-

ECB Stands Pat: The central bank maintains a neutral stance, signaling an end to the rate-cut cycle as the inflation target has been met, with no immediate plans for policy changes.

-

French Fiscal Risks Weigh on Euro: High deficit/debt and political instability in France are now the primary sources of risk for the Eurozone, dragging the euro lower.

-

EURUSD Oversold Signal: Despite the dollar's strength, the EURUSD pair may be undervalued/oversold based on the yield spread, though it recently broke its technical uptrend.

-

ECB Stands Pat: The central bank maintains a neutral stance, signaling an end to the rate-cut cycle as the inflation target has been met, with no immediate plans for policy changes.

-

French Fiscal Risks Weigh on Euro: High deficit/debt and political instability in France are now the primary sources of risk for the Eurozone, dragging the euro lower.

-

EURUSD Oversold Signal: Despite the dollar's strength, the EURUSD pair may be undervalued/oversold based on the yield spread, though it recently broke its technical uptrend.

ECB is Not Gearing Up for Monetary Policy Changes

Members of the ECB maintained an unambiguously neutral tone in their statements today, suggesting that the cycle of interest rate cuts has ended, and they describe the current state of monetary policy as close to neutral. Both Mārtiņš Kazāks and José Luis Escrivá emphasized that the inflation target has been achieved, and current readings do not require any reaction from the central bank. At the same time, they cautioned that short-term deviations from 2% will not be treated as a reason to adjust rates.

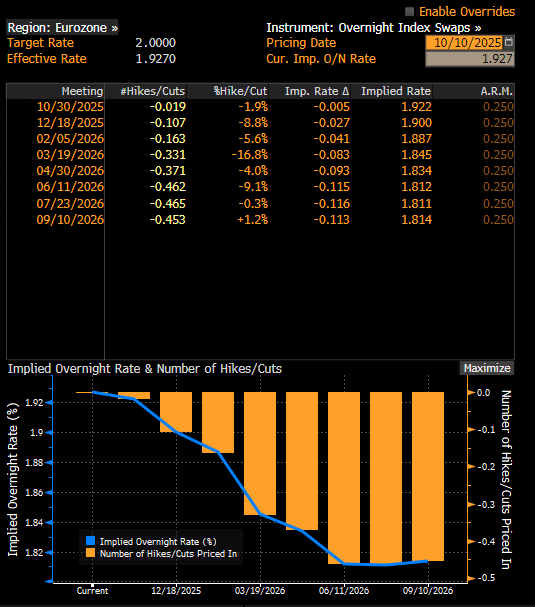

Expectations indicate no prospects for interest rate cuts in the near term. Source: Bloomberg Finance LP

These statements align with the broader ECB's communication in recent weeks: the lack of inflationary pressure and the stabilization of expectations allow for a "wait and see" stance, especially since risks to economic growth have not materialized. Therefore, we can speak of a consolidation of monetary policy at the current level, with a low probability of both further cuts and a return to tightening.

Does France Remain a Problem for the Euro?

Against the backdrop of the region, the thread of France's fiscal situation, discussed by François Villeroy de Galhau, remains particularly interesting. Despite maintaining the GDP growth projection at 0.7% for 2025, the country faces serious budgetary challenges—the deficit is approaching 5.5% of GDP, and public debt is hovering around 116%. This is significantly above the EU limits (3% and 60%), increasing tensions in the context of future negotiations with the European Commission. Additionally, political instability could cost the economy up to 0.5 percentage points in GDP growth.

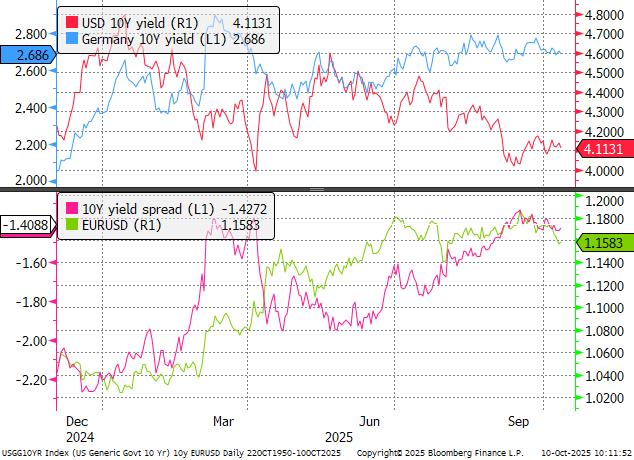

It was these negative reports concerning France that heavily dragged the euro down this week, although the strength of the US dollar itself was also a factor. While the European economy remains in a difficult position, as suggested by data from Germany this week, it seems that EURUSD may be somewhat too heavily oversold, a point also indicated by the yield spread.

The yield spread indicates excessive overselling in the EURUSD pair. Source: xStation5

In summary, the ECB signals a stabilization of monetary policy, while risks are shifting to the fiscal and political spheres, particularly in France. The bank sees no reason to react as long as inflation remains contained, but it is simultaneously observing the balance between slowing growth and maintaining fiscal credibility in the Eurozone.

Technical Analysis (EURUSD)

EURUSD saw a retracement below the 1.16 level and the 61.8% Fibonacci retracement yesterday, signifying a breakout from the uptrend. However, a new lower low in the downward sequence was potentially established yesterday, so an upward correction to the 1.16-1.1630 level cannot be ruled out. The 60.0% retracement remains the key resistance, where price reactions were observed previously.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.