Crude Oil

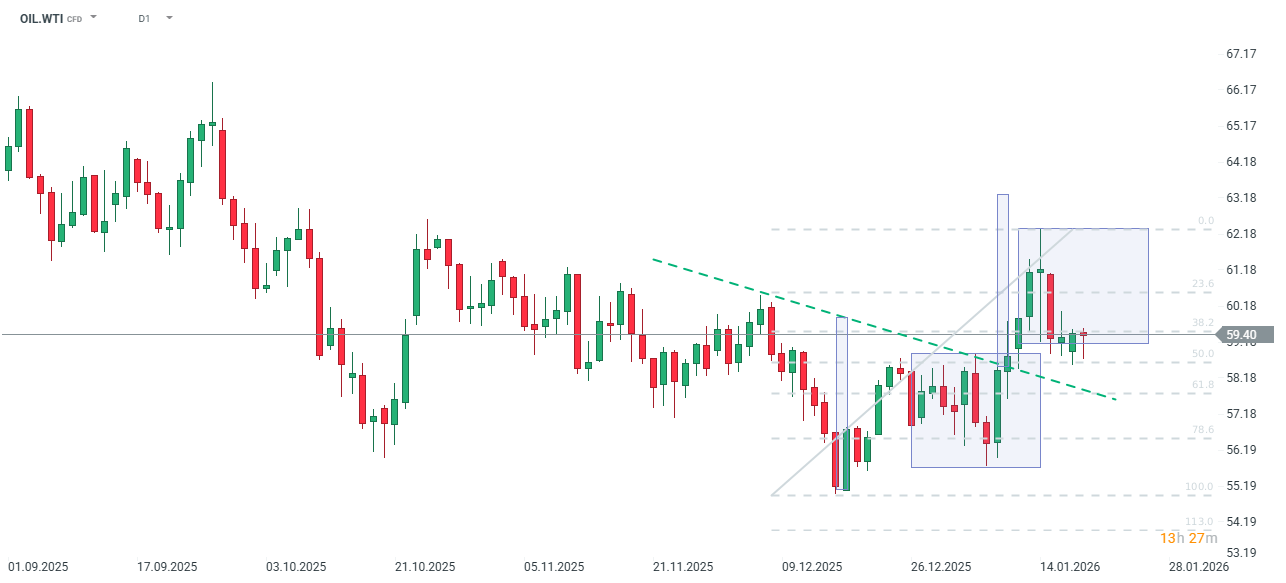

- Donald Trump’s current focus has shifted primarily toward Greenland, prompting crude oil prices to surrender a portion of their recent gains. WTI crude is currently trading near support at $59 per barrel, down from mid-January peaks of $62.

- The United States is simultaneously bolstering its military presence in the Middle East, signaling an increased likelihood of intervention should Iranian protests escalate further or Tehran issue new threats. Prices have also found support in recent weeks from persistent Ukrainian drone strikes on Russian oil infrastructure and robust Chinese crude purchases. Meanwhile, OPEC+ is maintaining its status quo policy, leaving production targets unchanged for the first quarter of 2026.

- Analysts at Bernstein suggest that crude may find a cyclical bottom in the first half of this year, with a potential rebound toward $70 per barrel. Their forecast pegs the annual average for Brent at $65, notably above the current market consensus of $61.

WTI retreated significantly last week as the perceived risk premium associated with Iran moderated. However, geopolitical risks remain elevated given the volatility in Venezuela, Iran, and Russia, now compounded by the Greenland dispute. Prices are currently rebounding from support near the 50.0 retracement level. Source: xStation5

