💸 The “debasement trade” is the strategy investors use to protect their money when currencies lose value due to excessive money printing.

🏦 Since the end of the gold standard in 1971, governments have been able to issue money without backing, leading to inflation and record global debt.

🪙 In this context, gold has regained its role as the preferred safe haven, because it cannot be printed, holds its value, and is accepted worldwide.

📈 With bonds and stocks showing increasing risks, many now wonder not if gold will rise further, but when it will reach new record highs.

💸 The “debasement trade” is the strategy investors use to protect their money when currencies lose value due to excessive money printing.

🏦 Since the end of the gold standard in 1971, governments have been able to issue money without backing, leading to inflation and record global debt.

🪙 In this context, gold has regained its role as the preferred safe haven, because it cannot be printed, holds its value, and is accepted worldwide.

📈 With bonds and stocks showing increasing risks, many now wonder not if gold will rise further, but when it will reach new record highs.

In financial markets, the so-called “debasement trade” refers to an investment strategy aimed at protecting purchasing power against the ongoing devaluation of fiat money.

The idea is simple: when governments and central banks expand the money supply faster than the real economy grows, the value of the currency declines — and assets with limited supply, such as gold, silver, or bitcoin, tend to appreciate.

The History of Fiat Money

Until 1971, the international monetary system (established at Bretton Woods in 1944) operated under a gold-dollar standard. The U.S. dollar was convertible into gold at $35 per ounce, and other currencies were pegged to the dollar. This meant the amount of money in circulation was limited by the U.S. Treasury’s gold reserves — in other words, it couldn’t be printed indefinitely.

