- Positive sentiment reigns on European stock markets

- The political situation in France remains tense

- Positive sentiment reigns on European stock markets

- The political situation in France remains tense

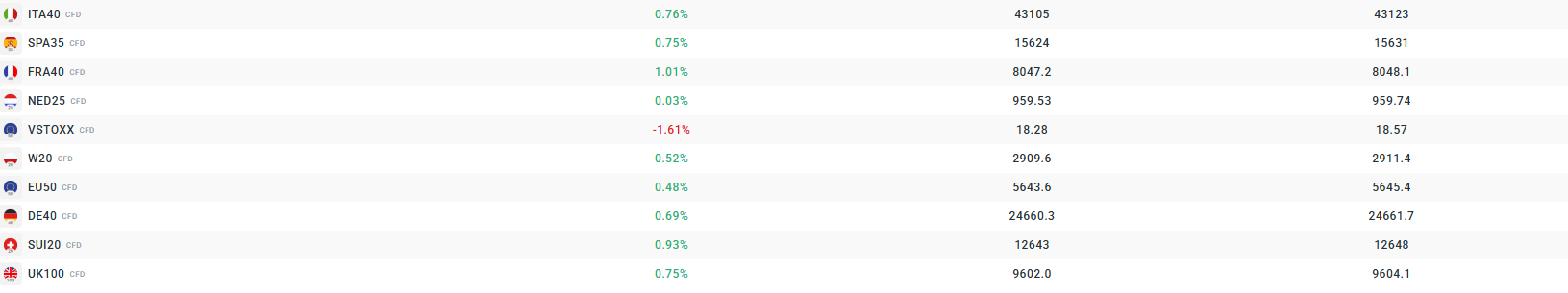

European equity markets recorded significant gains today, despite the ongoing political crisis in France, which continues to create uncertainty among investors. The FRA 40 index is up by over 1%, reaching a monthly high, demonstrating that despite political tensions, investors remain resilient. The British UK100 index also rose by around 0.8%, while the German DE40 increased by nearly 0.7%, continuing the positive sentiment across the Old Continent.

The political situation in France remains tense, and the crisis may impact the country’s economic stability, causing caution in the markets. However, despite these concerns, European stocks maintain an upward trend, supported by strong financial results from key companies and investors’ expectations of further central bank actions, particularly in monetary policy.

Investors are closely watching decisions by the US Federal Reserve and other major central banks, which could have a significant impact on global financial markets. Despite the uncertainty stemming from the political crisis, European stock exchanges today demonstrate their ability to effectively respond to volatility and maintain positive sentiment.