Gold

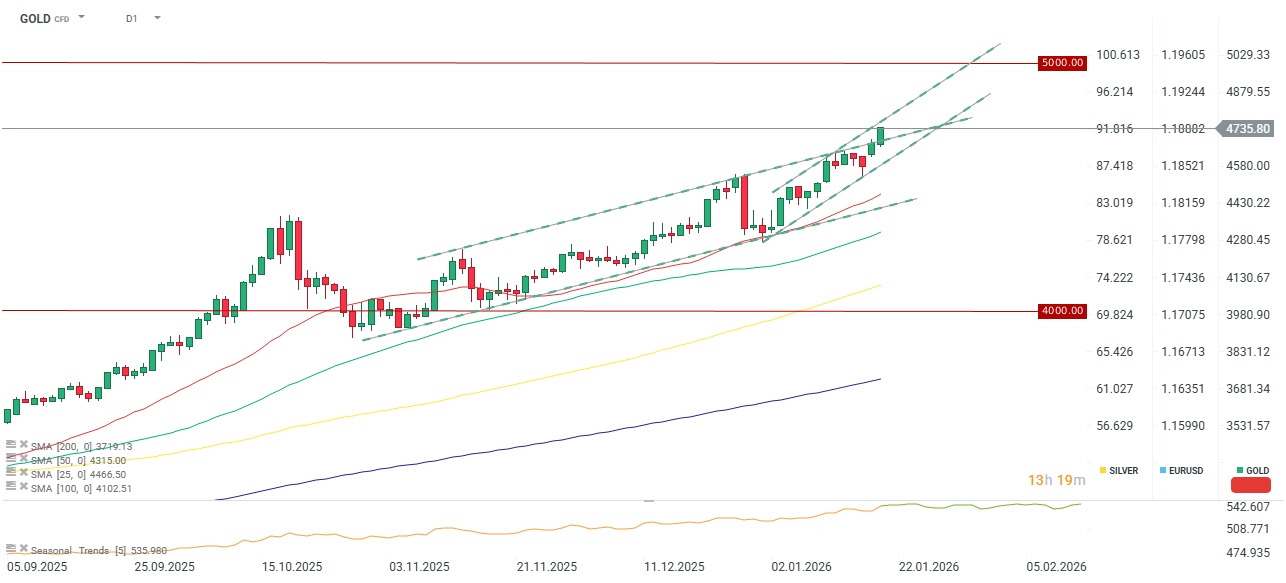

- Gold has surged to fresh historic highs above $4,700 per ounce as markets price in the heightened risks surrounding Donald Trump’s latest tariff offensive. The President intends to impose a 10% levy on nations that have recently deployed troops to Greenland, with the measures slated to take effect on February 1.

- While formal executive orders have yet to materialize beyond Truth Social posts, the market is treating these as cumulative "top-up" tariffs. Current rates negotiated by the European Commission—excluding automotive and other sensitive sectors—average 15%. Under the proposed escalation, Greenland-related tariffs would climb to 25% by June, remaining in place until a deal for the purchase of the island is secured.

- This friction provides a tense backdrop for the World Economic Forum in Davos. While Donald Trump is confirmed to attend, Denmark has notably withdrawn from the event. Trump’s keynote address, scheduled for Wednesday, is expected to cover not only the Greenland impasse but also potential shifts in policy toward Ukraine.

- Domestic headwinds in the U.S. are further stoking market anxiety. Investors are wary of perceived assaults on Federal Reserve independence and the clouded succession process for the next Fed Chair, exacerbated by recent Department of Justice actions. Although historical precedent over the last 50 years suggests an outgoing Chair resigns their seat on the Board of Governors, Jerome Powell’s recent rhetoric suggests he may intend to serve out his term to ensure data-dependent policy remains insulated from political pressure.

- Furthermore, the legal validity of the new tariffs remains an open question, with the Supreme Court yet to rule. A theoretical mandate to refund previously collected duties could spark fiscal chaos, as those revenues have already been absorbed into federal spending. Consequently, a string of resilient data and Fed-related uncertainty has led markets to push back expectations for the first rate cut from June to July.

- Gold is increasingly favored by institutional allocators. Following Citi’s 2025 decision to include gold in its model portfolio, Morgan Stanley has suggested pivoting away from the traditional 60:40 model, halving bond exposure in favor of a 20% gold allocation. Goldman Sachs maintains a year-end 2026 target of $4,900 per ounce.

Gold has broken above the upper boundary of its primary ascending channel, suggesting a potential acceleration of the trend. The metal is now within 5% of the psychological $5,000 mark. Source: xStation5

Silver

- Silver’s status was elevated in 2025 when the USGS officially designated it a critical mineral. It remains a linchpin for modern industrial applications, including solar photovoltaics (PV), electric vehicles, and AI-driven data centers. While the growth rate of PV-related demand may decelerate in 2026, it is still projected to post modest year-on-year gains.