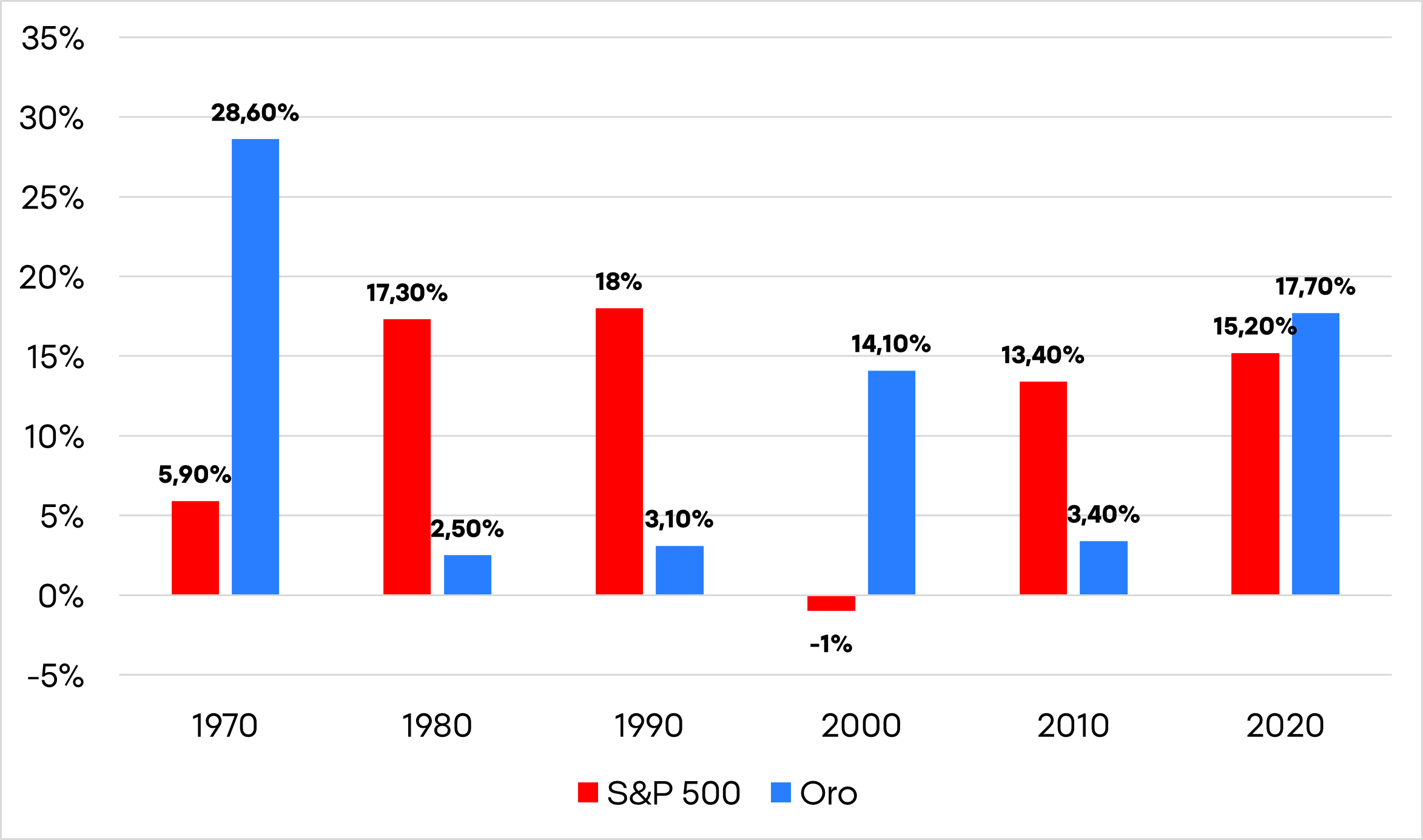

During the 1960s, however, the Vietnam War and expansive social programs created large fiscal deficits. The United States began issuing more dollars than it could back with gold, prompting several countries to demand conversion of their dollars into gold. Fearing depletion of its reserves, President Richard Nixon unilaterally suspended the dollar’s convertibility into gold on August 15, 1971 — an event known as the “Nixon Shock.” This marked the birth of pure fiat money, and during that decade gold delivered spectacular returns not seen again until recently.

Annualized performance of gold and the S&P 500 by decade. Source: XTB.

Since then, central banks have been free to expand the money supply at will. Cycles of devaluation, inflation, and asset bubbles have become recurrent. Every crisis (1987, 2000, 2008, 2020) has been met with new waves of liquidity — always producing the same pattern: accelerating money growth, rising debt, and erosion of real purchasing power.

In this context, investors have re-evaluated the role of money and sought refuge in assets that cannot be “printed” — mainly precious metals and cryptocurrencies. The debasement trade is not so much a speculative bet as a rational response to an environment where fiscal and monetary policies converge toward one outcome: the steady loss of purchasing power in fiat currencies.

