- GE Aerospace pleased investors, exceeding expectations in almost every field

- Revenue and profits are significantly up, despite modest orders growth

- Both military and civilian branches grow rapidly

- Supply chain remains strong and reliable

- Company has lifted its FY guidance

- GE Aerospace pleased investors, exceeding expectations in almost every field

- Revenue and profits are significantly up, despite modest orders growth

- Both military and civilian branches grow rapidly

- Supply chain remains strong and reliable

- Company has lifted its FY guidance

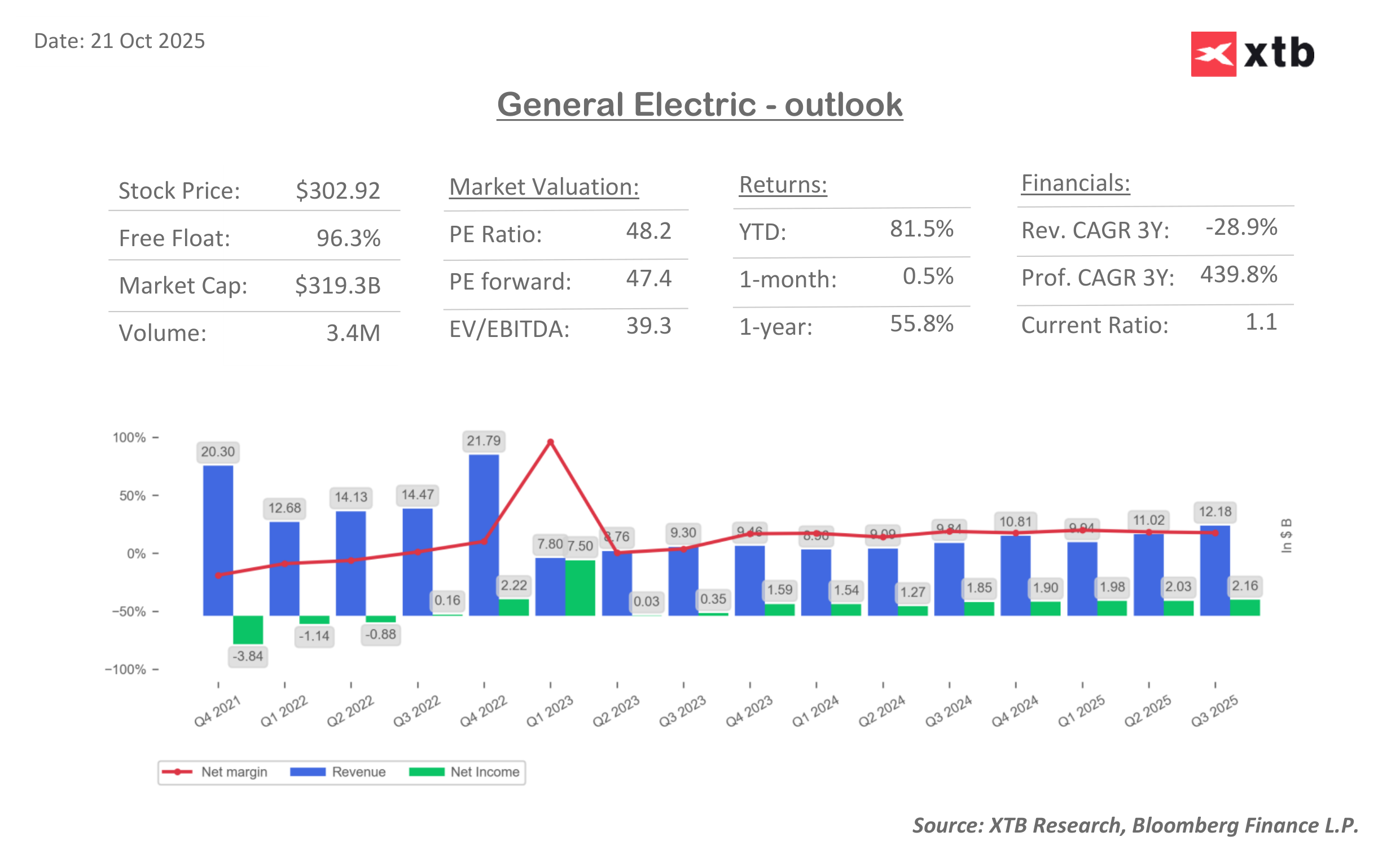

GE Aerospace, a subsidiary of the giant General Electric, is a global leader in aviation propulsion, service solutions, and defense systems and solutions. Today, before the stock market session begins, it is publishing its results for the third quarter of the fiscal year. The company operates a vast fleet of commercial and military engines, and its condition is of great significance to the global aviation and defense sectors.