- Speculation regarding a physical supply squeeze continues to mount. Although physical deliveries have ticked up, the bulk of silver stocks remains within exchange warehouses (primarily COMEX), with movements largely driven by contract rolling and commodity index rebalancing. However, acute availability issues are emerging in London and, most notably, Shanghai.

- The Shanghai Gold Exchange is currently exhibiting backwardation—where spot prices command a premium over futures—confirming a genuine physical deficit. Prices in China have already eclipsed $100 per ounce, representing a $10–$12 premium over COMEX.

As silver hits record territory, COMEX prices are gravitating toward the $100 level, requiring only a 5% move to reach the milestone. Short-term support is established near $87. Source: xStation5

Cocoa

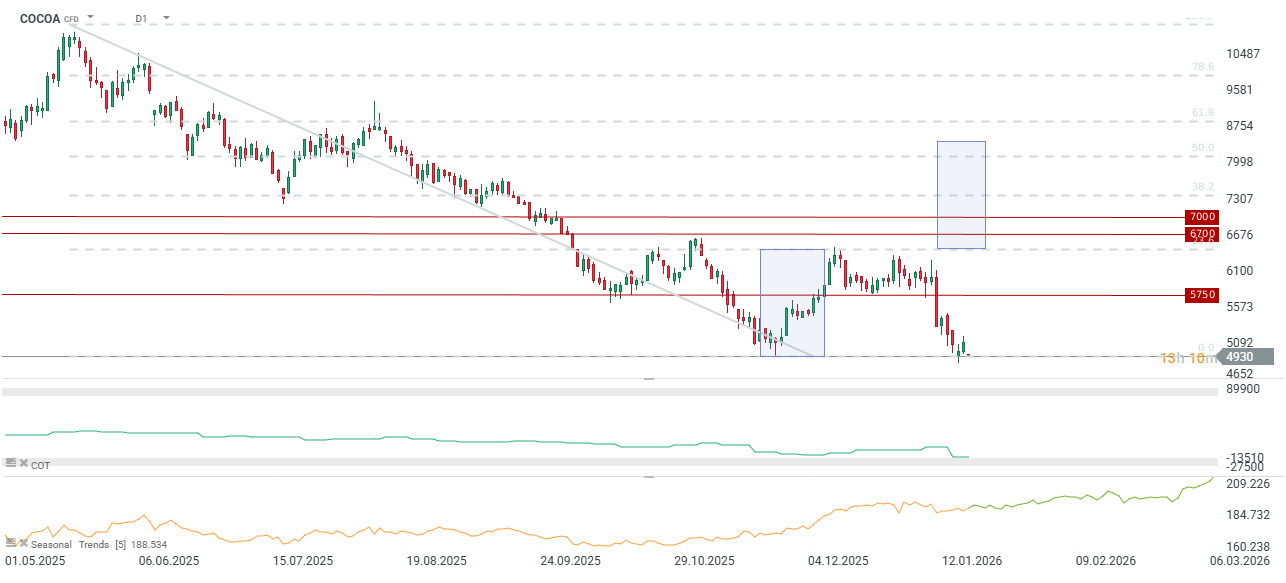

- Reports from West Africa point to a resilient harvest season. Arrivals from October 1 to January 11 totaled 1.13 million tonnes, compared to 1.16 million tonnes in the prior year.

- Expectations are also rising for Ecuador, where production could climb to 570,000–600,000 tonnes, potentially positioning the country as the world’s second-largest producer.

- Grindings data—a proxy for demand—presents a mixed picture:

- Asia: Fell 4.8% y/y (outperforming the -12% forecast).

- USA: Rose 0.3% y/y (though data may be skewed by the inclusion of two additional processors).

- Europe: Slumped 8.3% y/y to 304,500 tonnes, significantly worse than the -3% estimate and marking the weakest Q4 in at least 12 years.

Prices opened below $5,000 following the extended U.S. holiday weekend. Dismal European demand data likely triggered profit-taking on short positions. Net positioning has retreated to its lowest levels since 2022; while this may serve as a contrarian signal, a sustained recovery would likely require fresh evidence of supply-side constraints. Source: xStation5

Morning wrap (05.03.2026)

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.