Summary:

-

US30 moves back into the green after early declines

-

Index boosted by BA earnings

-

US30 in danger of lagging US500 for 1st time in 4 years

The latest set of earnings results from the US have boosted the Dow Jones Industrial Average (US30 on xStation), with two of the benchmarks largest-weighted stocks reporting ahead of the opening bell. The index had earlier slid to its lowest level in almost 2 weeks below 26,600 but has since recovered after Boeing and Caterpillar reported their figures for the third quarter.

Today’s session could be pivotal for the Dow going forward, with lows around 26585 seen as potentially key support. Should this hold then a move back up to the 27000 region could occur and with price in between the 8 and 21 EMAs there is a feeling that whichever way we go from here could be the start of the next trend. Source: xStation

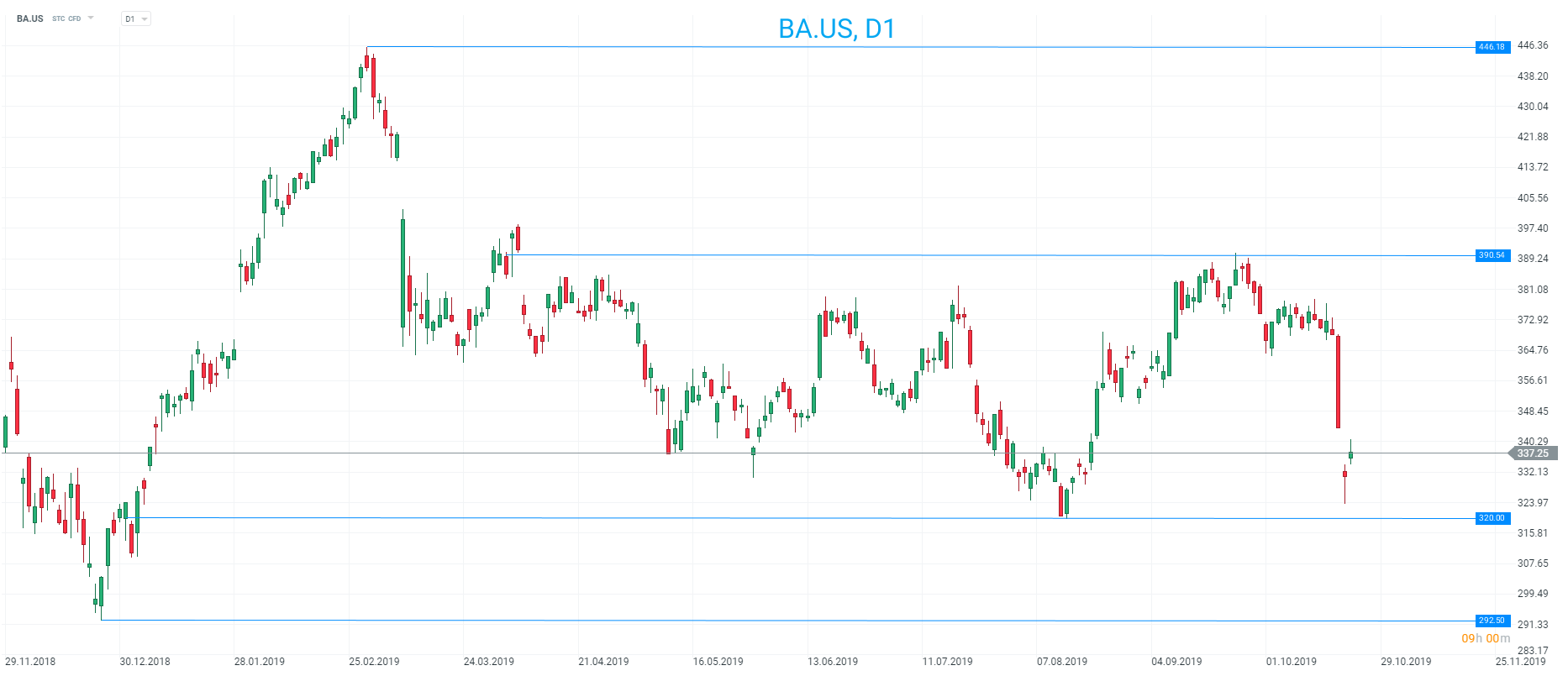

These two stocks account for comfortably more than 10% of the broader index due to the price-weighted nature with Boeing alone having a weighting of more than 8%. The poor performance of these shares so far in 2019 go some way to explaining the Dow’s underperformance compared to the S&P500 (US500 on xStation) with Boeing being a particular laggard. The aerospace firm’s stock has experienced a double-digit drop over the past 6 months as issues surrounding it 737 Max jet has shaved approximately 370 points of the broader index.

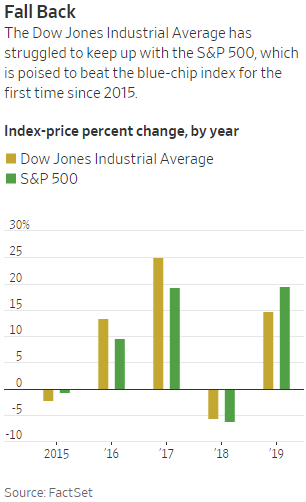

The DJIA has outperformed the S&P500 in each of the past 4 years, but so far in 2019 is lagging behind. Source: FactSet

Boeing stock to gain

-

EPS: $1.45 vs $2.09 expected (Refintiv)

-

Revenue: $19.98B vs $19.67B expected (Refinitiv)

This represents a 5-0% slide in profits and 20% drop in turnover. However, a miss in earnings here has seemingly been outdone by some positive remarks on the 737 Max, with the aerospace giant assuming a return to service in the fourth quarter of 2019. Given the recent backdrop and the dour newsflow around Boeing for much of the year, this is seen as a clear positive and the stock is trading higher in the premarket.

Boeing investors have had a trying year but the stock is called to begin higher this afternoon on hopes of a return to service for the trouble 737 MAX jets this quarter. This has seemingly outweighed a disappointing set of results with both profits and revenue falling in Q3. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.