Too Much Money and Too Much Debt

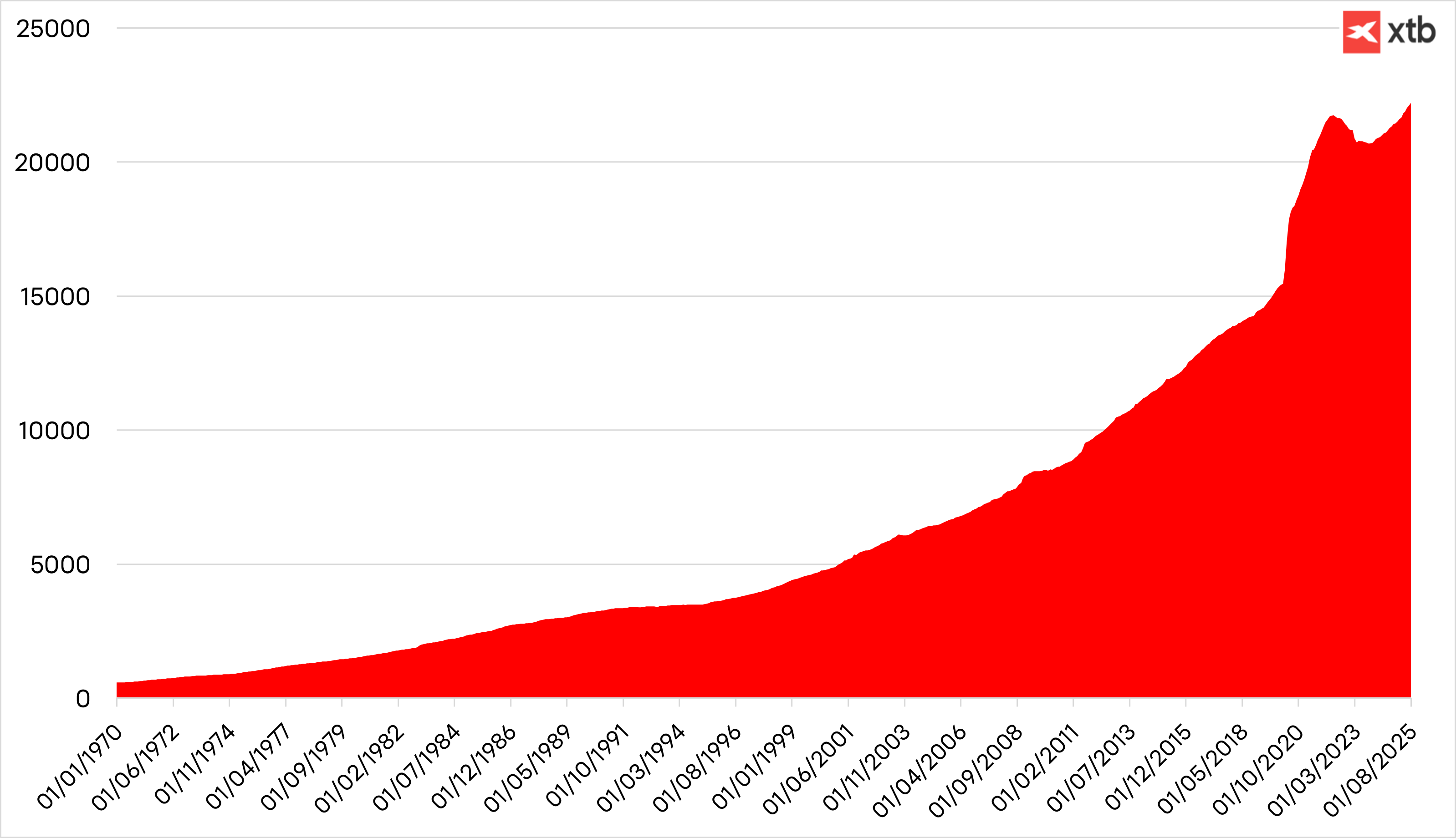

The global monetary expansion of recent years has been the largest in modern history. Following the 2020 pandemic, the U.S. M2 money supply grew by over 40% in just two years, while total global debt now exceeds $330 trillion — more than three times the world’s GDP, according to Reuters.

Money supply measured through M2. Source: XTB.

