Mass profit-taking and mounting pressure on leveraged long positions are weighing on precious metals today. Gold is down nearly 5%, and the pullback from its all-time high is now around 10%. Silver is also sliding sharply, down almost 8%. Palladium is off nearly 9%, while platinum is retreating by as much as 10%.

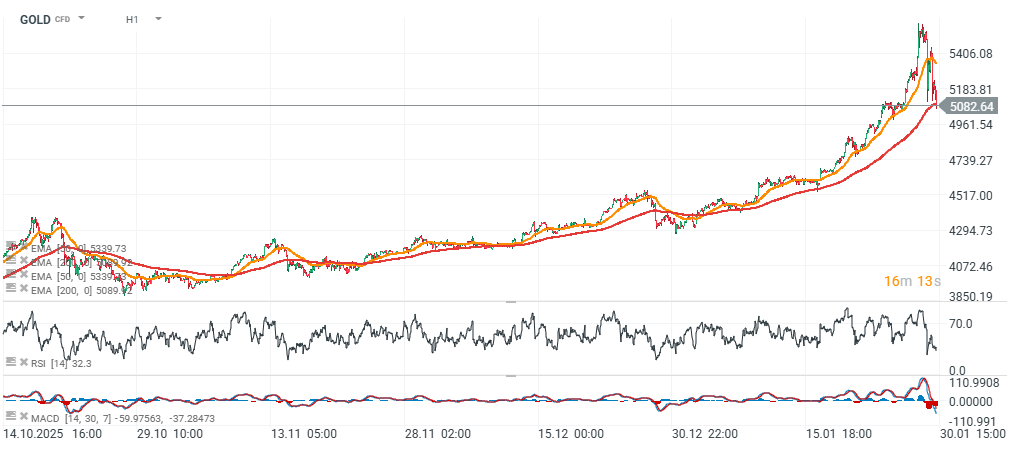

The move comes despite major banks such as JPMorgan and UBS raising their forecasts, suggesting that short-term momentum has turned against precious metals. Gold’s RSI plunged yesterday from around 89 to just under 28, during one of the largest precious-metals sell-offs in modern market history.

Gold is currently testing the EMA200 (red line) near $5,100 per ounce. Volatility remains elevated and bulls may attempt to reverse the move quickly. A potentially solid support zone appears around $4,600–$4,700 per ounce (one standard deviation).

GOLD (H1)

Source: xStation5

On the daily timeframe, the current correction range looks roughly 1:1 compared with the October decline, although it’s worth noting that the latest pullback followed a much stronger prior upswing, which naturally increases the likelihood of a larger deviation.

Source: xStation5

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.