Today's session in Europe is unfolding in exceptionally good spirits. Investors on practically all major exchanges are seeing green boards, and indices are recording clear gains.The largest increases are seen on the DAX and AEX, with rises above 0.6%. The FTSE 100 and ATX20 are performing weaker, with declines around 0.15%.

Buyers are not deterred by either geopolitical tensions or the prolonged "government shutdown" in the United States. On the contrary, some investors interpret the fiscal troubles in the USA as a factor increasing pressure on the Federal Reserve to accelerate interest rate cuts. This further fuels the appetite for risk in Europe and Asia.

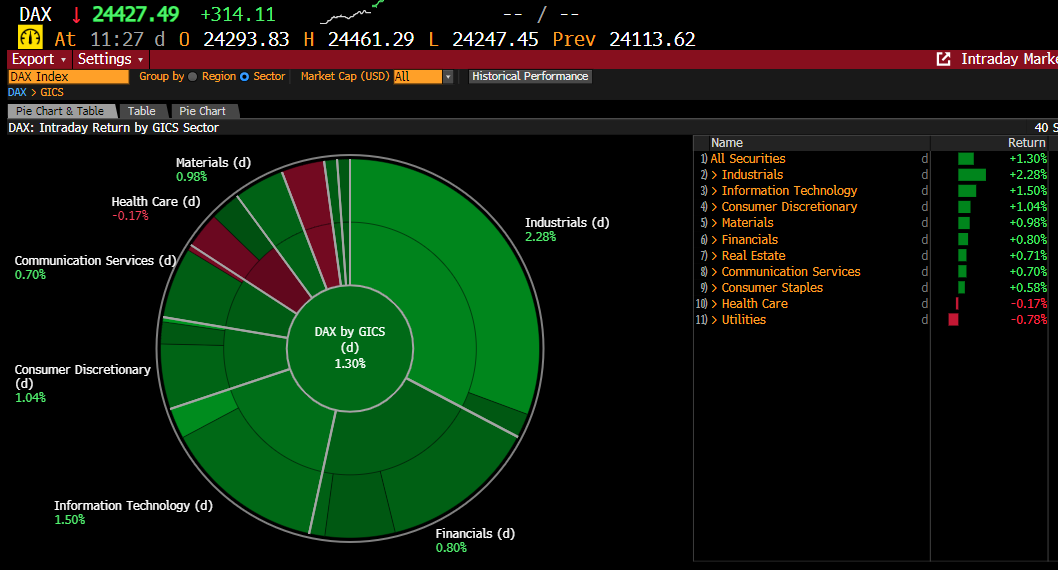

Source: Bloomberg Finance Lp

The German Index is experiencing unusual gains today. The industrial and IT sectors are rising the most, while utility companies are slightly down.

Macroeconomic Data

In the background of today's trading, macroeconomic data plays an important role. Due to the shutdown in the USA, the report on new unemployment benefit claims and durable goods orders data will not be published.

- Data publications from Europe are proceeding without disruptions. Eurostat data showed an increase in the unemployment rate in the eurozone from 6.2% to 6.3%.

- At 1:00 PM, the market is also awaiting the Challenger report on planned layoffs and employment in the USA, which may be a factor for additional volatility in the markets.

