Precious metals are benefiting from a broader destabilization in global financial markets, which is weighing on the US dollar and potentially on demand for US Treasuries. The diversification trend away from Treasuries appears strategic and long-term in nature, supporting the fundamental backdrop for gold in particular. Goldman Sachs has raised its 2026 gold price target to $5,400 per ounce, up from $4,900 previously.

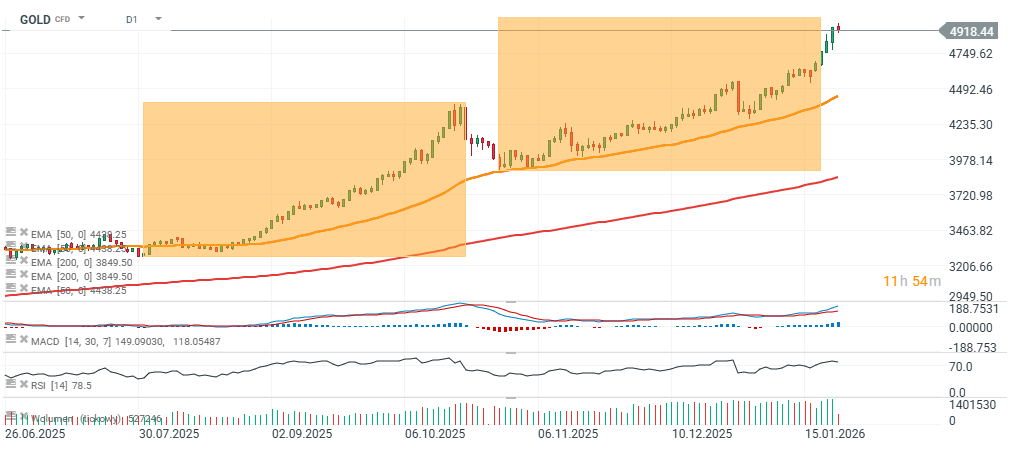

- If we assume the next leg in gold follows a 1:1 pattern similar to the two prior impulses—and that the corrective phases also respect a 1:1 structure—this would imply a potential pullback toward $4,400 before a new upside impulse. In that scenario, the next move could be roughly $1,000 higher, taking gold toward $5,400 per ounce, broadly in line with Goldman’s projection.

- The two previous upward impulses (July–October, and mid-October–January 2026) each delivered gains of around $1,000 per ounce. If the corrections were to be comparable as well, a pullback of roughly $500 would be consistent—pointing to a potential test of the $4,400 area. That said, there is no certainty that gold will continue to follow this pattern, or that a 1:1 correction must occur at this stage.

The biggest risk for gold and the broader metals complex appears to be Jerome Powell remaining in charge of the Fed—an outcome that would likely reduce the chances of implementing a “Trump model,” in which the Federal Reserve cuts rates aggressively while tolerating inflation near target. Even so, such a scenario would not necessarily prevent foreign central banks and large funds from deciding to reduce exposure to Treasuries. Against the backdrop of escalating tensions around Greenland, this is a debate that could increasingly matter for Nordic countries and pension funds in Northern Europe, not only for BRICS nations.

GOLD (D1 timeframe)

Source: xStation5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.