Summary:

- Economic releases from the US have been gloomy

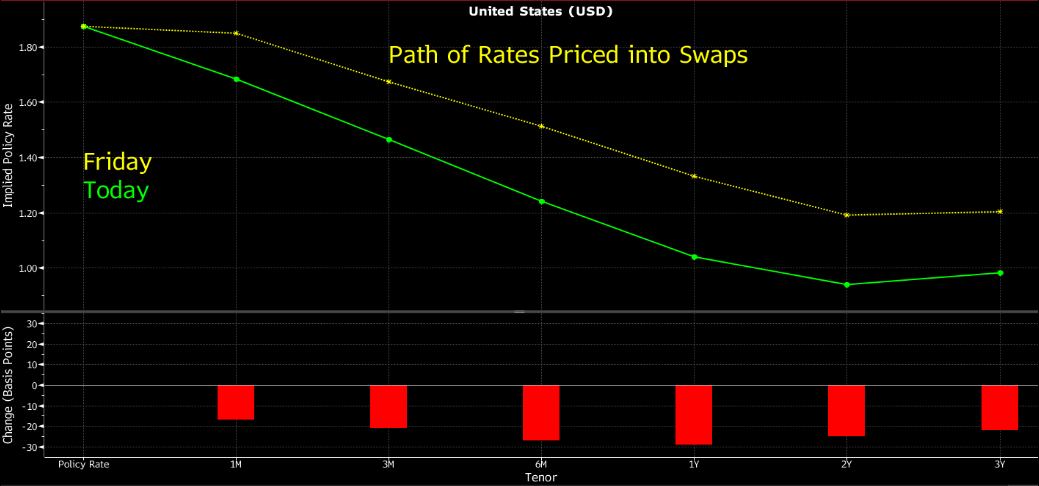

- Market participants have doubled down on deeper rate cuts this year

- “Bad data is good data” has come back

A set of economic releases we have been offered thus far this week has been particularly soft to say the least. Chicago PMI, manufacturing ISM, non-manufacturing ISM, all of them came in well below expectations strengthening the case the US economy could be heading for a recession sooner rather than later. Even an apparent good result regarding employment reported by the ADP was not so good given the fact that a lot of jobs came from temporary jobs. Although US indices have been heading lower so far this week, we got a sudden shift in this pattern on Thursday when a big U-turn took place in the wake of rising rate cut expectations following another grim report from the Institute for Supply Management. That has reminded us of the old adage present in markets already few years ago that a bad release is actually a good one. Thus, one may conclude that financial markets are getting yet again addicted to monetary policy. All in all, it appears that the yield curve inversion has been again a valuable predictor of a future slowdown.

Markets have doubled down on lower rates in the wake of dismal economic releases. Source: xStation5

Markets have doubled down on lower rates in the wake of dismal economic releases. Source: xStation5

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

🔵 ECB Press Conference (LIVE)

BREAKING: ECB maintains rates in line with expectations!💶

BREAKING: Bank of England holds rates as expected 📌 GBPUSD ticks down on dovish vote split 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.