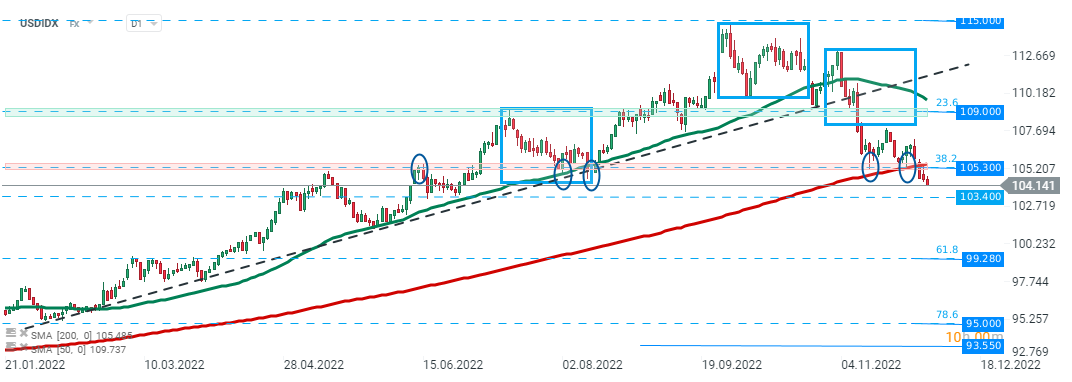

The dollar index fell to 104.15 mark, lowest level since end of June and as prospects of a less aggressive tightening from the Fed put pressure on greenback. Money markets digested the latest NFP report and are pricing an 80% chance of 50 bp in December after delivering four successive 75 bp rate increases. USD weakened not only against major currencies like EUR and GBP pound but also against the Chinese yuan as bets of a swifter reopening of China's economy lent optimism to yuan bulls.

Dollar extends fall and today the most pronounced selling pressure can be spotted against South African Rand and Chinese yuan. Source: xStation5

USDIDX erased more than half of this year’s gains and if current sentiment prevails, support at 103.40 may be at risk. Source: xStation5

USDCNH pair is testing major support zone around 6.95, which is marked with lower limit of the local 1:1 structure and 38.2% Fibonacci retracement of the upward wave launched in March 2022. Should break lower occur, next support to watch lies at 6.83 and coincides with 50.0% retracement, however earlier sellers will need to overcome 200 SMA (red line). On the other hand, if buyers manage opt regain control, then another upward impulse may be launched towards resistance at 7.10. Source: Station5

EURUSD hovers near key resistance at 1.06 which coincides with 38.2% Fibonacci retracement of the upward wave launched in January 2021. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.