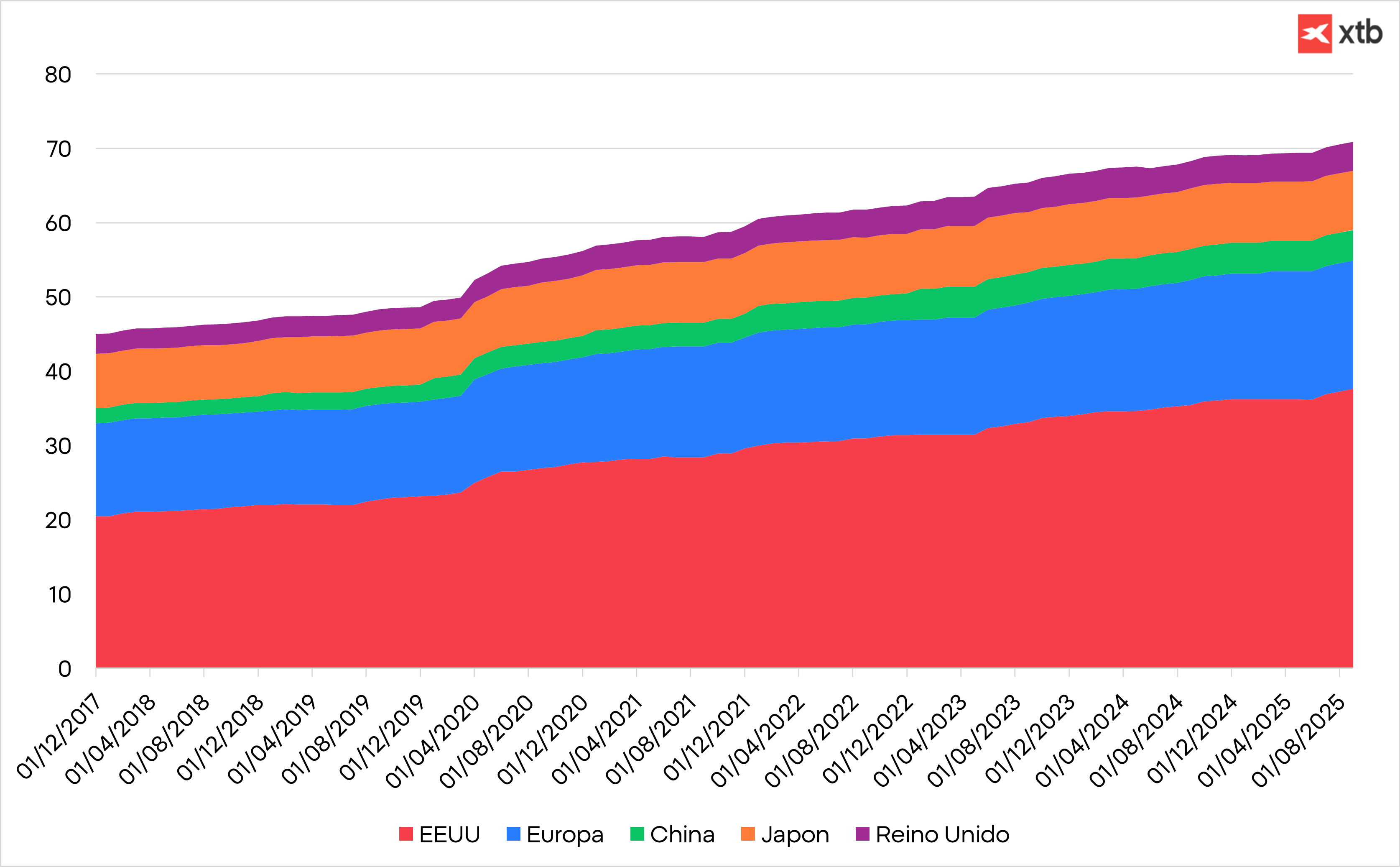

Debt growth in trillions of dollars across major economies. Source: XTB

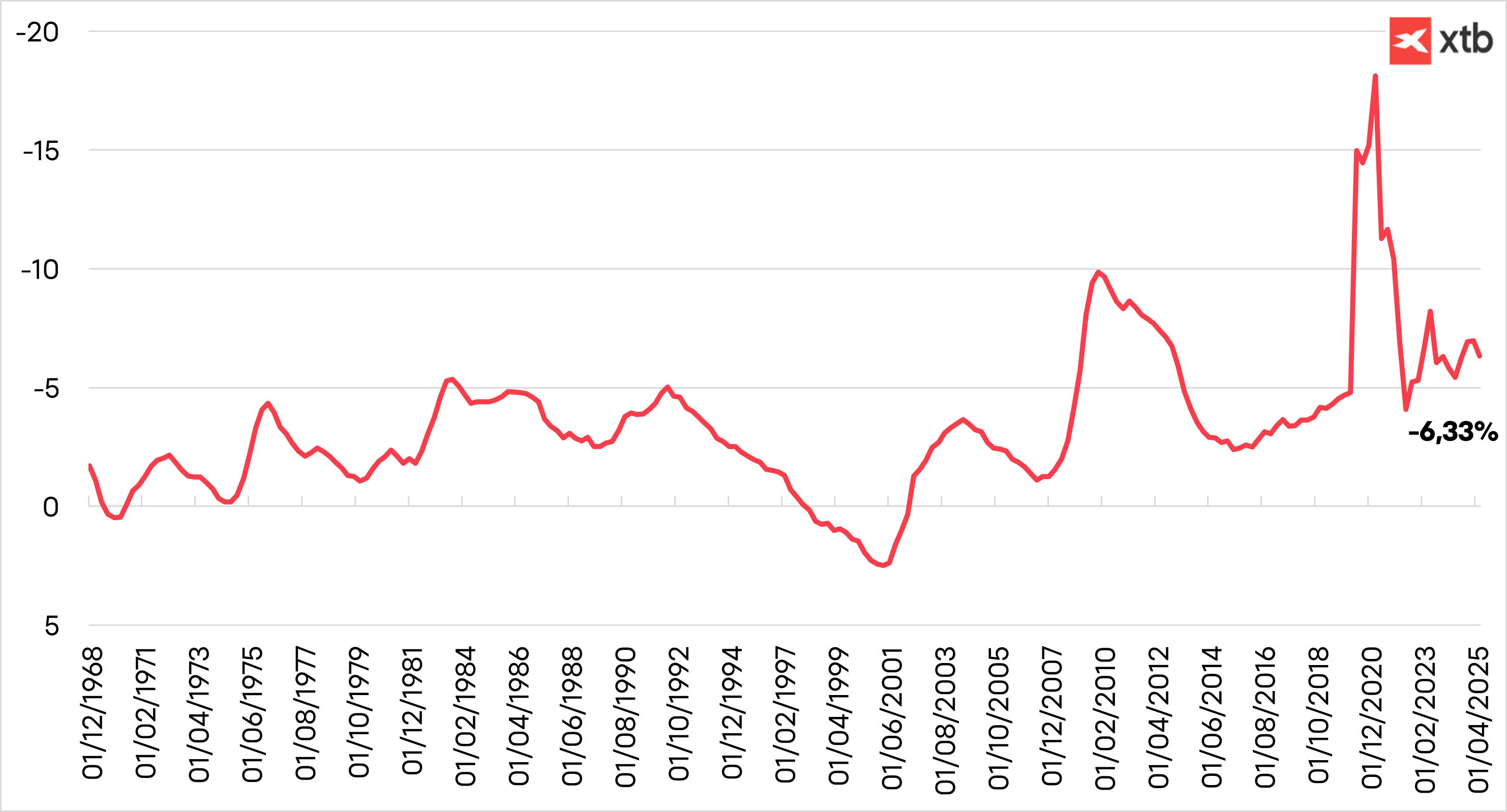

Structural fiscal deficits and debt-financed public spending have turned central banks into permanent buyers of government bonds. This vicious circle — deficit, issuance, and monetization — keeps real rates negative and makes holding cash or traditional fixed income increasingly unattractive.

U.S. fiscal deficit as a percentage of GDP. Source: XTB

The Recent Wave of Currency Devaluation

Adding political instability and fiscal irresponsibility to this backdrop creates the perfect storm for investors to turn toward alternative assets.

- Japan faces insolvency concerns, with bondholders suffering heavy losses.

- The United Kingdom is on the brink of a debt crisis.

- France is in turmoil — two governments have fallen in just four weeks.

- Germany, after years of fiscal discipline, is now expanding its debt by €500 billion — and that’s just the beginning.

- The United States is increasing its debt by 7% annually while bonds yield around 4%, ensuring a real loss each year, and the independence of public institutions like the Federal Reserve is under political pressure.

Gold as a Safe Haven

In this environment of abundant liquidity, instability, and lack of alternatives, assets with limited or decentralized supply are gaining value — and likely will continue to do so. For centuries, gold has been the preferred safe haven in times of political and economic uncertainty. Its tangible value, portability, and global liquidity offer a sense of security when everything else is in crisis.

Gold has a track record of rising during market stress. It surpassed $1,000 per ounce after the global financial crisis, $2,000 during the COVID-19 pandemic, and briefly approached $3,000 during periods of trade tension under the Trump administration. The surge even pushed gold ahead of the euro as the world’s second-most-held reserve asset earlier this year.

