which currently amount to 7.6 billion USD. This would likely unlock meaningful shareholder value.

- A favorable outcome for Bayer could improve cash flow, credit ratings and dividend prospects, while also easing management and communication pressures.

- However, the case remains politically sensitive. Support from the Trump administration does not guarantee a Supreme Court decision.

- Even a positive ruling would not fully eliminate future lawsuits unless the Supreme Court provides a broad clarification on the extent of federal preemption.

- Reputation risk for Bayer remains elevated, particularly if health advocacy groups intensify public pressure.

- If the Supreme Court agrees to hear the case in 2025–2026, the market may continue to price in lower legal risk, potentially supporting further appreciation of the shares.

- Bayer nonetheless remains in a situation where legal dynamics dominate valuation more than operating fundamentals.

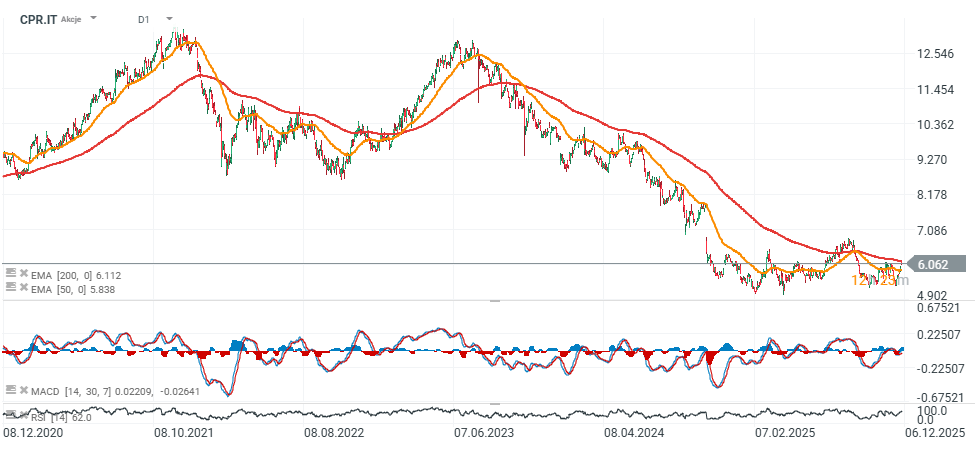

Bayer shares, BAYN.DE (D1 interval)

Source: xStation5

JP Morgan analysts upgraded Campari to “Outperform” with a price target of 7.9 EUR per share. The stock is trading near its 200-day EMA (red line).

Source: xStation5

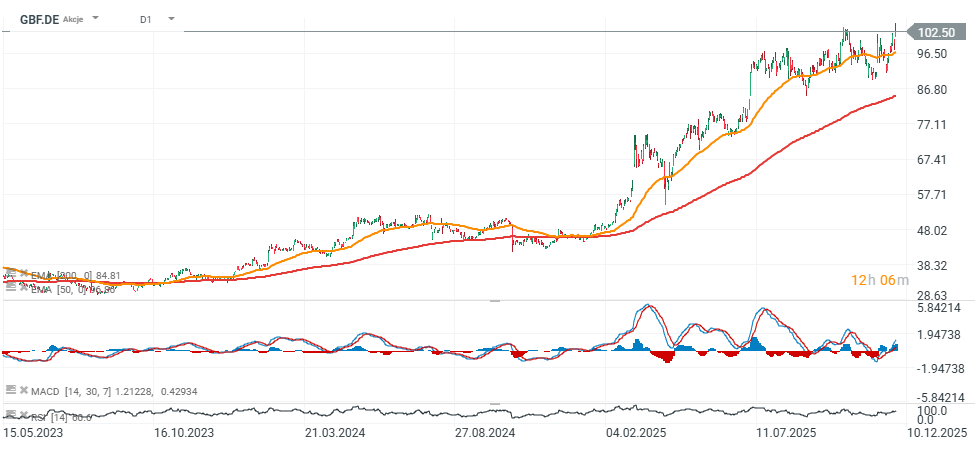

Bilfinger expects margins to rise to approximately 8–9 percent by 2030. Shares reached new all-time highs today following the company’s optimistic outlook but pulled back amid profit-taking.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.