Summary:

- The Fed announced it would start Treasury bills purchases in mid-October

- The program is aimed to boost the amount of reserves in the banking system

- It will continue offering overnight and term repo operations

The Federal Reserve announced on Friday it would start purchasing Treasury bills at the pace of $60 billion per month. The program will be conducted at least through the second quarter of 2020 and can be adjusted in both size and duration, as the Fed’s statement underlines. The statement also stresses that this program should not be likened to quantitative easing (these comments are in line with what we heard from Jerome Powell several days earlier). We concur because purchases of T-bills are intended to affect a completely different part of the yield curve. Overall, the newly designed program is to boost the amount of reserves in the US banking system to take pressure off money market rates.

Taking into account that these purchases are to last more than 8 months, one may expect the overall amount of reserves to exceed $2 trillion, a level not seen since mid-2018. Concurrently, the Fed will continue conducting overnight and repo operations at least through January 2020. Putting all of the above-mentioned together one may suppose that the upcoming Fed’s meeting later this month will be remarkably interesting.

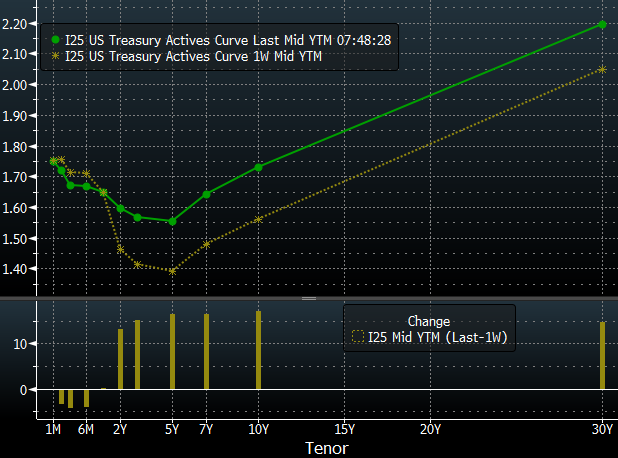

The front-end of the US yield curve lowered over the past week as the Fed announced purchases of T-bills. Source: xStation5

The front-end of the US yield curve lowered over the past week as the Fed announced purchases of T-bills. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.