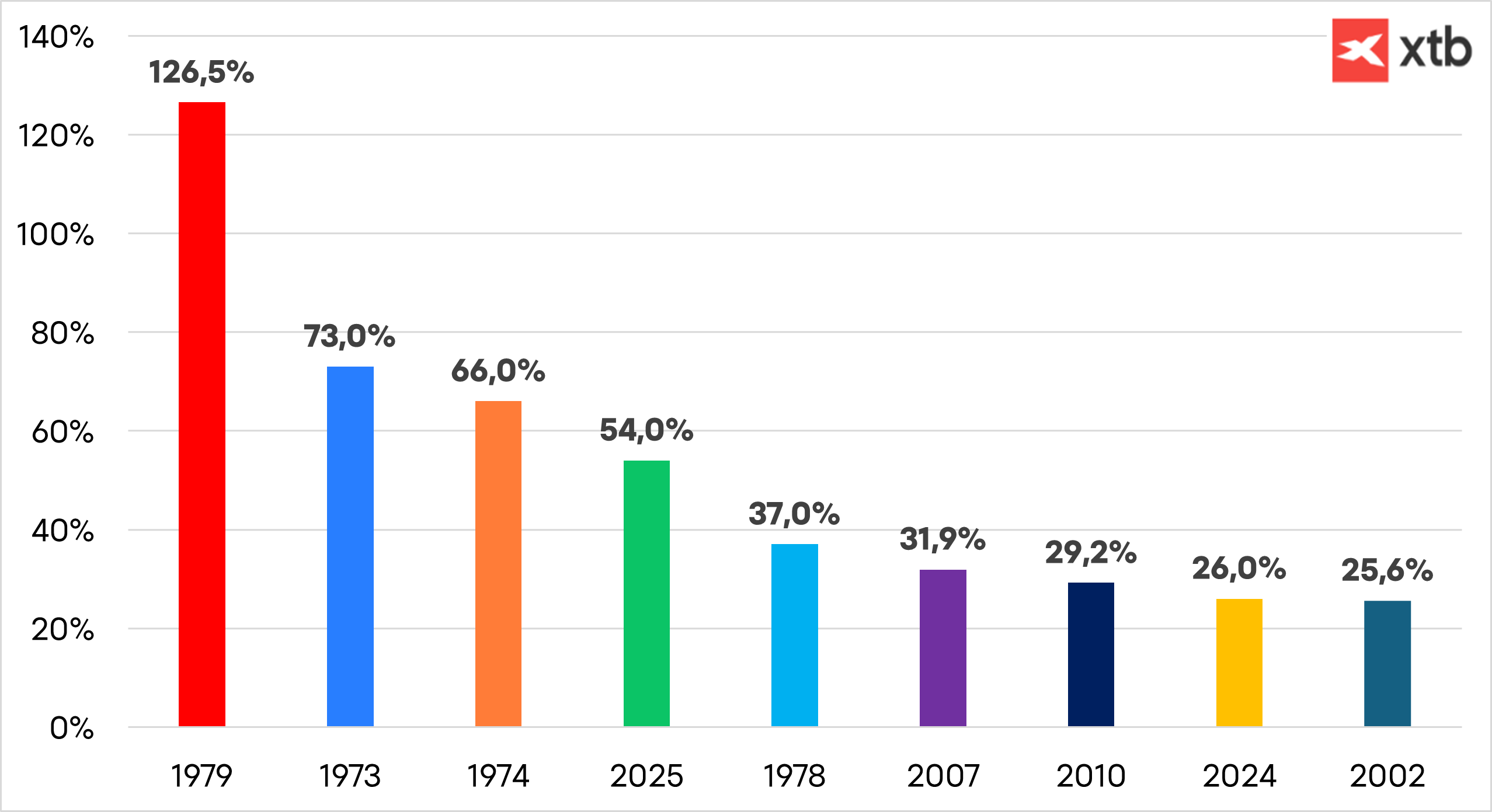

Gold performance in its best years. Source: XTB

Central banks have been net buyers of gold for the past 15 years, but their pace of accumulation doubled after Russia’s invasion of Ukraine. The freezing of Russian central bank reserves by Western nations exposed the vulnerability of foreign currency holdings to sanctions. In 2024, central banks purchased more than 1,000 tons of gold for the third consecutive year, according to the World Gold Council, and now hold about one-fifth of all the gold ever mined.

Investors, too, have flocked to gold amid renewed trade tensions, record government debt, and growing concerns over the Federal Reserve’s independence. Exchange-traded funds (ETFs) backed by gold reached their highest holdings in over three years as of September. Gold also acts as an inflation hedge, and at a time when the Fed seems likely to ease its inflation fight prematurely — pressured by immigration policies, tariffs, and a weakening dollar — it gains renewed importance. Combined with the rising risk of sovereign defaults, these forces could continue to drive gold prices higher.

Can It Keep Rising?

To answer that question, we must consider the factors supporting gold’s upward trend — and whether any viable alternatives exist. So far, few do.

Government bonds have lost appeal among investors who distrust fiscal management and prefer not to lock into assets that erode purchasing power. As money leaves bonds, some of it naturally flows into gold.

Equities continue to hit record highs, but growing fears over lofty valuations and market concentration push investors to look sideways — toward gold — as a safer store of value.

Thus, the question may not be if gold will reach $5,000 per ounce, but when. History shows that whenever money is debased, capital seeks refuge in what cannot be printed.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.