The opening on Wall Street indicated a potential rebound after several days of increased selling pressure. However, the first few hours of trading verified this, and currently, both the US500 and US100 are experiencing declines and struggling to maintain key resistance zones.

Fitch Ratings: U.S. Consumer Health Monitor — 3Q23

Today, Fitch published its quarterly report on consumer conditions in the USA. From the document, we learn that consumer spending in the United States remained at a high level throughout 2023, supported by significant job and income growth, a strong consumer balance sheet, and positive consumer sentiments. The robustness is evident with real consumer spending rates of 4.3% in 1Q23, 1.7% in 2Q23, and an anticipated 3% in 3Q23. Fitch Ratings adjusted its annual consumer spending growth forecast to 1.9% from 1.0%.

However, an anticipated slowdown is visible on the horizon due to factors like a cooling labor market, decelerating wage growth, and the effects of the Fed's tightening policy. The slowdown will be noticeable in Q423, with spending expected to decrease by 1.2% and continue to decline in 2024. The consistent spending so far can be attributed to the increase in household incomes, supported by savings accumulated during the pandemic, but this buffer is expected to largely deplete by the end of 4Q23.

Moody's

On the other hand, the rating agency Moody's also expects an upcoming slowdown in consumer spending. According to Moody's, the decrease in dynamics will be visible in the coming months. Moreover, the quality of consumer debt is declining, which may signal potential risk in certain areas of the credit market.

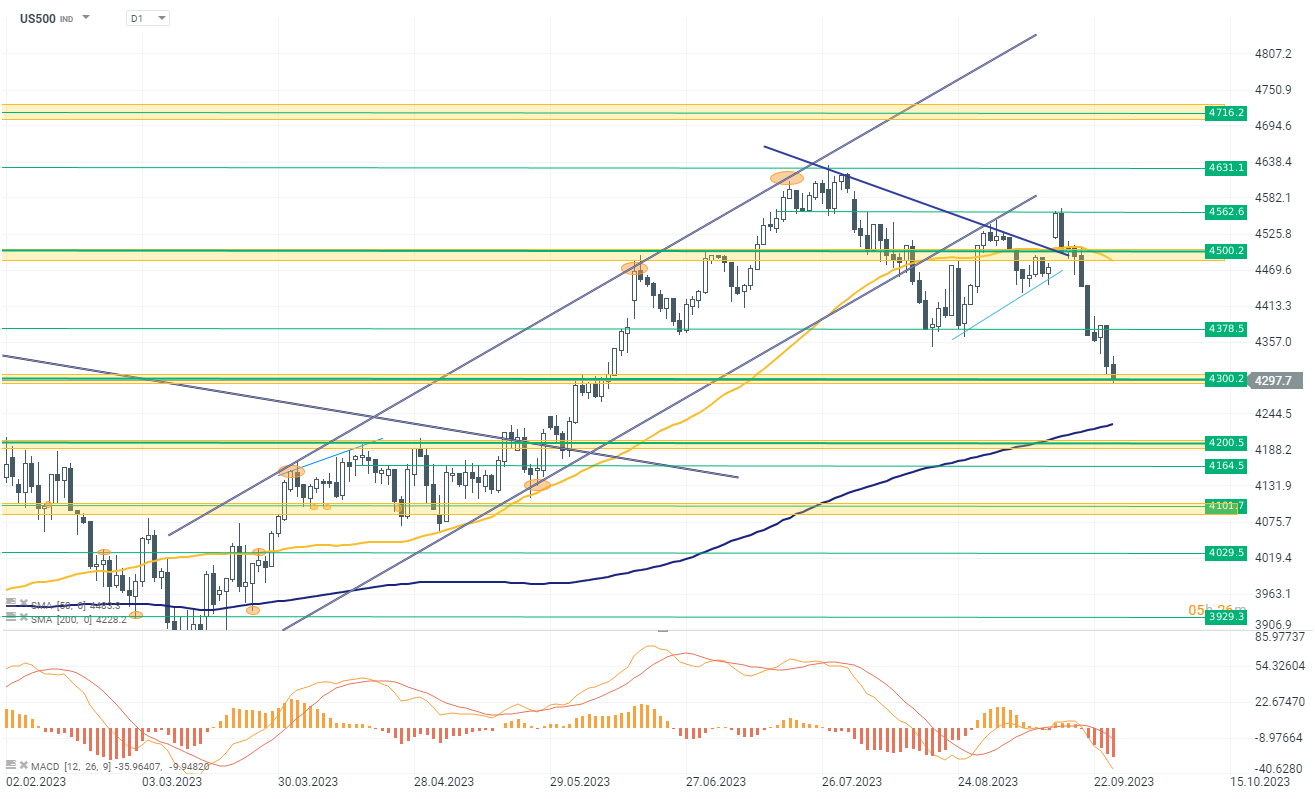

US500

At the beginning of today's session, the US500 opened 0.30% higher. However, initial gains were quickly reversed, and currently, the index is down by 0.60%. Bulls are struggling to maintain another key support zone at the 4300 points level. At the moment, the price is breaking below this level. If the selling pressure remains, the index may head towards the next support zone at the 4200 points level.

Source: xStation 5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.