- European markets extend declines, fueled by disappointment with US rates expectations

- Spain's inflation comes out hot

- China's industry disappoints

- EU GDP in line with expectations

- Siemens Energy climbs on wind turbines and data center outlooks

- European markets extend declines, fueled by disappointment with US rates expectations

- Spain's inflation comes out hot

- China's industry disappoints

- EU GDP in line with expectations

- Siemens Energy climbs on wind turbines and data center outlooks

The last session of the week brings a deepening of declines on the European market. Recent comments from the FOMC in the USA have dashed market hopes for rate cuts in December, which is reverberating across global markets. The leaders of declines in Europe are Poland and Germany. DAX40 contracts are losing over 1%. Slightly less, but also down by about 0.7%, are the prices of SPA35, ITA40, and UK100 contracts. The French stock market is doing better, with CAC40 down by about 0.4%. Switzerland is on a slight positive at the halfway point of the session.

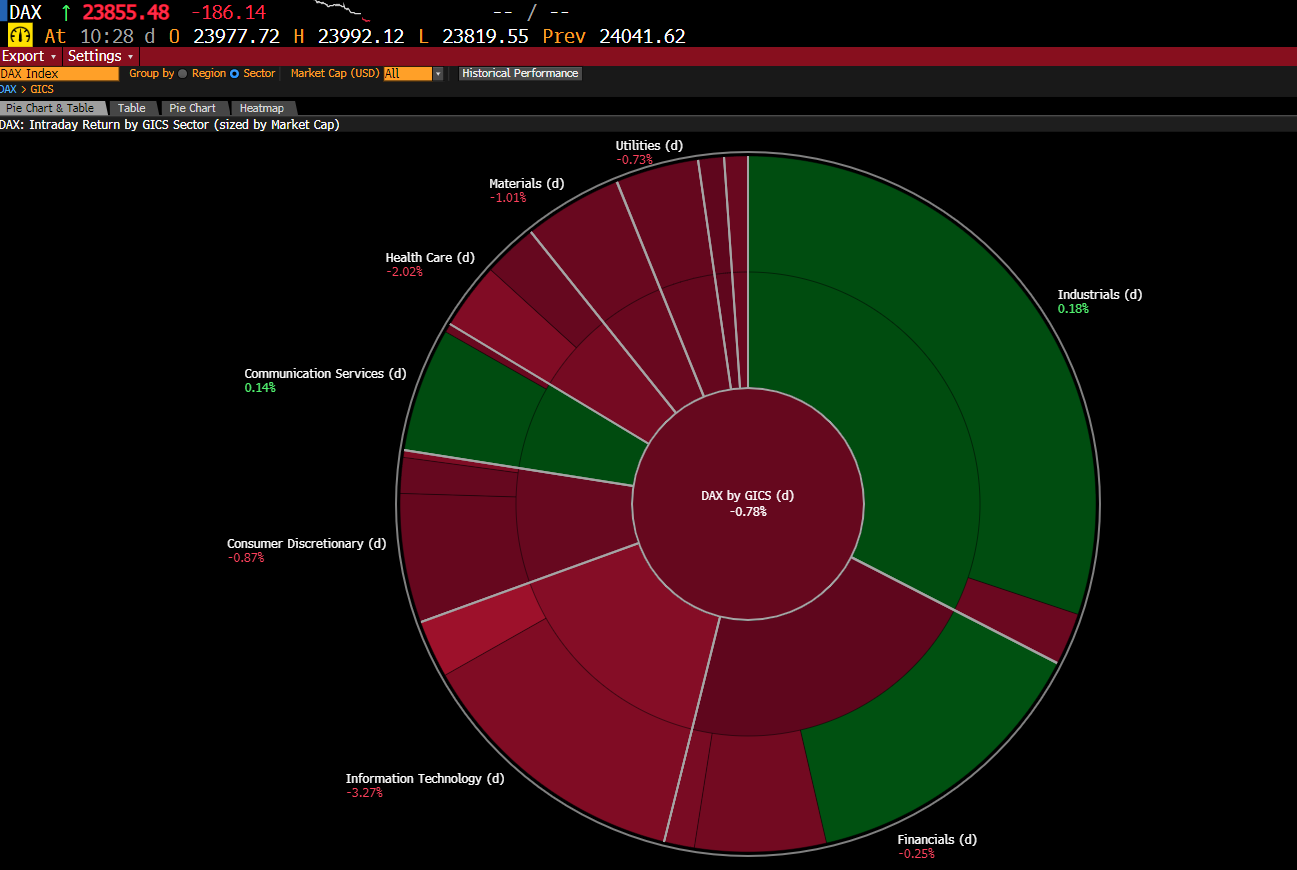

Source: Bloomberg Finance Lp

The market is under broad pressure. On the DAX index, the biggest declines are seen in technology and pharmaceutical companies. They are followed by retailers, services, and distributors. Industrial companies are currently on a slight positive.

Macroeconomic Data:

- The inflation reading from Spain still indicates a significant rise in prices. Prices increased monthly by 0.7%, and annual inflation rose to 3.1%.

