The European equity market is not showing much volatility today. Moves are limited to ±0.30% for most markets, except for Poland’s WIG20, which is down 0.70%. The DAX is trading lower by about 0.30% at 23,730 points. The euro is slipping slightly (0.20–0.30%) after political turmoil in France.

French Prime Minister François Bayrou — an experienced centrist and MoDem leader appointed in December 2024 — was ousted on September 8, 2025. The former prime minister lost a confidence vote in the National Assembly (364–194) over his proposed austerity budget plan, deepening the country’s political paralysis. President Emmanuel Macron announced he will appoint a new prime minister in the coming days, while Bayrou will effectively move into a caretaker role until a successor is chosen. Despite fiscal challenges, the French CAC40 index is up 0.35% today, with French banks posting the strongest year-to-date performance within the index.

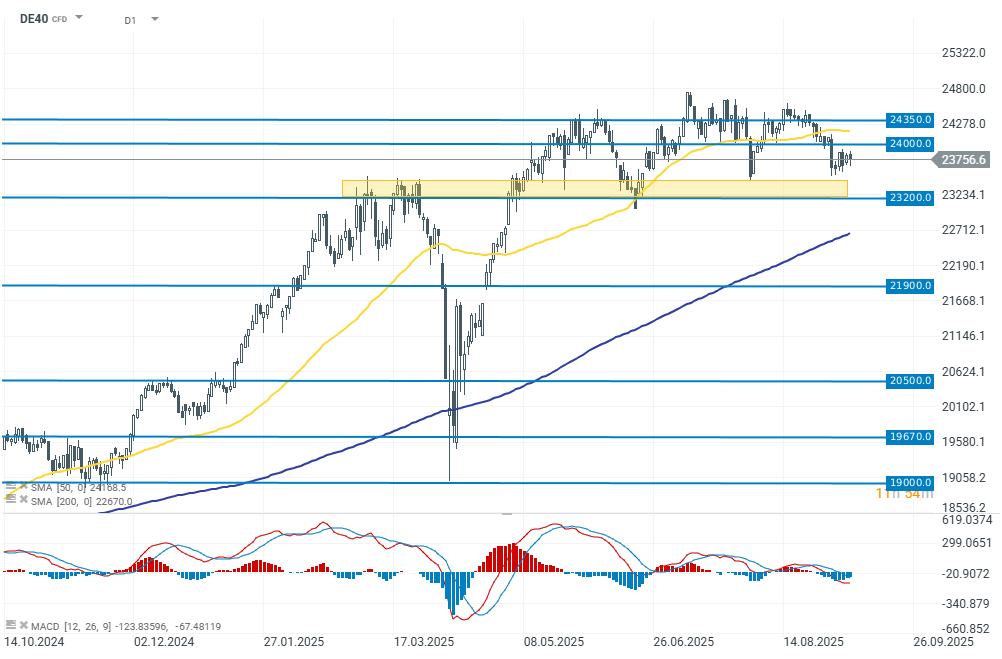

DAX (D1 interval)

The German index is attempting to defend support above 23,200 points. Despite today’s modest sell-off of about 0.30%, technically the bulls remain in control. The key to sustaining the uptrend will be holding above this support level.

Company news

Anglo American announced a record merger plan worth $50–53bn with Canada’s Teck Resources to form “Anglo Teck Plc.” Teck shares traded in Frankfurt are up nearly 11% today. The deal concentrates copper exposure (synergies in Chile) with targeted ~$800m in annual cost savings.

Spanish banks (BBVA/Sabadell): after regulatory approval at the end of last week, BBVA’s hostile €14.8–14.9bn bid for Sabadell is now formally active, keeping Iberian banks in focus and sustaining merger-arbitrage activity.

DEUTZ raised just over €131m via an accelerated capital increase. Proceeds will finance the acquisition of Sobek, a drone propulsion company, deepening diversification into defense beyond the cyclical engines segment.

ASML will invest €1.3bn in Mistral AI for an 11% stake and a seat on its strategic committee. The partners will implement AI models across ASML’s product portfolio, R&D, and operations.

Novartis announced its intention to acquire Tourmaline Bio for about $1.4bn ($48/share), with completion expected in Q4.

Daily summary: Risk assets keep sliding on US rate cut jitters (17.11.2025)

Soybean at 15-month high on USDA report and US-China trade optimism 📈 🫛

Quantum Computing after Earnings: Quantum Breakthough?

Chart of the day: USDJPY (17.11.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.