Shares of Disc Medicine (IRON.US) fell more than 7% today following a Reuters article on the FDA's accelerated drug approval program. The main reason for the decline is the suspension of the regulatory review of the company's flagship drug, bitopertin due to serious concerns about its efficacy and risk of abuse. The regulators' decision has been postponed by two weeks, to February 10, 2026, which is a clear warning signal for the capital market.

What happened – details of the FDA decision

The FDA has suspended its review of bitopertin under the FDA Commissioner's National Priority Voucher Program — an accelerated drug approval program unveiled by the Trump administration in June 2025. The program promised regulatory decisions in just 1-2 months, which would shorten the standard priority process by as much as 4-6 months.

Bitopertin is an experimental drug being developed for patients with a rare blood disorder that causes extreme sensitivity to sunlight. Regulators have identified three key issues in the regulatory documentation:

First reservation – research methodology: The FDA questions whether "pain-free time in a relaxed, outdoor setting" – the second objective of the clinical trials – is a statistically robust measure of the drug's efficacy, or whether it simply shows that patients feel better mentally in conditions that are pleasant for them. The agency is requesting additional biomarker-based data to confirm that the decrease in toxic metabolites actually translates into measurable therapeutic benefits for patients.

Second concern – potential for abuse: FDA staff responsible for classifying drugs with addictive potential are conducting additional studies on bitopertin to assess its potential for misuse. Reuters could not confirm details about the abuse potential, but warnings from regulators could lead to special restrictions on the drug's distribution.

Context – issues broader than Disc Medicine itself

Disc Medicine is not alone. Almost simultaneously, Reuters revealed that Sanofi (SAN.FR) , the French pharmaceutical giant, had to face the suspension of the review of its drug Tzield (intended for the treatment of type 1 diabetes). The suspension of Tzield is even more alarming, as the FDA cites patient deaths associated with the treatment and serious adverse events such as seizures (in December 2024 and September 2025) and thromboembolic complications (May 2025).

Trump's voucher program is proving to be much more stringent than initially thought. Only one drug — a generic antibiotic — has been approved under the program, even though the FDA announced in October 2025 that 18 drugs would participate in the accelerated approval process. Most reviews are scheduled to begin in 2026, with two additional ones planned for 2027-2028.

Disc Medicine Position and Implications

John Quisel, CEO of Disc Medicine, told Reuters that bitopertin data show "a solid safety profile and multiple medical benefits." He pointed to a significant decrease in toxic metabolites (the primary endpoint of two mid-stage studies) and a reduction in phototoxic reactions in patients.

However, the CEO's optimism did not stop the stock from falling. For investors, the FDA's hold is a clear sign of risk — meaning that approval is not certain, and the next two weeks (until February 10) may only be the beginning of the process. History shows that when regulators raise questions about research methodology or the potential for abuse, the road to approval often becomes longer.

Implications for the sector

This incident is significant for the entire biotechnology and pharmaceutical sector. The voucher program was seen by investors as a potential fast track to profits for selected companies. However, today's suspensions show that the FDA will not cut corners, regardless of political pressure or promises of acceleration.

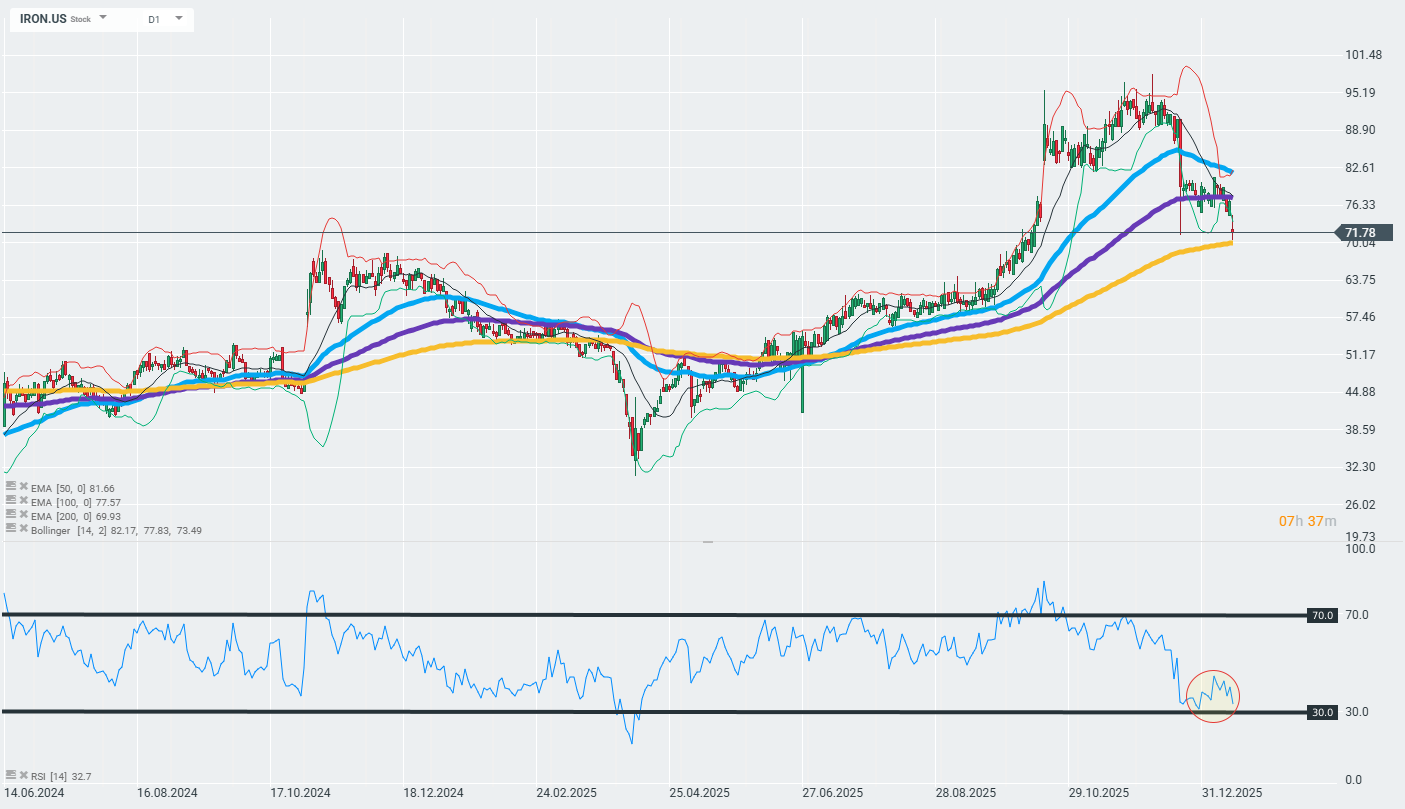

The company's shares are losing ground today and falling into important technical support zones marked by the 200-day exponential moving average (the gold curve on the chart). The further reaction to this zone may determine whether the current trend will continue or whether we will see a reversal.

Source: xStation

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.