- Economic growth from the European Union turned out to be slightly above expectations on an annual basis. Quarterly, the EU economy grew by 0.2%. The trade balance is also in an upward trend. After the session ends, ECB representative Philip Lane will speak on monetary policy.

- Outside Europe, the economic situation appears much weaker. China, one of Europe's key trading partners, is experiencing weak industrial production growth, with its dynamics remaining in a downward trend.

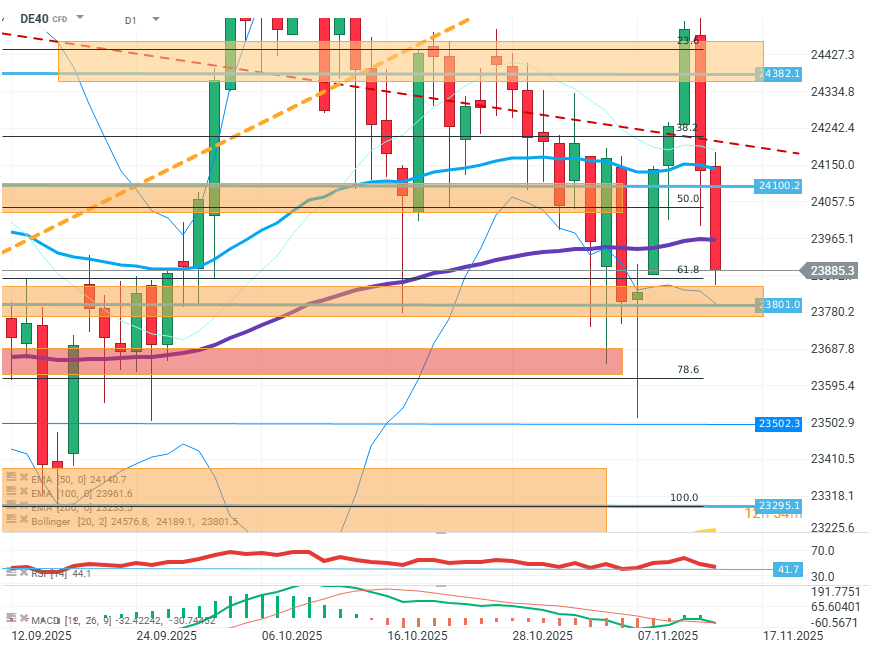

DE40 (D1)

Source: xStation5

The price extends yesterday's declines and stops in the resistance zone around the FIBO 61.8 level of the last upward wave. The most important task for buyers will be to prevent the rate from exceeding 23,800 points to avoid deepening the correction. In case of failure, further declines may reach 23,500-23,300 where the next support zones are located. The base scenario is transitioning into consolidation and waiting for a price impulse in the 24,400-23,800 zone.

Company News:

- Siemens Energy (SIE.DE) - Part of the Siemens group responsible for power systems is rising by as much as 8% in today's session. The increases are driven by excellent forecasts regarding wind turbines and demand from data centers.

- Bechtle (BC8.DE) — The German IT company published quarterly results that exceeded investor expectations regarding EBIT. The company's valuation is rising by over 10%.

- Allianz (ALV.DE) - The financial group published very good results and also raised its year-end forecast. The company is up by over 1%.

- Richemont (CFR.CH) — The fashion company published very good results, including a 14% increase in quarterly sales. The company is up by as much as 6%.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.