The European Central Bank (ECB) left its key interest rates unchanged, with the deposit facility rate at 2% since June 2025. ECB President Christine Lagarde is set to speak in Frankfurt, where she will explain the rationale behind the decision and discuss recent developments in the eurozone economy.

Key insights from ECB's Lagarde:

-

The latest developments confirm inflation setting in the ECB's 2-percent target. Inflation continued to ease, mainly thanks to falling energy prices. Goods inflation ticked up slightly, while services inflation cooled. Long-term inflation expectations remain well anchored at 2%.

-

Eurozone economy grew 0.3% in Q4, showing modest but continued expansion despite a still-uncertain global backdrop. Growth was supported by information & communication services, while manufacturing showed resilience, easing earlier fears of a deeper industrial slowdown.

-

Construction activity is gaining momentum, partly driven by stronger public spending. Business sentiment is improving and firms are gradually lifting investment even amid lingering uncertainty.

-

Labour market conditions improved, with unemployment edging down to 6.2% from 6.3% in November. Rising real wages are supporting household consumption, while government spending is adding to domestic demand.

-

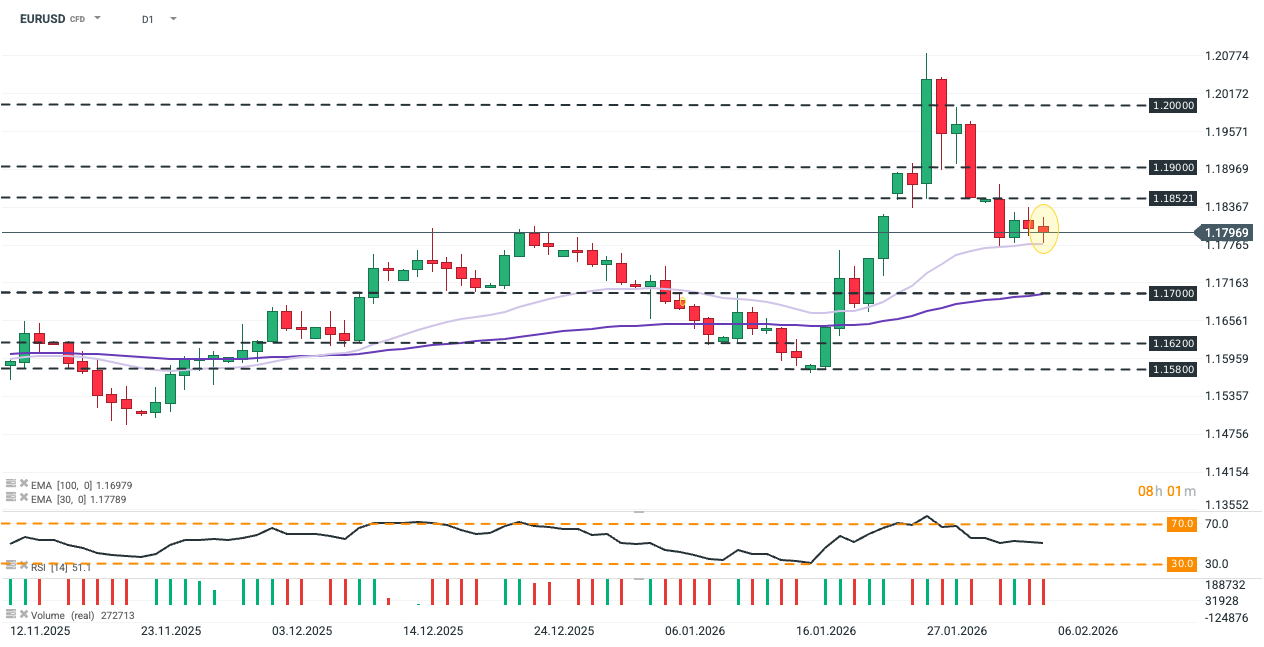

Stronger euro could push inflation below the target. The Governing Council discussed the EURUSD exchange rate during today's meeting. The impact of the appreciation of the euro is well incorporated, as the dollar's weakness has been developing gradually over almost a year and is staying within the expected range. Nevertheless, ECB doesn't target the rate with its policy.

-

ECB views further financial integration as one of the key conditions for the economic development of the Eurozone.

-

The monetary policy remains agile.

In conclusion, the ECB’s February decision reaffirmed a status-quo outlook for both the Eurozone economy and the policy path. Inflation remains on track toward the 2% medium-term target, while activity is gradually rebounding amid improved risk sentiment, stronger business confidence, and rising consumer spending. The EUR/USD exchange rate was discussed, though the ECB does not target a specific level and views the euro’s appreciation as already reflected in its outlook. The pair traded calmly during the conference, hovering around 1.18.

Source: xStation5

Economic calendar: US-Iran talks in Geneva in the spotlight

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

BREAKING: Massive Crude Build Shatters Expectations. WTI is down by 1%

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.