Investors were thrilled with the results, as the (parent) company opened with a growth of over 4% and reached its new all-time high.

In the third quarter, it was announced that orders increased by 2% year-over-year. The company also reported a 26% increase in operating profit compared to the same period last year. There were also increases in earnings per share and free cash flow, with the latter rising by approximately 30% and EPS by as much as 44%.

This suggests that not only revenues were growing, but also operational efficiency and cash conversion were improved. In numerical terms: the company declared that free cash flow amounted to $2.4 billion (+30% year-over-year) and adjusted EPS reached $1.66, representing a 44% increase.

Breaking down the business into segments:

- In the "Commercial Engines & Services" segment, demand for services (including maintenance and spare parts) increased by 32% year-over-year, while revenue from these services grew by 28%.

- In the "Defense & Propulsion Technologies" segment, revenue increased by 26% year-over-year, while profit in this part of the business rose by 75%, suggesting significant margin improvements and benefits from cost optimization or improved client-product mix.

- GE Aerospace also emphasized in its statement that the supply chain is operating solidly, with the company declaring that suppliers are delivering about 95% of the declared volume on time. Combined with growing demand, this gives the company great confidence that it will not be limited by the availability of materials or components.

The best news for investors turned out to be the change in forecasts for the entire fiscal year. The company raised its predictions: revenue growth is now set not just at around 10%, but at "high teens." Operating profit was adjusted upward by approximately $300 million, and free cash flow is expected to exceed $7 billion (from the previous forecast of $6 billion).

This represents a significant positive market impulse, with management signaling that it is capable of not only maintaining strong growth, but also exceeding its own expectations.

The third-quarter results show that GE Aerospace is in very good condition: despite relatively modest order growth, the company was able to generate strong growth in operating results and cash flows. The key catalyst seems to be the aftermarket services, including maintenance, spare parts, and shop visits, which traditionally generate higher margins than the sale of new engines.

In the CES segment, a 32% increase in services and a 28% increase in service revenue were noted, which supports this thesis.

On the other hand, the defense segment (DPT) with a huge profit increase, suggests that cost management, improvement in client or contract mix, and possibly higher prices had a clear impact.

This is a very positive signal in a sector where cost pressure and supply chain disruptions can work in the opposite direction.

Raising forecasts is often a moment when the market starts to actively price the company, expecting the continuation of the trend. Indicating that free cash flow will exceed $7 billion is particularly important. Strong cash generation is the foundation that allows for investments, the development of new technologies, and potentially attractive shareholder policies such as share buybacks and dividends.

Of course, several risk factors should be remembered. Firstly, orders increased by only 2% year-over-year, which means that one-time jumps or base effects may be less spectacular than during the rapid recovery of the aviation industry. Secondly, although the supply chain is improving, the labor market situation is not the best, and the aviation industry is still sensitive to material disruptions, cost inflation, and wage pressure. Thirdly, a high comparative base may limit future growth rates, especially when the recovery of aviation markets is more gradual.

Moreover, raised forecasts always pose a challenge, as the market expects the company to achieve or exceed them. In case of any disappointments, the valuation may be susceptible to correction.

For investors, GE Aerospace's results signal a strong start to the fourth quarter and a good foundation for a year with higher revenue and profit dynamics. The company shows that it can grow operationally and efficiently generate cash, which is particularly important in technology capital with intensive investments.

If management maintains a good pace, and the aviation services and engine orders market continues to develop, the company's shares may be an interesting position in the aviation/defense sector. At the same time, investors should monitor whether the pace of order growth starts to accelerate, as strong results largely result from optimization, mix, and deliveries, not just pure unit growth.

October's results confirm that GE Aerospace is in a strong phase, and management is confident enough to raise the entire set of forecasts for the year. It's a good time to take a closer look at the company.

GE.US (D1)

Source: Xstation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.