-

French inflation miss: Annual CPI fell to 0.3% against an expected 0.6%, signaling a sharp cooling of price pressures in the Eurozone's second-largest economy.

-

US data blackout: The ongoing government shutdown has halted BLS operations, leading to an official delay of this Friday's Non-Farm Payrolls report.

-

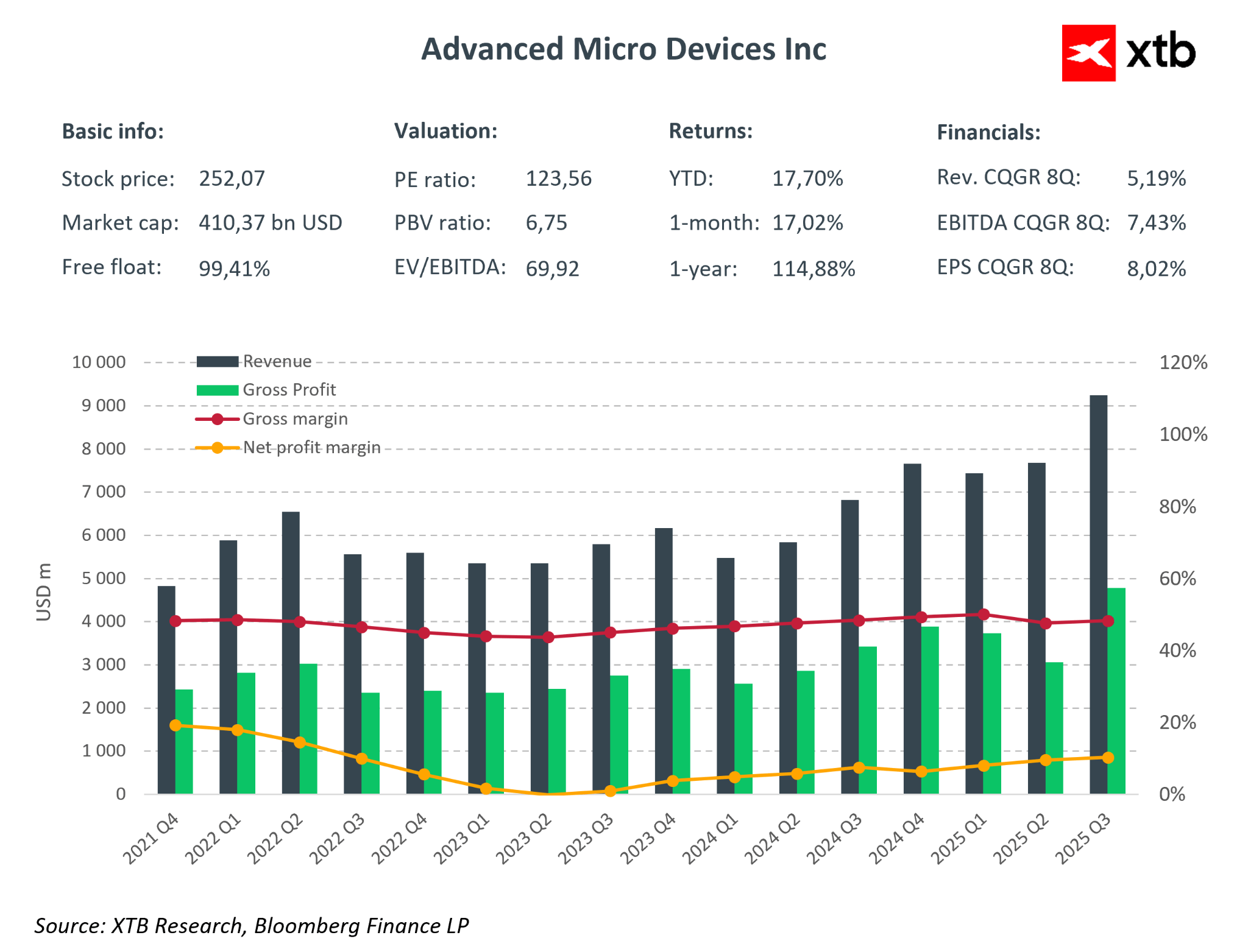

Corporate focus: Markets await AMD's results tonight, with the chipmaker expected to post a 27% revenue surge to $9.67bn amid high AI-driven expectations.

-

French inflation miss: Annual CPI fell to 0.3% against an expected 0.6%, signaling a sharp cooling of price pressures in the Eurozone's second-largest economy.

-

US data blackout: The ongoing government shutdown has halted BLS operations, leading to an official delay of this Friday's Non-Farm Payrolls report.

-

Corporate focus: Markets await AMD's results tonight, with the chipmaker expected to post a 27% revenue surge to $9.67bn amid high AI-driven expectations.

The global macroeconomic schedule for the European and North American sessions is relatively light following earlier significant releases. Markets have already digested the Reserve Bank of Australia’s decision to hike interest rates—a move that defied forecasts from several investment banks that had expected the RBA to hold steady for longer. Meanwhile, inflation data out of France continues to surprise to the downside. French annual CPI slowed to just 0.3% year-on-year, missing the 0.6% consensus and cooling significantly from the previous 0.8%. On a monthly basis, prices fell by a sharp 0.3%.

The primary focus for market participants this week remains the operational paralysis in Washington. The ongoing US government shutdown has shuttered key federal agencies, including the Bureau of Labor Statistics (BLS). Consequently, the highly anticipated Non-Farm Payrolls (NFP) report, originally slated for this Friday, has been officially delayed.

In the absence of top-tier US employment data, today’s agenda shifts to central bank rhetoric, private inventory data, and New Zealand’s labor market update. Investors also remain laser-focused on the corporate earnings cycle, with AMD set to report after the closing bell in New York.

Economic Calendar (All times GMT)

-

13:00 – Fed’s Barkin speaks

-

14:40 – Fed’s Bowman speaks

-

21:40 – API Weekly Crude Oil Stock Report

-

21:45 – New Zealand Labour Market Data (Q4):

-

Employment Change: Exp. 0.5% q/q; Prev. 0.5% q/q

-

Labor Cost Index: Exp. 0.3% q/q; Prev. 0.0% q/q

-

Unemployment Rate: Exp. 5.3%; Prev. 5.3%

-

-

22:00 – Australia Services PMI: Exp. 56; Prev. 51.1

Corporate Earnings

-

AMD (AMD.US) – After market close

-

Merck (MRK.US) – Pre-market

-

PepsiCo (PEP.US) – Pre-market

-

Pfizer (PFE.US) – Pre-market

AMD is expected to post revenue of $9.67bn, representing a 27% year-on-year increase. Should the company meet these targets, it would build on the momentum from Q3, where revenues beat the consensus by 5%. Consensus EPS stands at $1.32. Historically, AMD has a track record of moderate outperformance, beating revenue estimates by an average of just over 2% over the past eight quarters.

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

Daily summary: The market looks for direction, oil and metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.