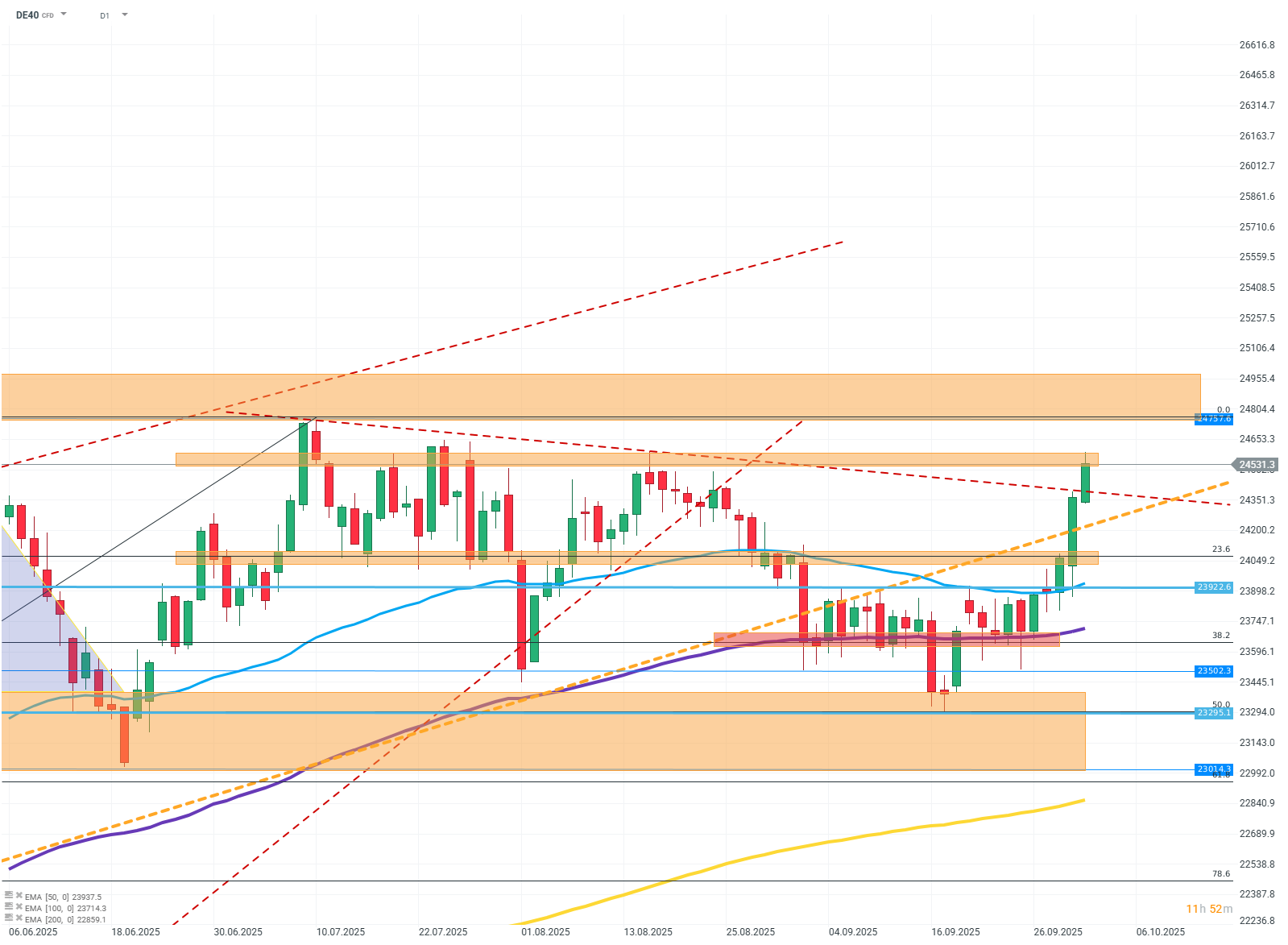

DE40 (D1)

Source: xStation5

The chart shows that buyers have forcefully broken through the resistance zone at FIBO 23.6 and are currently halted at the last support zone separating the price from the ATH. Breaking the resistance around 24530 may result in testing the vicinity of the ATH, while bouncing off the resistance will most likely mean a return to consolidation between 24500 and 23500.

Company News:

Siemens (SIE.DE) — The German giant is up over 2% following the announcement of a "spin-off" of its subsidiary (Siemens Healthineers).

Rational (RAA.DE) — The company is up 3% after receiving a positive recommendation from an investment bank, with a new target price of 1035 euros.

Novo Nordisk (NOVOB.DK) — The Danish pharmaceutical giant is up over 2% after an investment bank raised its recommendation for the company's shares.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.