Source: xStation

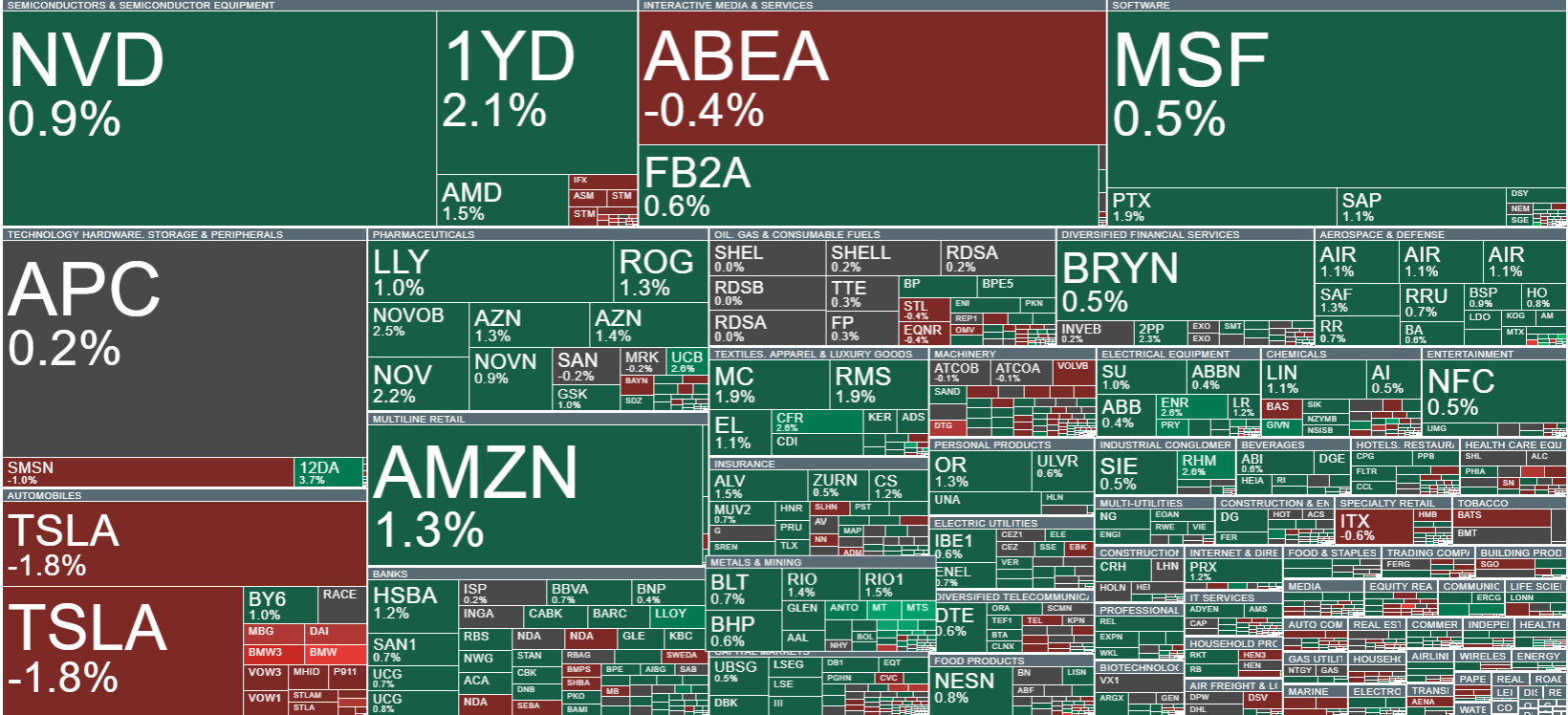

Current volatility observed in the broader European market. Source: xStation

The DAX has been rising in recent sessions and is decisively breaking through key resistance levels, confirming its strength. The index is currently above the 50-day and 100-day exponential moving averages, which serve as important technical support levels. Maintaining a position above these averages is especially important, as it provides a solid base for further gains. If the DAX sustains this momentum and remains above these levels, it could signal the continuation of a strong upward trend and further increases.

Source: xStation

Company News:

BMW (BMW.DE) shares fell by more than 7% after the company lowered its profit forecast for 2025. The decline is mainly due to weaker sales in the Chinese market, higher costs related to tariffs, and delays in tariff refunds from US and German authorities, which are now expected only in 2026.

ASML (ASML.NL) shares dropped over 4% following calls from some US politicians to expand the ban on sales of chip manufacturing equipment to China. Washington, along with its allies, is considering introducing stricter restrictions, negatively impacting the company’s stock.

Similarly, ASM International (ASM.NL) shares lost about 1.5% after reports of a bipartisan investigation revealed that regulatory differences in the US, Japan, and the Netherlands allowed non-US manufacturers to sell chip production equipment to Chinese firms, which US companies were prohibited from selling to.

Puma (PUM.DE) shares gained nearly 1% after Bank of America upgraded its recommendation from “sell” to “neutral.” BofA analysts noted that following earlier significant price drops, the company’s current valuation already reflects many risk factors, limiting potential for further declines. The upgrade indicates a possible stabilization of the company’s situation, although challenges related to business transformation and strong competition in the sportswear sector remain.

Daily Summary: Shutdown ends, rate cut fades and risk is off

Siemens after Earnings: What went wrong?

BREAKING: Oil inventories raise more than expected! 🛢️📈

Google's European troubles

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.