- After Friday's slump, gold regains its balance and gains 2.5%

- After Friday's slump, gold regains its balance and gains 2.5%

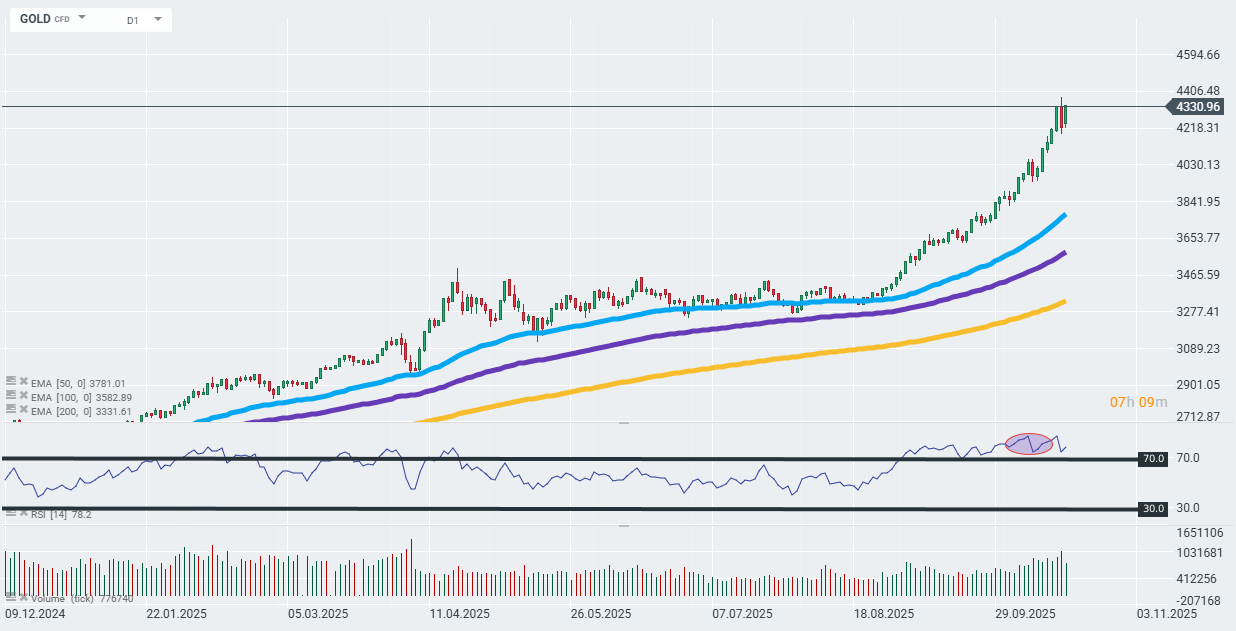

After Friday's slump, which brought gold prices down by almost 2% from record highs of $4,378 per ounce, the market is regaining its balance in Monday trading. The spot price is once again hovering around $4,320, supported by expectations of further interest rate cuts by the Federal Reserve and continued demand for safe-haven assets. Analysts point out that the correction was technical in nature and was the result of profit-taking after several weeks of dynamic growth. President Donald Trump's reassuring statements about a “more reasonable” approach to China temporarily weakened demand for gold, but upcoming trade talks and the ongoing government shutdown in the US are again increasing uncertainty.

The People's Bank of China (PBoC) continues to purchase gold regularly – in September, it made its 11th consecutive accumulation, buying 1.2 tons, and in the entire third quarter, the increase amounted to 5 tons, bringing official reserves to 2,303 tons (7.7% of the value of foreign exchange reserves). This clearly confirms the strategic importance of gold for China's reserve policy.

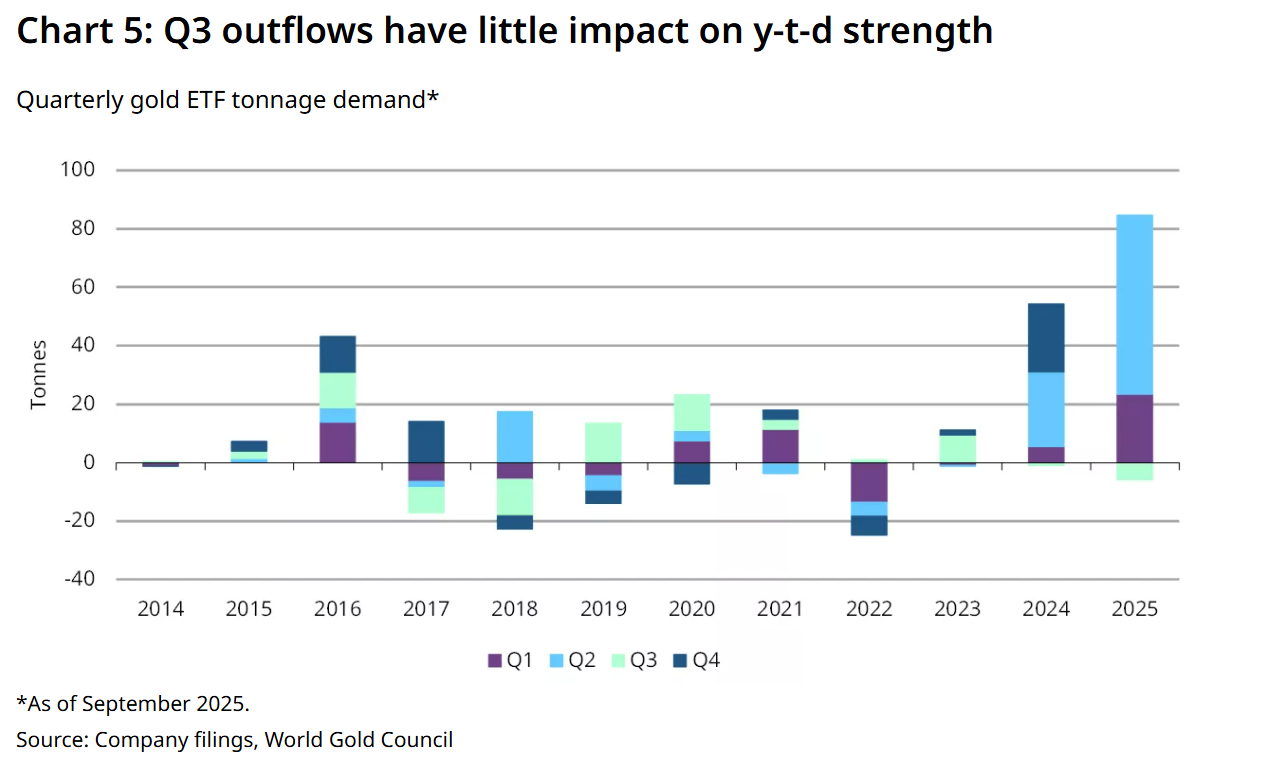

The increased demand is also due to large purchases of ETFs. These funds recorded record inflows in the first two quarters of the year (a total of 79 tons of gold on the Chinese market), although Q3 saw slight net outflows.

Source: World Gold Council, ETF data for the Chinese market.

GOLD is returning to its recent historical highs. The RSI for the 14-day average on the D1 interval remains above 70 points. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.